Walmart 1099 Forms

Walmart 1099 Forms - Includes “nonemployee compensation” — in other words, your delivery earnings from the spark driver platform. There are several kinds of 1099. Login to your pay portal; Click resources > tax documents; If you consent to electronic delivery, your tax documents will be available by january 31, 2024.

Eligibility requirements for payoneer’s capital advance apply. If you consent to electronic delivery, your tax documents will be available by january 31, 2024. If you do not consent to electronic delivery, your tax documents will be mailed by january 31, 2024. Get started *after payoneer’s approval. This form shows your total earnings from your independent contractor work, and it’s a critical piece of documentation for filing your taxes. Includes “nonemployee compensation” — in other words, your delivery earnings from the spark driver platform. Click resources > tax documents;

Tops 5Part 1099NEC Tax Forms 8.5 x 11 50/Pack 22993MISC

This form shows your total earnings from your independent contractor work, and it’s a critical piece of documentation for filing your taxes. Web delivery drivers can typically receive two types of 1099 forms: Login to your pay portal; There are several kinds of 1099. Click resources > tax documents; Get started *after payoneer’s approval. Web.

TOPS, TOPB2299, 4Part 1099 Miscellaneous Forms, 600 / Carton Walmart

Whenever you receive a 1099 form, a matching document will. Locate your form 1099 under “available year end tax forms”. Submit your walmart partner id to see if you qualify receive your offer* accept the offer and receive funds in your payoneer account it’s that easy! There are several kinds of 1099. This form shows.

1099 Form Printable and Fillable PDF Template

Login to your pay portal; Get started *after payoneer’s approval. Includes “nonemployee compensation” — in other words, your delivery earnings from the spark driver platform. Submit your walmart partner id to see if you qualify receive your offer* accept the offer and receive funds in your payoneer account it’s that easy! Eligibility requirements for payoneer’s.

Adams 1099MISC Tax Kit, 5Part Sets, 10 Peel & Seal Security Envelopes

Login to your pay portal; Whenever you receive a 1099 form, a matching document will. This form shows your total earnings from your independent contractor work, and it’s a critical piece of documentation for filing your taxes. If you do not consent to electronic delivery, your tax documents will be mailed by january 31, 2024..

TOPS 2019 1099R Laser Forms, 100 Forms/Pack (LRFEDAS)

This form shows your total earnings from your independent contractor work, and it’s a critical piece of documentation for filing your taxes. If you consent to electronic delivery, your tax documents will be available by january 31, 2024. Web delivery drivers can typically receive two types of 1099 forms: Includes “nonemployee compensation” — in other.

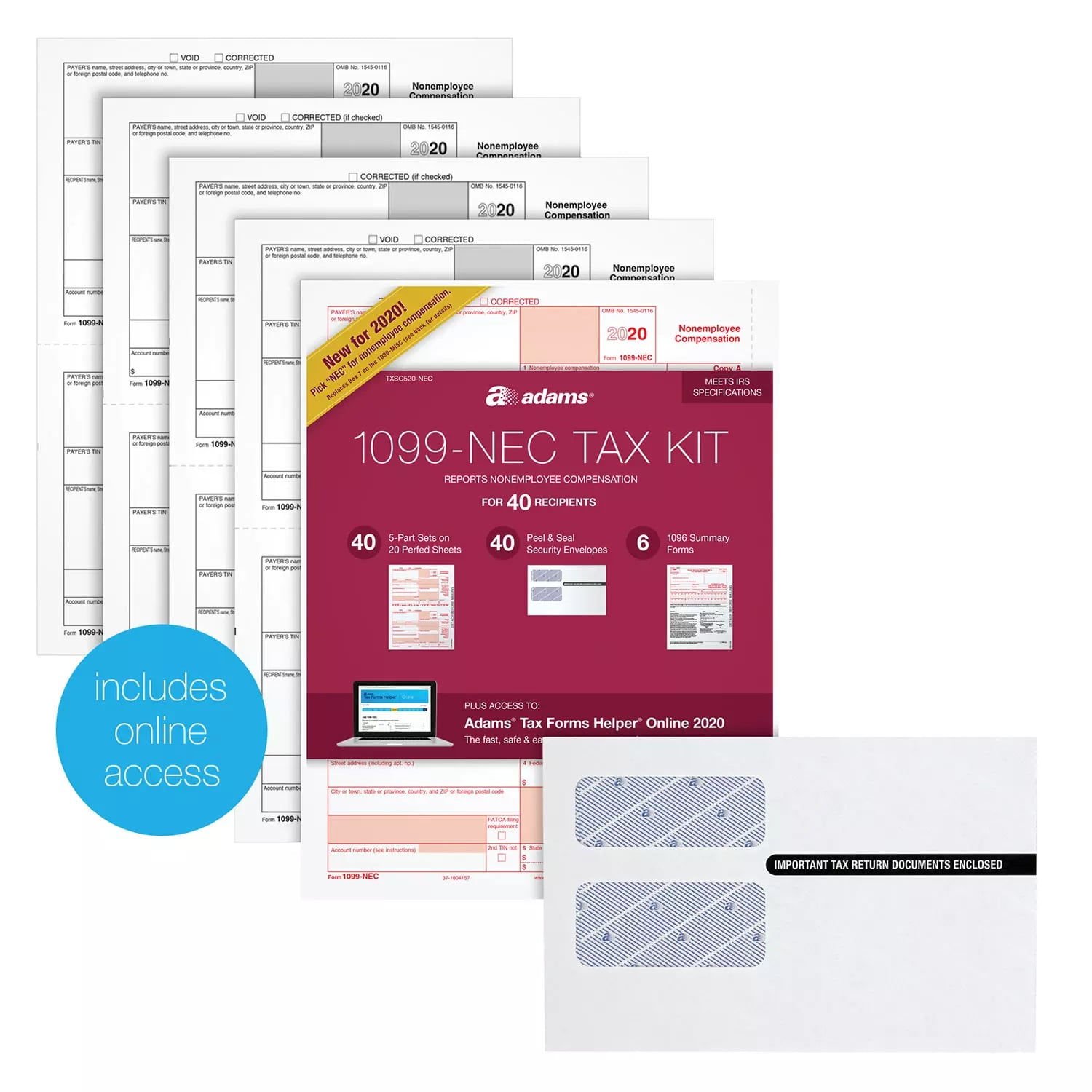

Adams 1099NEC 2020 Tax Forms Kit W/Tax Forms Helper Online, 40/pack

Get started *after payoneer’s approval. Locate your form 1099 under “available year end tax forms”. Eligibility requirements for payoneer’s capital advance apply. Click resources > tax documents; If you consent to electronic delivery, your tax documents will be available by january 31, 2024. Web a 1099 form is a record that an entity or person.

TOPS 1099 Continuous Miscellaneous Forms

Eligibility requirements for payoneer’s capital advance apply. Includes “nonemployee compensation” — in other words, your delivery earnings from the spark driver platform. If you consent to electronic delivery, your tax documents will be available by january 31, 2024. Whenever you receive a 1099 form, a matching document will. Web a 1099 form is a record.

4part 1099NEC Tax Forms

Web delivery drivers can typically receive two types of 1099 forms: If you do not consent to electronic delivery, your tax documents will be mailed by january 31, 2024. Get started *after payoneer’s approval. Login to your pay portal; If you consent to electronic delivery, your tax documents will be available by january 31, 2024..

Tops 1099 Tax Forms Fiscal Year 2022 3Part Carbonless 5.5x8.5 50 Forms

Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. If you do not consent to electronic delivery, your tax documents will be mailed by january 31, 2024. If you consent to electronic delivery, your tax documents will be available by january 31, 2024..

Adams 1099NEC 2020 Tax Forms Kit w/Tax Forms Helper Online, 40 Count

Submit your walmart partner id to see if you qualify receive your offer* accept the offer and receive funds in your payoneer account it’s that easy! The payer fills out the 1099 and sends copies to you and the irs. Login to your pay portal; There are several kinds of 1099. If you consent to.

Walmart 1099 Forms Eligibility requirements for payoneer’s capital advance apply. There are several kinds of 1099. Submit your walmart partner id to see if you qualify receive your offer* accept the offer and receive funds in your payoneer account it’s that easy! Includes “nonemployee compensation” — in other words, your delivery earnings from the spark driver platform. Login to your pay portal;

Submit Your Walmart Partner Id To See If You Qualify Receive Your Offer* Accept The Offer And Receive Funds In Your Payoneer Account It’s That Easy!

Login to your pay portal; Locate your form 1099 under “available year end tax forms”. Includes “nonemployee compensation” — in other words, your delivery earnings from the spark driver platform. If you consent to electronic delivery, your tax documents will be available by january 31, 2024.

Get Started *After Payoneer’s Approval.

Web delivery drivers can typically receive two types of 1099 forms: Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Eligibility requirements for payoneer’s capital advance apply. If you do not consent to electronic delivery, your tax documents will be mailed by january 31, 2024.

The Payer Fills Out The 1099 And Sends Copies To You And The Irs.

This form shows your total earnings from your independent contractor work, and it’s a critical piece of documentation for filing your taxes. Click resources > tax documents; There are several kinds of 1099. Whenever you receive a 1099 form, a matching document will.