What Is A Recoverable Draw

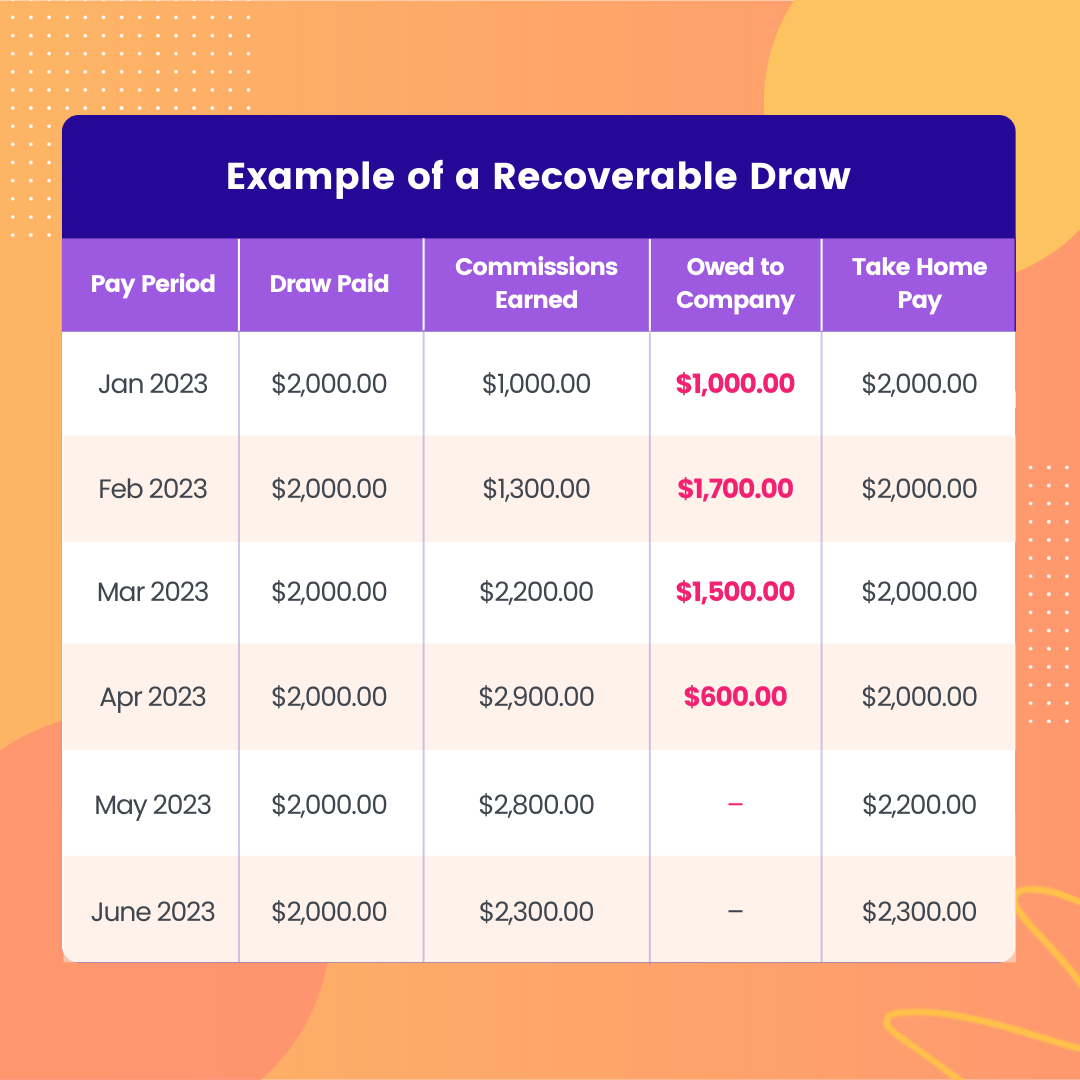

What Is A Recoverable Draw - It often acts as a loan for earning sales commissions, and if an employee earns less than what they received in a draw, they owe the difference back to the company. But let’s understand the basics. Recoverable draws (the difference between total pay and commissions earned) allows reps to get paid up front, but the company will recover the draw payments from earned commissions over time. If the salesperson does not meet the draw amount, they will carry this debt to the next pay cycle. Web recoverable draws are ‘technically’ a loan given by the company to the reps and you can recover them against all future commissions.

It’s like a salary because all payroll deductions must be taken out of every draw check. These funds are typically deducted from future commission earnings. The amount of the draw is based on the expected earnings of the employee during a given period, such as a month or a quarter. If it’s less than the draw, the employee is guaranteed the original advance. When a salesperson′s compensation is derived largely from commissions, a company can pay the salesperson a substantial sum of money even before the commissions are earned. Web fixed recoverable costs give certainty in advance about the maximum amount that the losing party will have to pay as they set the amount of legal costs that the winning party can claim back from. It guarantees employees a minimum income each pay cycle.

Outside Sales Offer Letter with Recoverable Draw CleanTech Docs

What is a recoverable draw? It’s best (for both dol issues and for recruiting) to call it what it is and refigure your incentive to use a threshold (which. Web a recoverable draw is what most people may think of when considering a draw against commission. Web the draw works essentially as a loan that.

Effective AND Fair Sales Compensation Plan Blueprints [With Examples

It often acts as a loan for earning sales commissions, and if an employee earns less than what they received in a draw, they owe the difference back to the company. It guarantees employees a minimum income each pay cycle. When a salesperson′s compensation is derived largely from commissions, a company can pay the salesperson.

what is recoverable draw Alesia Carder

A recoverable draw against commission is money paid to a sales rep paid from the future commission they earn. The commissions are used to “repay” the loan, thereby reducing the “red figure” — the indebtedness owed. It guarantees employees a minimum income each pay cycle. Web a recoverable draw (also known as a draw against.

what is recoverable draw Alesia Carder

Brian sells $100,000 of products and is entitled to receive $20,000 in commissions. Web fixed recoverable costs give certainty in advance about the maximum amount that the losing party will have to pay as they set the amount of legal costs that the winning party can claim back from. We will also discuss what is.

Recoverable Draw Spiff

If it’s less than the draw, the employee is guaranteed the original advance. The amount of the draw is based on the expected earnings of the employee during a given period, such as a month or a quarter. These funds are typically deducted from future commission earnings. Web a recoverable draw is a type of.

Recoverable and NonRecoverable Draws » Forma.ai

It guarantees employees a minimum income each pay cycle. With a recoverable draw, the sales rep eventually brings in enough commission to repay their advance. However, it must be repaid by the salesperson’s commission at the end of the pay cycle. Brian sells $100,000 of products and is entitled to receive $20,000 in commissions. Recoverable.

Recoverable Draw Spiff

How does a draw work in sales? It’s best (for both dol issues and for recruiting) to call it what it is and refigure your incentive to use a threshold (which. Web a recoverable draw is the more prevalent of the two. Web a draw against commission can be helpful when selling products or services.

Recoverable Draw Spiff

Web a recoverable draw is the more prevalent of the two. Web a recoverable draw is a form of pay advance given to employees against future commissions or bonuses, which the employer can recover from future earnings. These funds are typically deducted from future commission earnings. With a recoverable draw, the sales rep eventually brings.

FAQ What Are The Pros and Cons of Straight Commission Plans?

Web the draw works essentially as a loan that the employee will be responsible for paying back at a later date. Think of it as a guaranteed minimum commission payment. A recoverable draw against commission is money paid to a sales rep paid from the future commission they earn. These funds are typically deducted from.

what is recoverable draw Alesia Carder

What is draw against commission? The amount of the draw is based on the expected earnings of the employee during a given period, such as a month or a quarter. Web the draw works essentially as a loan that the employee will be responsible for paying back at a later date. Web a draw against.

What Is A Recoverable Draw Web fixed recoverable costs give certainty in advance about the maximum amount that the losing party will have to pay as they set the amount of legal costs that the winning party can claim back from. Web the draw works essentially as a loan that the employee will be responsible for paying back at a later date. Web a recoverable draw is a payout that you expect to gain back. A recoverable draw against commission is money paid to a sales rep paid from the future commission they earn. Web a recoverable draw is the more prevalent of the two.

How Does A Draw Work In Sales?

Web fixed recoverable costs give certainty in advance about the maximum amount that the losing party will have to pay as they set the amount of legal costs that the winning party can claim back from. But let’s understand the basics. Web recoverable draws are ‘technically’ a loan given by the company to the reps and you can recover them against all future commissions. Think of it as a guaranteed minimum commission payment.

Web A Draw Is Similar To A Loan While The Employee (Consultant) Is On The Payroll.

The amount of the draw is based on the expected earnings of the employee during a given period, such as a month or a quarter. Web a recoverable draw is a fixed amount advanced to an employee within a given time period. If the employee earns more in commissions than the draw amount, the employer pays the employee the difference after the commissions have been earned. However, it must be repaid by the salesperson’s commission at the end of the pay cycle.

What Is A Recoverable Draw?

Web a recoverable draw is the more prevalent of the two. Web a recoverable draw is a type of advance payment made by a company to a commissioned employee. For example, if you give an employee a draw of $2,000 per month, you expect the employee to earn at least $2,000 in commissions each month. You are basically loaning employees money that you expect them to pay back by earning sales commissions.

These Funds Are Typically Deducted From Future Commission Earnings.

Web a recoverable draw (also known as a draw against commission) is a set amount of money paid to the sales representative by the company at regular intervals. A recoverable draw against commission is money paid to a sales rep paid from the future commission they earn. When a salesperson′s compensation is derived largely from commissions, a company can pay the salesperson a substantial sum of money even before the commissions are earned. It’s like a salary because all payroll deductions must be taken out of every draw check.