Wacc Excel Template

Wacc Excel Template - Web steps to calculate wacc in excel. Web the weighted average cost of capital (wacc) excel template is a comprehensive financial tool expertly designed by ryan o’connell, cfa, frm. Web download wso's free wacc calculator model template below! Compare the cost of capital against industry peers to gain a competitive edge. Web the wacc calculator spreadsheet uses the formula above to calculate the weighted average cost of capital.

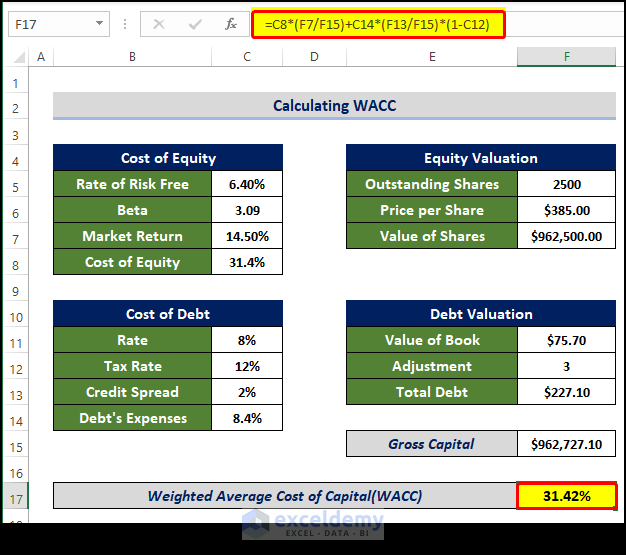

By following the steps outlined in this article and keeping in mind the tips and best practices, you can ensure accuracy and avoid common mistakes. Web calculating wacc on excel can save time and effort for finance professionals, making it easier to determine the cost of capital and make informed investment decisions. Web use the weighted average cost of capital (wacc) calculator excel template to quickly and easily evaluate the cost of capital for a given company. What is the wacc formula? Delve into the realm of financial analysis as we guide you through the intricate process of calculating the weighted average cost of capital (wacc) in excel. This template allows you to calculate wacc based on capital structure, cost of equity, cost of debt, and tax rate. Build an understanding of when using ai is appropriate and when it is not.

How to Calculate WACC in Excel Sheetaki

The term “wacc” is the acronym for a weighted average cost of capital (wacc), a financial metric that helps calculate a firm’s cost of financing by combining the cost of debt and the cost of equity structure. Web weighted average cost of capital (or wacc) is an excel tool that calculates the discount rate of.

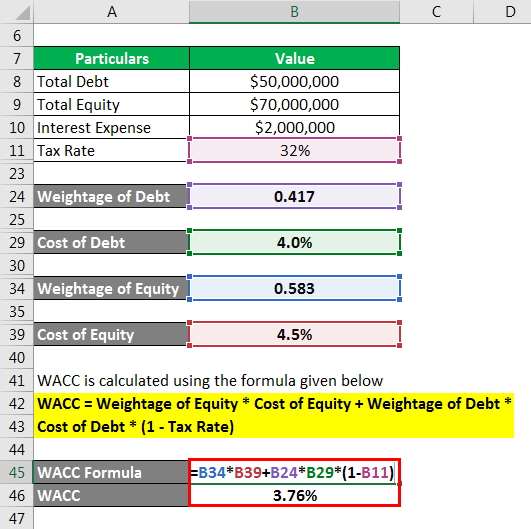

How to Calculate the WACC in Excel WACC Formula Earn & Excel

Web the wacc calculator spreadsheet uses the formula above to calculate the weighted average cost of capital. This template allows you to calculate wacc based on capital structure, cost of equity, cost of debt, and tax rate. By following the steps outlined in this article and keeping in mind the tips and best practices, you.

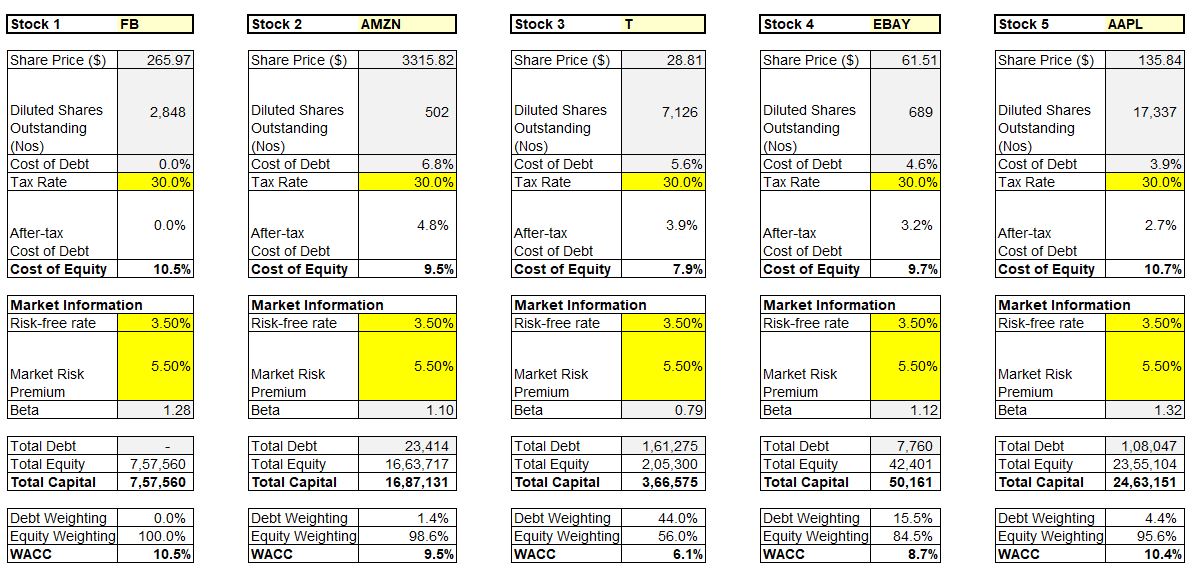

Stock Wacc Analysis Excel Example (Marketxls Template) MarketXLS

Delve into the realm of financial analysis as we guide you through the intricate process of calculating the weighted average cost of capital (wacc) in excel. This excel template has a comprehensive wacc calculator. Web the wacc calculator spreadsheet uses the formula above to calculate the weighted average cost of capital. Web weighted average cost.

How to Calculate WACC in Excel Sheetaki

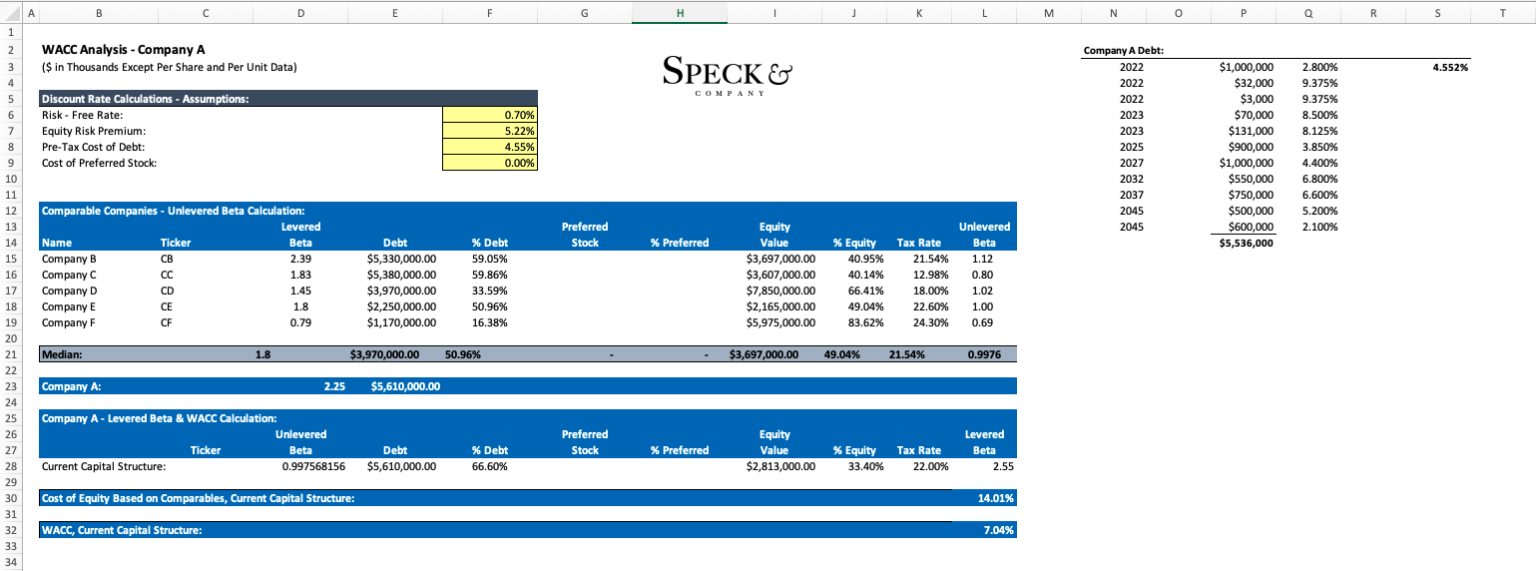

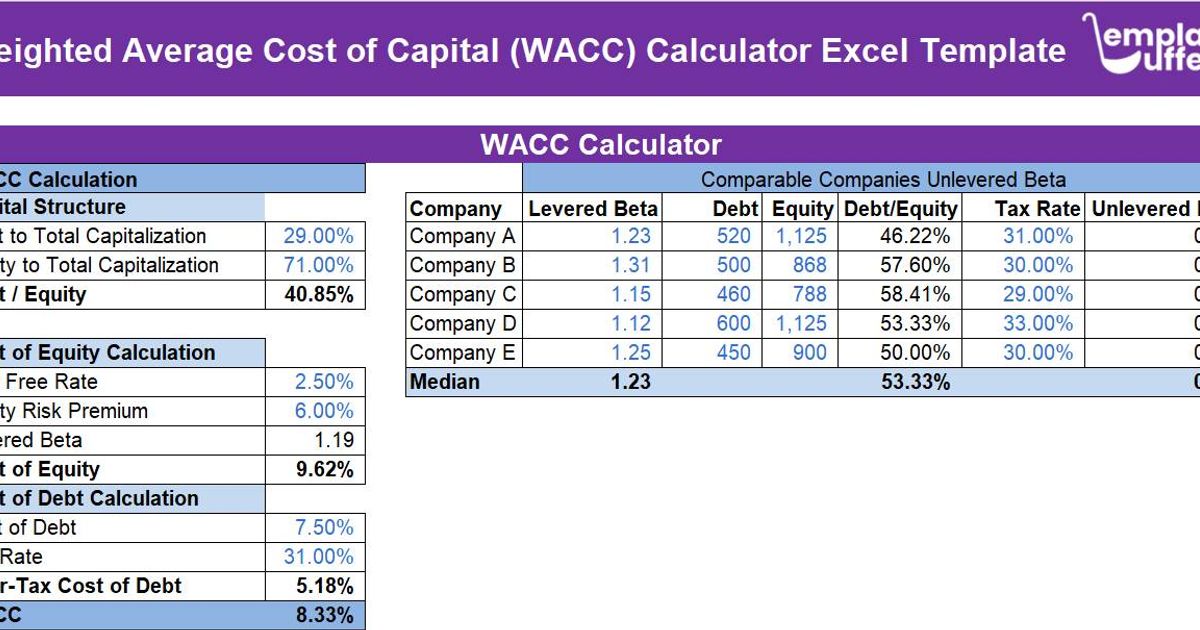

Also, it includes a detailed analysis of the beta estimation using comparable companies and two sensitivity tables. Use chat gpt & gemini to solve basic excel formula tasks. Compare outputs from different ai tools to understand strengths and weaknesses. This template allows you to calculate wacc based on capital structure, cost of equity, cost of.

How to Calculate Wacc in Excel?

Web upon completing this course, you will be able to: Web weighted average cost of capital (or wacc) is an excel tool that calculates the discount rate of a company, which effectively is the weighted mix of the cost of debt and the cost of equity of a company. Web in this article, we showed.

How to Calculate WACC in Excel Speck & Company

Web calculating wacc on excel can save time and effort for finance professionals, making it easier to determine the cost of capital and make informed investment decisions. Delve into the realm of financial analysis as we guide you through the intricate process of calculating the weighted average cost of capital (wacc) in excel. Web this.

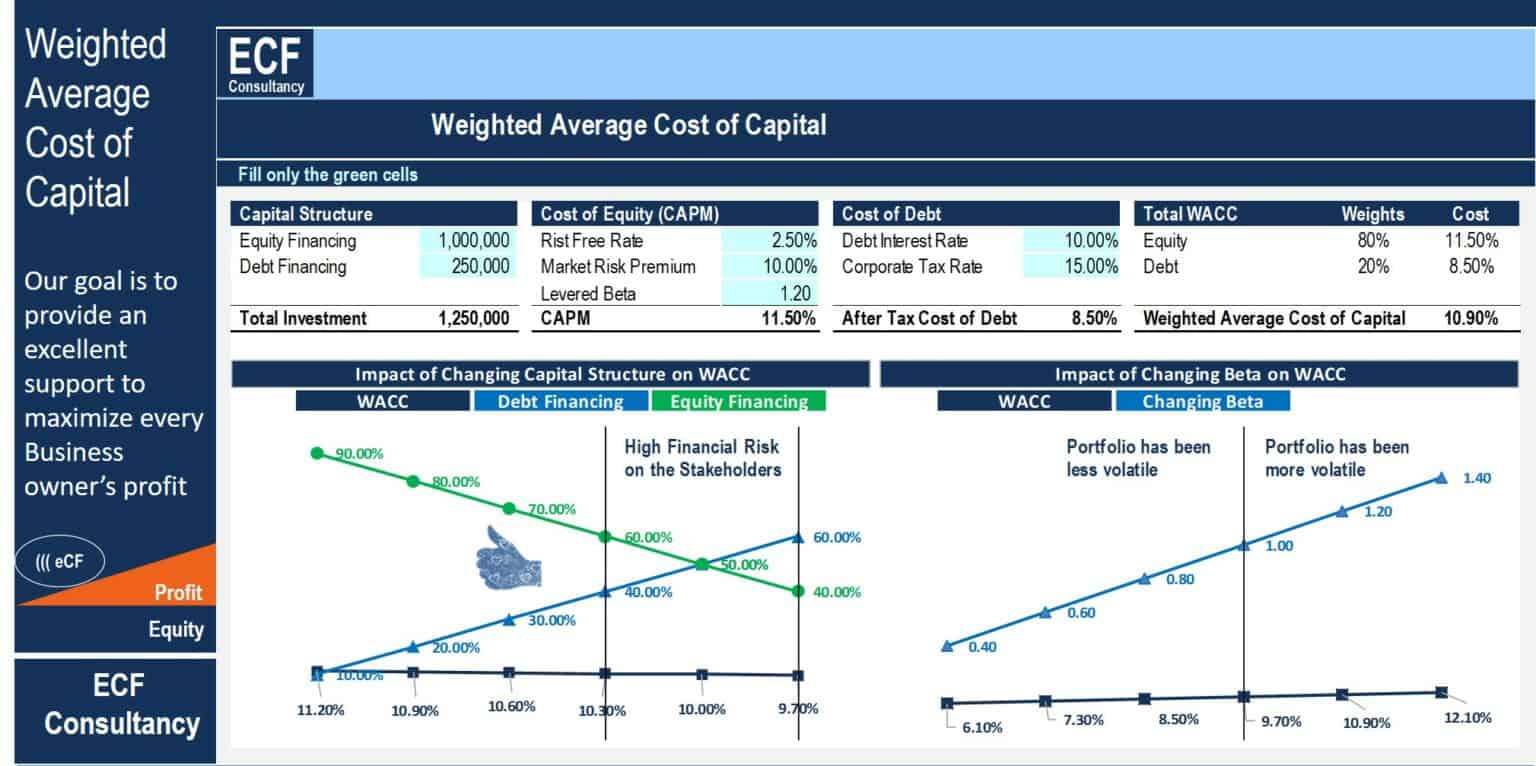

WACC Calculator Free Download eFinancialModels

Solve problems from formula simplification to logic explanations and text formulas. Web download wso's free wacc calculator model template below! It represents the average rate of return that a company is expected to pay to all its security holders to finance its assets. Use chat gpt & gemini to solve basic excel formula tasks. What.

How to Calculate WACC in Excel (with Easy Steps) ExcelDemy

Here’s your practice workbook for this guide, download it and come along with me. Web the wacc calculator spreadsheet uses the formula above to calculate the weighted average cost of capital. Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt and tax rate. Web steps to.

Calculate WACC in Excel Step by Step YouTube

Web calculating wacc on excel can save time and effort for finance professionals, making it easier to determine the cost of capital and make informed investment decisions. This versatile template will empower you to calculate your own wacc, providing a deep understanding of your firm’s financial standing. Web weighted average cost of capital (or wacc).

Free Weighted Average Cost of Capital (WACC) Calculator Excel Template

Web the weighted average cost of capital (wacc) excel template is a comprehensive financial tool expertly designed by ryan o’connell, cfa, frm. Web the wacc calculator spreadsheet uses the formula above to calculate the weighted average cost of capital. It allows you to estimate the cost of equity, debt, and preferred equity. Web looking for.

Wacc Excel Template Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt and tax rate. Web download wso's free wacc calculator model template below! Web looking for a weighted average cost of capital (wacc) excel template? It represents the average rate of return that a company is expected to pay to all its security holders to finance its assets. The cost of equity is defined as the rate of return that an investor expects to earn for bearing risks in investing in the shares of a company.

What Is The Wacc Formula?

Web this tutorial is all about the concept of wacc, how it works out, and most importantly how you calculate it in excel. Solve problems from formula simplification to logic explanations and text formulas. Compare outputs from different ai tools to understand strengths and weaknesses. 88k views 6 years ago excel tutorials.

It Allows You To Estimate The Cost Of Equity, Debt, And Preferred Equity.

Web in this article, we showed how you can calculate wacc in excel with 8 separate steps with elaborate explanations. Web the weighted average cost of capital (wacc) excel template is a comprehensive financial tool expertly designed by ryan o’connell, cfa, frm. 16k views 2 years ago excel training for finance students. It represents the average rate of return that a company is expected to pay to all its security holders to finance its assets.

Web The Wacc Calculator Spreadsheet Uses The Formula Above To Calculate The Weighted Average Cost Of Capital.

Web download wso's free wacc calculator model template below! Delve into the realm of financial analysis as we guide you through the intricate process of calculating the weighted average cost of capital (wacc) in excel. This excel template has a comprehensive wacc calculator. This versatile template will empower you to calculate your own wacc, providing a deep understanding of your firm’s financial standing.

Web Upon Completing This Course, You Will Be Able To:

Also, it includes a detailed analysis of the beta estimation using comparable companies and two sensitivity tables. Web weighted average cost of capital (or wacc) is an excel tool that calculates the discount rate of a company, which effectively is the weighted mix of the cost of debt and the cost of equity of a company. By following the steps outlined in this article and keeping in mind the tips and best practices, you can ensure accuracy and avoid common mistakes. Web this wacc calculator helps you calculate wacc based on capital structure, cost of equity, cost of debt and tax rate.