Wa State Liquor Tax Calculator

Wa State Liquor Tax Calculator - The evergreen state is followed by oregon ($22.86),. Web wa liquor tax calculator. If additional fees are due, the amount must be remitted along with the corrected report, including any applicable late penalties on the. The lcb headquarters front desk at. Jail time of up to one year.

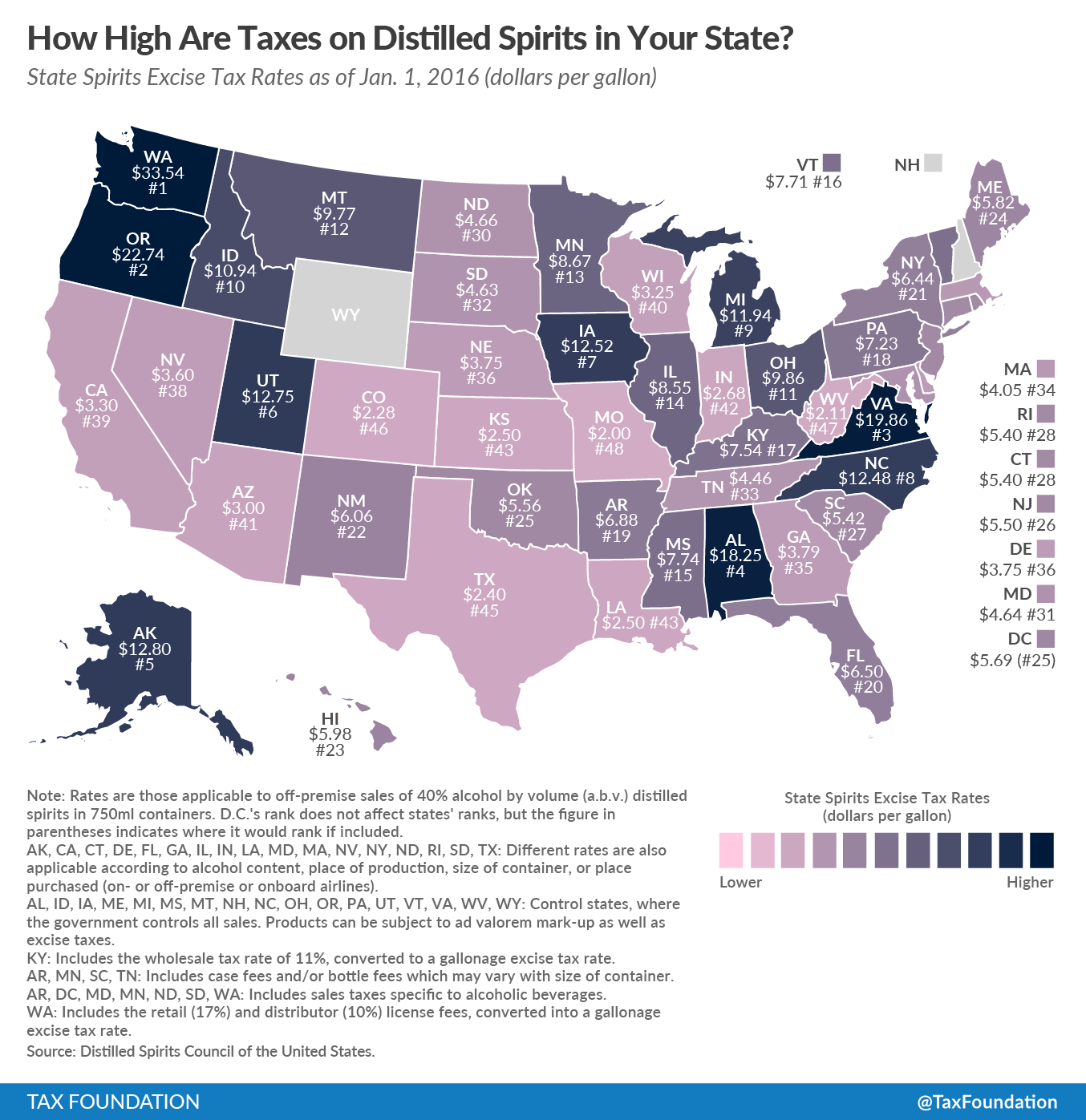

Web beer and wine taxes: 1 liter = 0.264172 gallons. (1) there is levied and collected a tax upon each retail sale of spirits in the. Jail time of up to one year. Spirits sales tax is based on the selling price of spirits in the original package. Web across states, washington levies the greatest excise tax rate on distilled spirits, at $36.55 per gallon. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent).

Washington Liquor Taxes Explorer

Web washington state liquor tax calculator by frank schmitt iphone ipad free in the app store what is it about? Web tax on certain sales of intoxicating liquors — additional taxes for specific purposes — collection. Enter a desired case cost and case quantity, and the resulting retail price is calculated. Gallons x 3.78544 =.

WA Liquor Tax Calculator by Adam Argo

Web the tax rate for consumers is $3.7708 per liter. License suspension, which may impact the ability to. Jail time of up to one year. Web 31 gallon barrel wine tax increase $ 5 oz. Washington's general sales tax of 6.5% does not apply to the purchase of liquor. Liters ÷ 3.78544 = gallons in.

Liqour Taxes How High Are Distilled Spirits Taxes in Your State?

A spirits sales tax and a spirits liter tax. Web costs to individuals for dui may include the following: Web for smaller url see: Ounces x bottles in case. Quickly calculate the total price (including sales. Choose the container size, quantity, tax rate, and source of the beer, and get the tax. In washington, liquor.

How High Are Taxes on Distilled Spirits in Your State? (2016) Tax

Web across states, washington levies the greatest excise tax rate on distilled spirits, at $36.55 per gallon. Web the tax rate for consumers is $3.7708 per liter. Liter gallon 31 gallon barrel step 4: Brewers and beer wholesalers report the tax monthly, with payment due by the 20th day of the following month. Web for.

Taxing Tipple Washington has nation's highest liquor taxes

Web costs for federal, state and local taxes license fee business expenses additional markup for desired profit $5.00 total selling price $15.00 total price paid by the consumer. Web across states, washington levies the greatest excise tax rate on distilled spirits, at $36.55 per gallon. Web use this spirits tax calculator (.xls) to determine the.

Alcohol Tax by State 2023 Wisevoter

Web washington state liquor tax calculator by frank schmitt iphone ipad free in the app store what is it about? This system is designed to make the. Gallons x 3.78544 = liters. Web use this spirits tax calculator (.xls) to determine the spirits sales tax and spirits liter tax for your business or purchase of.

Washington State Liquor Tax Calculator by Frank Schmitt

Web beer and wine taxes: Web wine tax per 9 liter case (standard case):conversion formulas. Web use this spirits tax calculator (.xls) to determine the spirits sales tax and spirits liter tax for your business or purchase of spirits in washington. Web 31 gallon barrel wine tax increase $ 5 oz. Web wa liquor tax.

Washington State Liquor Tax Calculator for Android APK Download

Quickly calculate the total price (including sales. Web across states, washington levies the greatest excise tax rate on distilled spirits, at $36.55 per gallon. Web tax on certain sales of intoxicating liquors — additional taxes for specific purposes — collection. A spirits sales tax and a spirits liter tax. In washington, liquor vendors are responsible.

How Much Every State Taxes Beer (2021) [Map] Isaiah Rippin

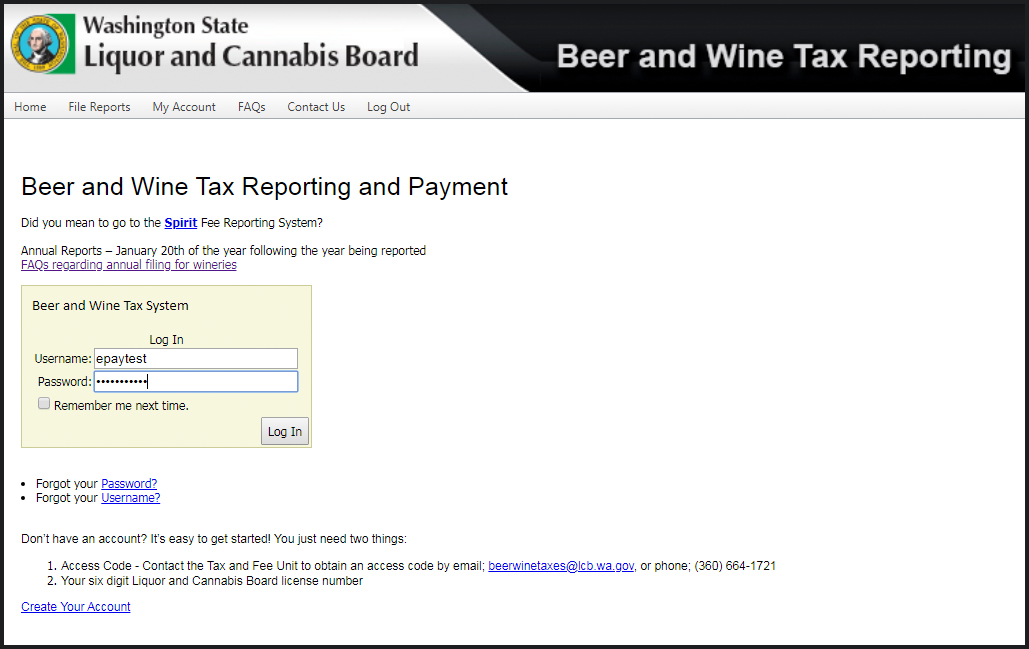

Web the washington state liquor tax link is an online system that allows users to pay their liquor taxes electronically. The evergreen state is followed by oregon ($22.86),. Web the rulemaking process has begun to implement e2ssb 5080 related to expanding and improving the cannabis social equity program. Web calculate the federal and state taxes.

How to File Online Tax Reports Washington State Liquor and Cannabis Board

If additional fees are due, the amount must be remitted along with the corrected report, including any applicable late penalties on the. Mini (50ml) half pint (200ml) pint (375ml) fifth (750ml) 1 liter half gallon (1.75l) gallon (3.5l) Web the rulemaking process has begun to implement e2ssb 5080 related to expanding and improving the cannabis.

Wa State Liquor Tax Calculator Web there are two types of spirits (liquor) taxes: Web the washington state liquor tax link is an online system that allows users to pay their liquor taxes electronically. Web 31 gallon barrel wine tax increase $ 5 oz. Web across states, washington levies the greatest excise tax rate on distilled spirits, at $36.55 per gallon. Liters ÷ 3.78544 = gallons in case.

The Lcb Headquarters Front Desk At.

Web the rulemaking process has begun to implement e2ssb 5080 related to expanding and improving the cannabis social equity program. Brewers and beer wholesalers report the tax monthly, with payment due by the 20th day of the following month. Web costs to individuals for dui may include the following: Web state administration liquor and cannabis board.

Web The Wa Liquor Tax Calculator Is An Online Tool Designed To Help Users Calculate The Specific Tax Amount For Different Types Of Liquors Sold In Washington State.

Mini (50ml) half pint (200ml) pint (375ml) fifth (750ml) 1 liter half gallon (1.75l) gallon (3.5l) Ounces x bottles in case. Web tax on certain sales of intoxicating liquors — additional taxes for specific purposes — collection. Web wa liquor tax calculator.

Liter Gallon 31 Gallon Barrel Step 4:

Web wine tax per 9 liter case (standard case):conversion formulas. In washington, liquor vendors are responsible for. (1) there is levied and collected a tax upon each retail sale of spirits in the. 1 liter = 0.264172 gallons.

Web Use This Spirits Tax Calculator (.Xls) To Determine The Spirits Sales Tax And Spirits Liter Tax For Your Business Or Purchase Of Spirits In Washington.

Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Gallons x 3.78544 = liters. Intuit.com has been visited by 1m+ users in the past month How do i pay the tax?

![How Much Every State Taxes Beer (2021) [Map] Isaiah Rippin](https://vinepair.com/wp-content/uploads/2021/07/2021-beer-taxes-Tax-Foundation.png)