Washington State Liquor Tax Calculator

Washington State Liquor Tax Calculator - Web calculate your totals for correction only. Web enter a desired case cost and case quantity, and the resulting retail price is calculated. Federal and usa state beverage taxes. Brewers or wholesalers of beer pay a tax to the washington state liquor and cannabis board for the privilege of manufacturing or selling beer in. Web washington state liquor tax calculator by frank schmitt iphone ipad free in the app store what is it about?

Web use this spirits tax calculator (.xls) to determine the spirits sales tax and spirits liter tax for your business or purchase of spirits in washington state. Calculate total liquor cost in all 50 states without going to the register Web brewer's tax rate per barrel table. Web tax on certain sales of intoxicating liquors — additional taxes for specific purposes — collection. Web washington state liquor tax calculator by frank schmitt iphone ipad free in the app store what is it about? The state’s base sales tax rate is 6.5%. The tax is $ notes:.

Washington State Liquor Tax Calculator for Android APK Download

Web calculate your totals for correction only. 4/5 (216k reviews) Brewers or wholesalers of beer pay a tax to the washington state liquor and cannabis board for the privilege of manufacturing or selling beer in. Web washington's general sales tax of 6.5% does not apply to the purchase of liquor. Enter a desired retail price.

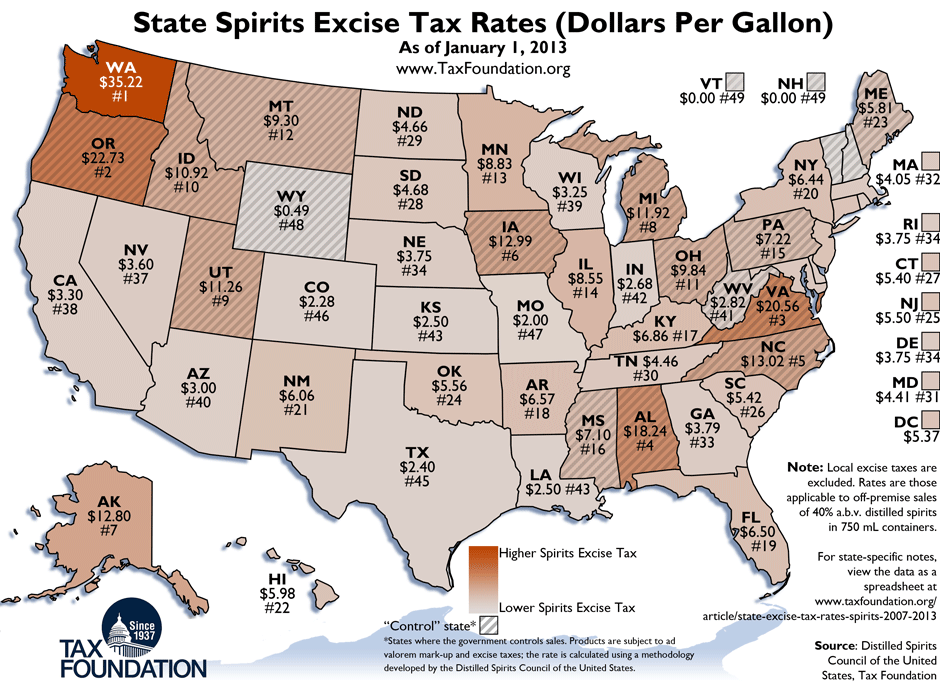

Taxing Tipple Washington has nation's highest liquor taxes

Beer federal tax calculator measurement: License suspension, which may impact the ability to. Web costs to individuals for dui may include the following: Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web wa liquor tax calculator. Levied by state administration liquor and cannabis board..

Alcohol Tax by State 2023 Wisevoter

In washington, liquor vendors are responsible for paying a state excise tax of $14.27 per. The tax is $ notes:. $2.83 spirits liter tax on 750 ml $3.08 spirits sales tax on the $15 selling price $5.90. Web washington state liquor tax calculator by frank schmitt iphone ipad free in the app store what is.

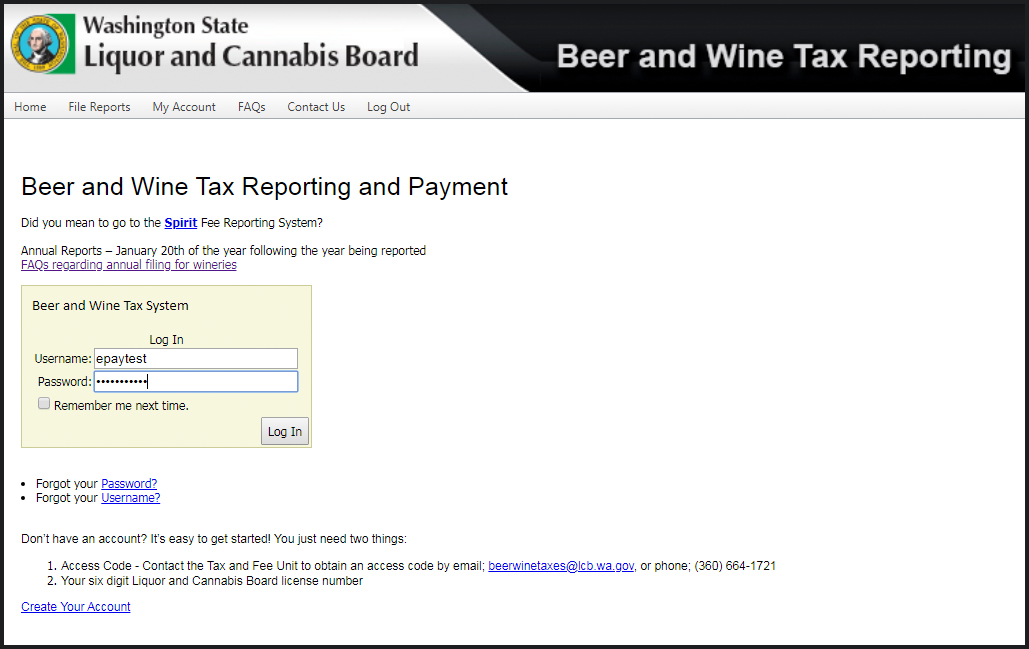

How to File Online Tax Reports Washington State Liquor and Cannabis Board

Jail time of up to one year. Federal and usa state beverage taxes. It uses the standard tax rates defined by washington state law. Web includes $5.90 in consumer spirits taxes $20.90 spirits taxes remitted to dor includes: Levied by state administration liquor and cannabis board. Enter a desired retail price and case quantity, and.

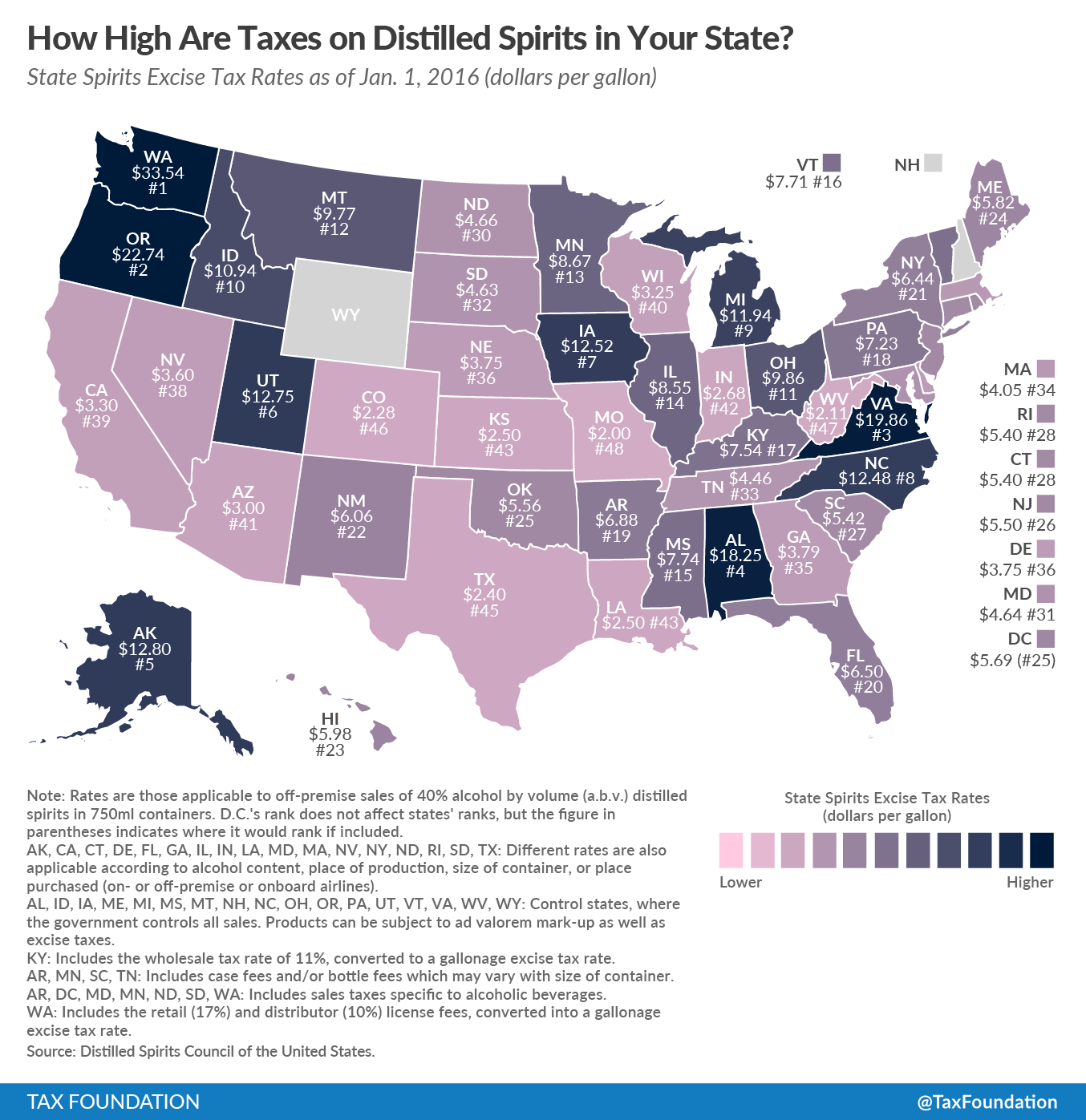

How High Are Taxes on Distilled Spirits in Your State? (2016) Tax

It uses the standard tax rates defined by washington state law. Click on the link above to view the table. Web wa liquor tax calculator. Web washington state beer tax. How do i pay the tax? Select a state, a tax or fee category, a unit of measurement, and a tax or fee. License suspension,.

How Much Every State Taxes Beer (2021) [Map] Isaiah Rippin

Web washington state liquor tax calculator by frank schmitt iphone ipad free in the app store what is it about? Web enter a desired case cost and case quantity, and the resulting retail price is calculated. Brewers and beer wholesalers report the tax monthly, with payment due by the. See the report of spirits tax..

Liqour Taxes How High Are Distilled Spirits Taxes in Your State?

How do i pay the tax? The state’s base sales tax rate is 6.5%. In washington, liquor vendors are responsible for paying a state excise tax of $14.27 per. See the report of spirits tax. Enter a desired retail price and case quantity, and the. Web costs to individuals for dui may include the following:.

How High Are Spirits Taxes in Your State? Tax Foundation

$8.08 or $4.782 (see brewers tax rate per barrel table) 4/5 (216k reviews) The state’s base sales tax rate is 6.5%. Web learn how to file and submit reports for beer and wine taxes in washington state, including due dates, penalties, and record keeping requirements. Web costs to individuals for dui may include the following:.

Washington State Liquor Tax Calculator by Frank Schmitt

Web washington state liquor tax calculator by frank schmitt iphone ipad free in the app store what is it about? Levied by state administration liquor and cannabis board. Conversion formulas 1 liter = 0.264172 gallons liters ÷ 3.78544 = gallons in case gallons x 3.78544 = liters ounces x bottles in case ÷. Web online.

Weekly Map State Spirits Excise Tax Rates

If you sell spirits, you will collect the spirits liter tax from your. If additional fees are due, the amount must be remitted along with the corrected report, including any applicable late penalties on the. $8.08 or $4.782 (see brewers tax rate per barrel table) The state’s base sales tax rate is 6.5%. Select a.

Washington State Liquor Tax Calculator Web learn about the two types of spirits (liquor) taxes in washington: Web wine tax per 9 liter case (standard case): Web enter a desired case cost and case quantity, and the resulting retail price is calculated. Web washington state liquor tax calculator by frank schmitt iphone ipad free in the app store what is it about? Levied by state administration liquor and cannabis board.

Web A Tool To Calculate The Specific Tax Amount For Different Types Of Liquors Sold In Washington State.

Web brewer's tax rate per barrel table. Mini (50ml) half pint (200ml) pint (375ml) fifth (750ml) 1 liter half gallon (1.75l) gallon (3.5l) Web wine tax per 9 liter case (standard case): Web washington state beer tax.

Web Online Reporting And Payment Available For:

Reporting guides these guides have information on filing dates, record keeping, reporting requirements and other details. Web washington's general sales tax of 6.5% does not apply to the purchase of liquor. The tax is $ notes:. The state’s base sales tax rate is 6.5%.

A Sales Tax Based On The Selling Price And A Liter Tax Based On The Volume.

Select a state, a tax or fee category, a unit of measurement, and a tax or fee. Web costs to individuals for dui may include the following: In washington, liquor vendors are responsible for paying a state excise tax of $14.27 per. Web enter a desired case cost and case quantity, and the resulting retail price is calculated.

It Uses The Standard Tax Rates Defined By Washington State Law.

License suspension, which may impact the ability to. Web use this tool to estimate new annual revenue from an alcohol tax or fee increase in your state. How do i pay the tax? Conversion formulas 1 liter = 0.264172 gallons liters ÷ 3.78544 = gallons in case gallons x 3.78544 = liters ounces x bottles in case ÷.

![How Much Every State Taxes Beer (2021) [Map] Isaiah Rippin](https://vinepair.com/wp-content/uploads/2021/07/2021-beer-taxes-Tax-Foundation.png)