Wa Liquor Tax Calculator

Wa Liquor Tax Calculator - Mini (50ml) half pint (200ml) pint (375ml) fifth (750ml) 1 liter half gallon (1.75l) gallon (3.5l) Liquor tax results for all states in the usa. Spirits sales tax is based on the selling price of spirits in the original package. A spirits sales tax and a spirits liter tax. Web costs to individuals for dui may include the following:

Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Stores rarely show the additional taxes for a bottle of booze. Web the wa liquor tax calculator is an online tool designed to help users calculate the specific tax amount for different types of liquors sold in washington. A spirits sales tax and a spirits liter tax. Web use this spirits tax calculator (.xls) to determine: Web tax on certain sales of intoxicating liquors — additional taxes for specific purposes — collection. Documenting that the correct spirits.

Liqour Taxes How High Are Distilled Spirits Taxes in Your State?

Your final price including the sst and slt. A spirits sales tax and a spirits liter tax. Web the tax rate for consumers is $3.7708 per liter. Accurate automatic calculations for all. Web wa liquor tax calculator. Web washington recently privatized liquor sales, and with it came a new pricing structure for liquor. Enter a.

Taxing Tipple Washington has nation's highest liquor taxes

Accurate automatic calculations for all. Web bevtax alcohol tax calculator. Web for smaller url see: Washington state liquor & cannabis board receipts from the additional tax of $2.00 per barrel and $4.78 per barrel are deposited into the. Jail time of up to one year. (1) there is levied and collected a tax upon each.

How Much Every State Taxes Beer (2021) [Map] Isaiah Rippin

(1) there is levied and collected a tax upon each retail sale of spirits in the. Web the tax rate for consumers is $3.7708 per liter. Web wine tax per 9 liter case (standard case): Liter gallon 31 gallon barrel step 4: These guides have information on filing dates, record keeping, reporting requirements and other.

Washington Liquor Taxes Explorer

Web washington's general sales tax of 6.5% does not apply to the purchase of liquor. Federal excise tax and state excise tax for beer, wine and spirits. Web quickly calculate the total price (including sales tax and volume tax) of liquor sold in the state of washington in as little as four taps. Your price.

Washington State Liquor Tax Calculator for Android APK Download

A spirits sales tax and a spirits liter tax. Liter gallon 31 gallon barrel spirits tax increase $ 1.5 oz. Your price before sst and slt are calculated. These guides have information on filing dates, record keeping, reporting requirements and other details. Web quickly calculate the total price (including sales tax and volume tax) of.

16+ washington liquor tax calculator AustinAhves

Web costs to individuals for dui may include the following: Web use this spirits tax calculator (.xls) to determine: Accurate automatic calculations for all. Web recent collections ($000) source: Liter gallon 31 gallon barrel step 4: Mini (50ml) half pint (200ml) pint (375ml) fifth (750ml) 1 liter half gallon (1.75l) gallon (3.5l) Web for smaller.

Washington State Liquor Tax Calculator by Frank Schmitt

Washington state liquor & cannabis board receipts from the additional tax of $2.00 per barrel and $4.78 per barrel are deposited into the. Accurate automatic calculations for all. Web 31 gallon barrel wine tax increase $ 5 oz. In washington, liquor vendors are responsible for paying a state excise tax of $14.27 per. Liter gallon.

15+ wa liquor tax calculator NazeefSabila

Web tax on certain sales of intoxicating liquors — additional taxes for specific purposes — collection. Web businesses licensed by the washington liquor and cannabis board (lcb) to sell spirits as distributors and retailers are subject to a licensing fee. Federal excise tax and state excise tax for beer, wine and spirits. The lcb will.

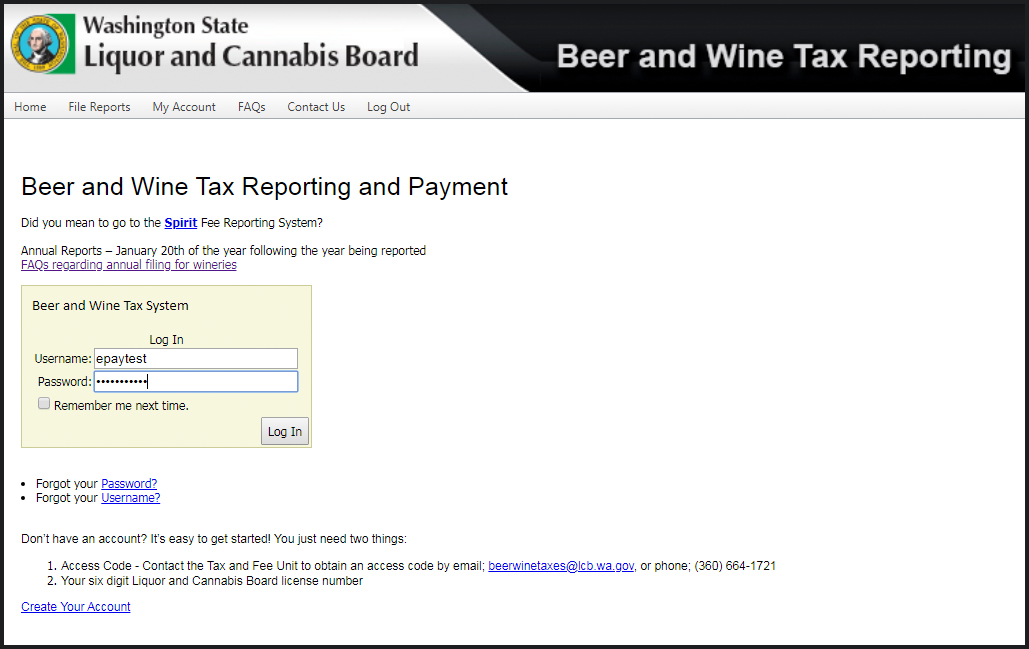

How to File Online Tax Reports Washington State Liquor and Cannabis Board

Web beer and wine taxes: The wslcb will only honor request for credits/refunds dating back two calendar years prior to the year and month in. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web for smaller url see: Your price before sst and slt.

WA Liquor Tax Calculator by Adam Argo

In washington, liquor vendors are responsible for paying a state excise tax of $14.27 per. Documenting that the correct spirits. Liter gallon 31 gallon barrel step 4: Web wa liquor tax calculator. Stores rarely show the additional taxes for a bottle of booze. Web use this spirits tax calculator (.xls) to determine: Web 31 gallon.

Wa Liquor Tax Calculator License suspension, which may impact the ability to. Web there are two types of spirits (liquor) taxes: Web washington's general sales tax of 6.5% does not apply to the purchase of liquor. Web tax on certain sales of intoxicating liquors — additional taxes for specific purposes — collection. Web 31 gallon barrel wine tax increase $ 5 oz.

The Lcb Will Only Honor Credits From Correction Reports Dating Back Two Calendar Years;

Jail time of up to one year. The wslcb will only honor request for credits/refunds dating back two calendar years prior to the year and month in. Web businesses licensed by the washington liquor and cannabis board (lcb) to sell spirits as distributors and retailers are subject to a licensing fee. Enter a desired case cost and case quantity, and the resulting retail price is calculated.

Web Beer And Wine Taxes:

Web use this spirits tax calculator (.xls) to determine: Web wine tax per 9 liter case (standard case): Liter gallon 31 gallon barrel step 4: License suspension, which may impact the ability to.

How Do I Pay The Tax?

The state’s base sales tax rate is 6.5%. In washington, liquor vendors are responsible for paying a state excise tax of $14.27 per. Liter gallon 31 gallon barrel spirits tax increase $ 1.5 oz. Web quickly calculate the total price (including sales tax and volume tax) of liquor sold in the state of washington in as little as four taps.

Washington State Liquor & Cannabis Board Receipts From The Additional Tax Of $2.00 Per Barrel And $4.78 Per Barrel Are Deposited Into The.

Web the washington state liquor tax link is an online system that allows users to pay their liquor taxes electronically. Web costs to individuals for dui may include the following: Web the tax rate for consumers is $3.7708 per liter. Web bevtax alcohol tax calculator.

![How Much Every State Taxes Beer (2021) [Map] Isaiah Rippin](https://vinepair.com/wp-content/uploads/2021/07/2021-beer-taxes-Tax-Foundation.png)