Wage Calculator Va

Wage Calculator Va - Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). After the calculator determines the rating, then you can. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Web virginia salary tax calculator for the tax year 2023/24. This calculator will take a gross pay and calculate the net.

Web welcome to the virginia wage calculator! Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Web for a veteran with no spouse, the monthly va disability pay for 2024 is $3,737.85. Web virginia salary and tax calculator features the following features are available within this virginia tax calculator for 2024: Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). This calculator will take a gross pay and calculate the net. Web you can calculate the gross pay from hourly wages by multiplying the regular hours times the regular hourly rate + overtime hours times the overtime rate.

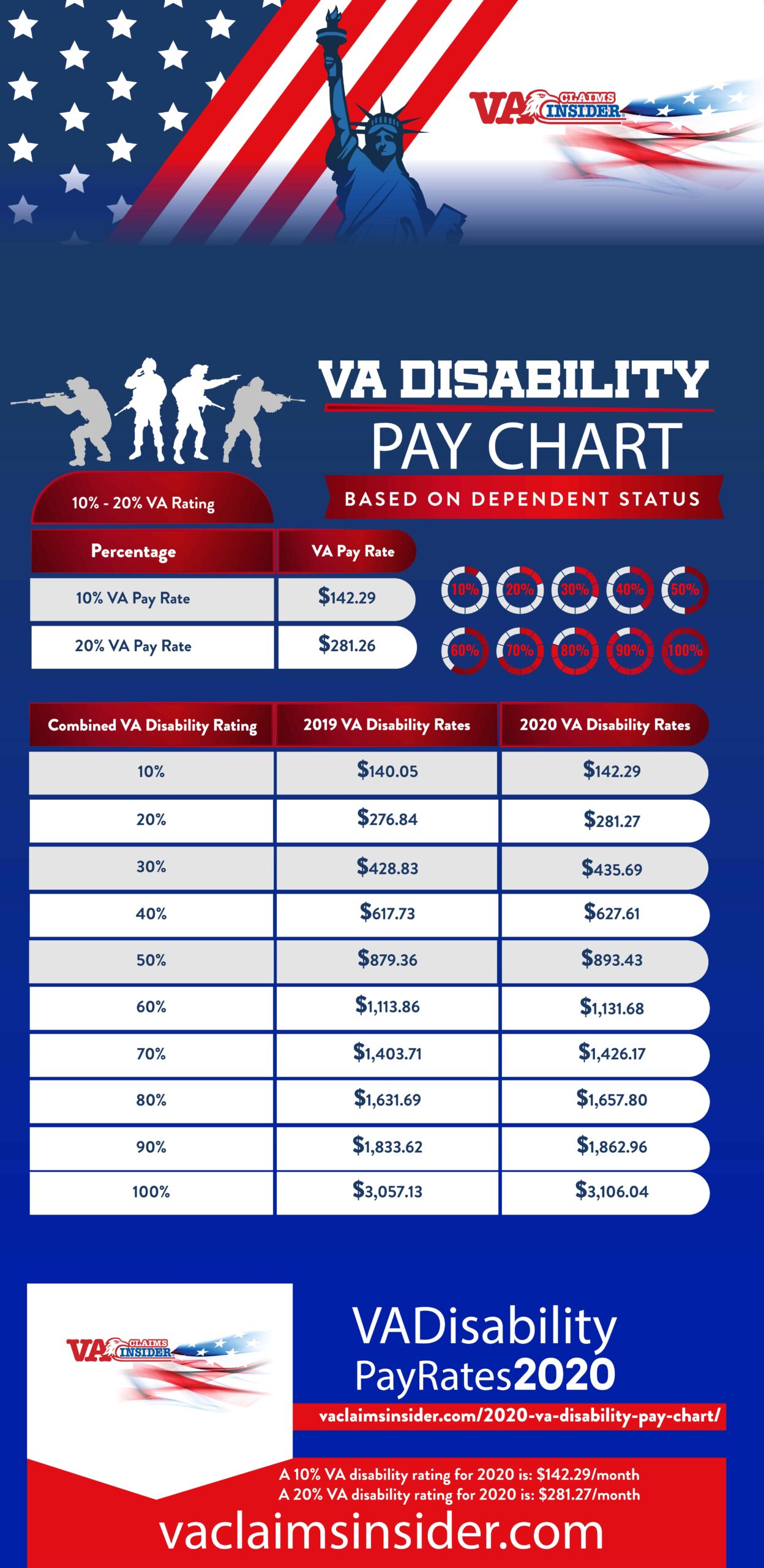

2020 V A Disability Pay Chart

Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. You can add multiple rates. Virginia has four different tax brackets, ranging. 48 contiguous states (all states except alaska and hawaii) dollars per year household/ family size 50% Web the livable wage for a single adult living in.

2020 VA Disability Pay Chart VA Claims Insider

Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. This number is the gross pay per pay period. Federal income tax calculation : Use adp’s virginia paycheck calculator to estimate net or “take home” pay for.

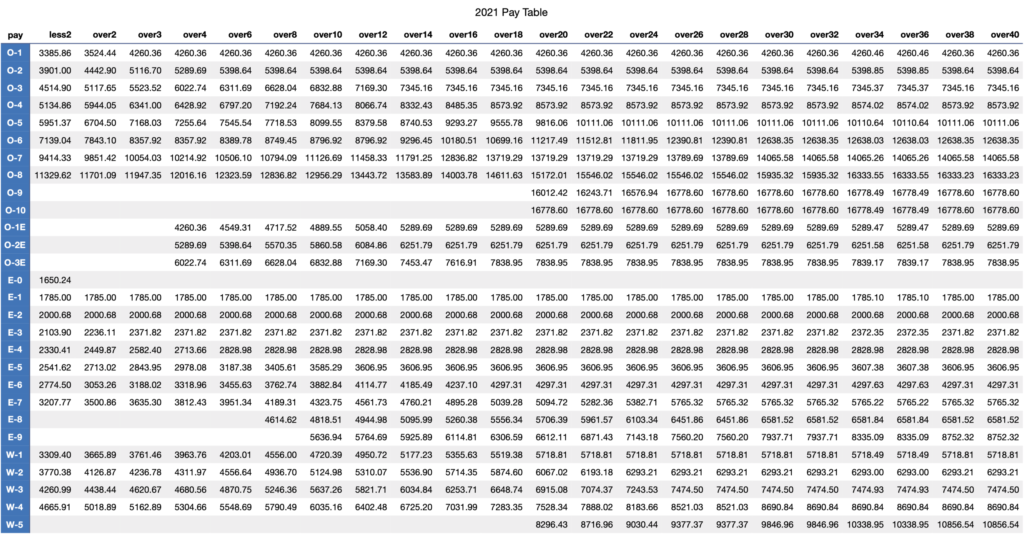

GS Pay Scale 2022 Va GS Pay Scale 2022

Before we jump in, who are you using this. A tax is a mandatory. Web for a veteran with no spouse, the monthly va disability pay for 2024 is $3,737.85. 48 contiguous states (all states except alaska and hawaii) dollars per year household/ family size 50% Federal income tax calculation : Web find out how.

2022 VA Disability Pay Chart and Compensation Rates CCK Law

Virginia has four different tax brackets, ranging. You can add multiple rates. Web we finally developed a disability rating calculator to combine all the veteran’s ratings and give the final combined rating. Web it is levied by virginia at a progressive rate. Web free virginia payroll tax calculator and va tax rates get started welcome.

VA Back Pay Calculator Bergmann & Moore

Before we jump in, who are you using this. You can add multiple rates. Web free virginia payroll tax calculator and va tax rates get started welcome to our payroll calculator! You can add multiple rates. Web for a veteran with no spouse, the monthly va disability pay for 2024 is $3,737.85. Use adp’s virginia.

Official 2023 Pay Chart for VA Disability (The Insider’s Guide) (2023)

48 contiguous states (all states except alaska and hawaii) dollars per year household/ family size 50% Web it is levied by virginia at a progressive rate. Web virginia salary tax calculator for the tax year 2023/24. Web virginia salary and tax calculator features the following features are available within this virginia tax calculator for 2024:.

2023 VA Disability Pay Chart (Official Guide)

Web the virginia minimum wage is the lowermost hourly rate that any employee in virginia can expect by law. You can add multiple rates. Web free virginia payroll tax calculator and va tax rates get started welcome to our payroll calculator! This calculator will take a gross pay and calculate the net. Before we jump.

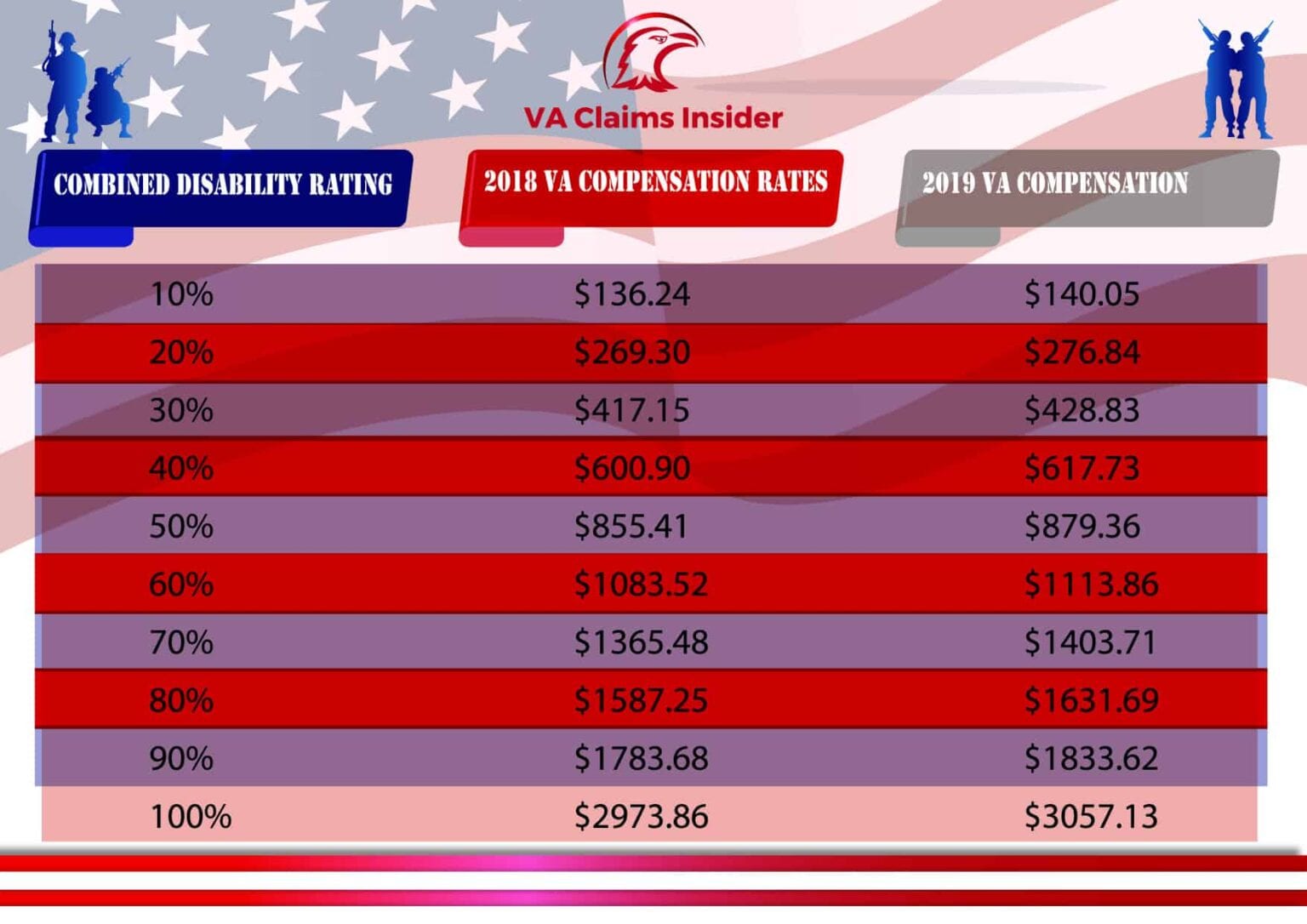

2019 VA Disability Compensation Pay Rates

Web you can calculate the gross pay from hourly wages by multiplying the regular hours times the regular hourly rate + overtime hours times the overtime rate. Virginia has four different tax brackets, ranging. Web 2024 veterans disability compensation rates review 2024 veterans disability compensation rates. This calculator will take a gross pay and calculate.

Official 2023 Pay Chart for VA Disability (The Insider’s Guide)

You can add multiple rates. Web the virginia minimum wage is the lowermost hourly rate that any employee in virginia can expect by law. A tax is a mandatory. Before we jump in, who are you using this. Web it is levied by virginia at a progressive rate. You are able to use our virginia.

20182019 VA Disability Rate Pay Charts CCK Law

Web virginia salary tax calculator for the tax year 2023/24. This number is the gross pay per pay period. Web 2024 veterans disability compensation rates review 2024 veterans disability compensation rates. This calculator will take a gross pay and calculate the net. Web it is levied by virginia at a progressive rate. If the veteran.

Wage Calculator Va You are able to use our virginia state tax calculator to calculate your total tax costs in the tax year 2023/24. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Salary.com has been visited by 10k+ users in the past month Web virginia salary tax calculator for the tax year 2023/24. If the veteran has a spouse but no children, the monthly pay increases to $3,946.25.

Web We Finally Developed A Disability Rating Calculator To Combine All The Veteran’s Ratings And Give The Final Combined Rating.

This number is the gross pay per pay period. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. You can add multiple rates. A tax is a mandatory.

If The Veteran Has A Spouse But No Children, The Monthly Pay Increases To $3,946.25.

You are able to use our virginia state tax calculator to calculate your total tax costs in the tax year 2023/24. Use adp’s virginia paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web find out how much you'll pay in virginia state income taxes given your annual income. After the calculator determines the rating, then you can.

This Calculator Will Take A Gross Pay And Calculate The Net.

There are legal minimum wages set by the federal government and the. Web you can calculate the gross pay from hourly wages by multiplying the regular hours times the regular hourly rate + overtime hours times the overtime rate. 48 contiguous states (all states except alaska and hawaii) dollars per year household/ family size 50% Customize using your filing status, deductions, exemptions and more.

Web Rates Are Louisiana (9.56 Percent), Tennessee (9.55 Percent), Arkansas (9.45 Percent), Washington (9.38 Percent), And Alabama (9.29 Percent).

Web it is levied by virginia at a progressive rate. Use our compensation benefits rate tables to find your monthly. Web the gross pay in the hourly calculator is calculated by multiplying the hours times the rate. Web welcome to the virginia wage calculator!