Wyoming Sales Tax Calculator

Wyoming Sales Tax Calculator - Web the wyoming sales tax comparison calculator allows you to compare sales tax between all locations in wyoming in the usa using average sales tax rates and/or. Intuit.com has been visited by 1m+ users in the past month View a detailed list of local sales tax rates in wyoming with supporting sales tax calculator. Web a tax deduction for legal fees would help the plaintiff to avoid owing tax on the legal fees, but starting in 2018, many legal fees paid before 2026 are no longer. Web state wide sales tax is 4%.

This takes into account the rates on the. Web putting everything together, the average cumulative sales tax rate in the state of wyoming is 5.44% with a range that spans from 4% to 6%. In addition, local and optional taxes can be assessed if approved by a vote of the citizens. Wyoming state sales tax rate range. For example, let’s say that you want to purchase a new car for $30,000,. Wyoming sales tax map legend: The wyoming state sales tax rate is 4%, and the average wy sales tax after local surtaxes.

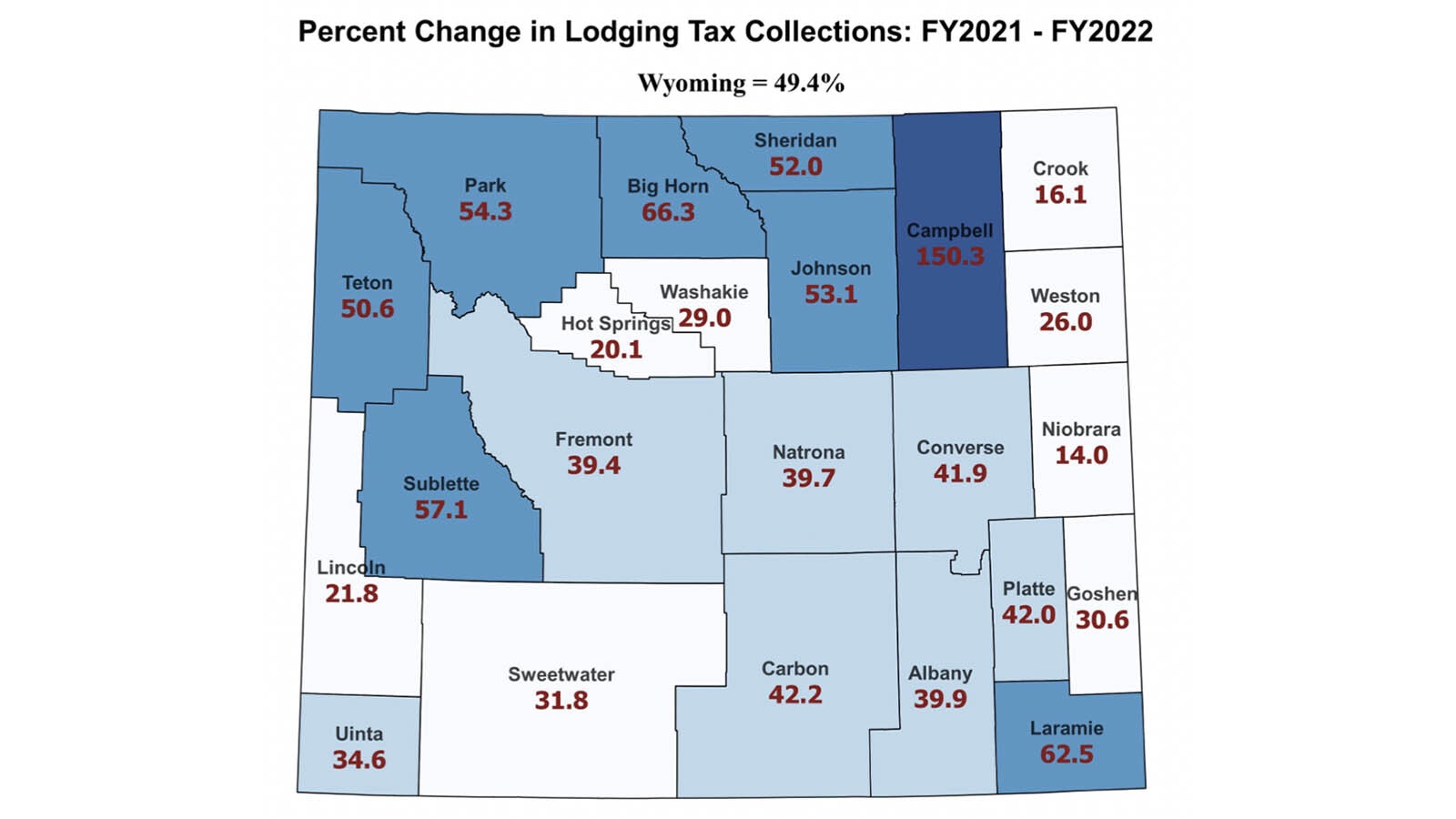

Wyoming Tax Revenues Top 1 Billion For Fiscal Year 2022; Increase Of

View a detailed list of local sales tax rates in wyoming with supporting sales tax calculator. Tax rate charts are only updated as changes in rates occur. Web putting everything together, the average cumulative sales tax rate in the state of wyoming is 5.44% with a range that spans from 4% to 6%. 4% is.

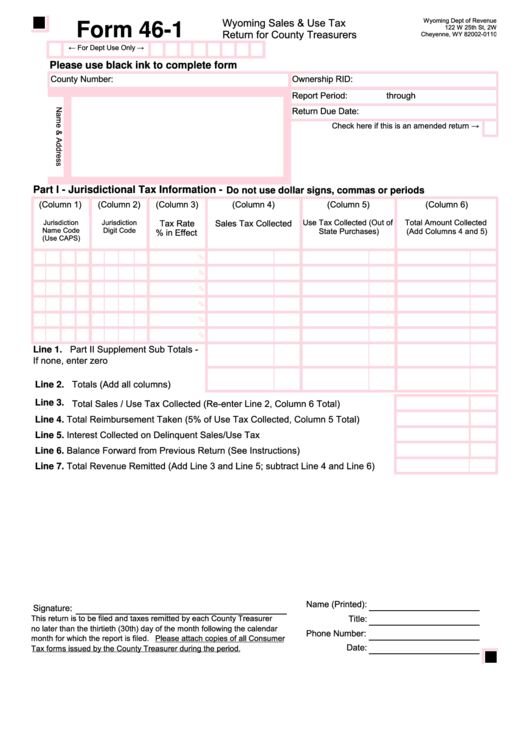

Fillable Form 461 Wyoming Sales & Use Tax Return For County

Web tax rates can vary based on the location of your business and the location of your customer, plus the levels of sales tax that apply in those specific locations. There are a total of 106 local tax jurisdictions across. Wyoming sales tax map legend: Web get a quick rate range. Web the average sales.

Wyoming Sales Tax Small Business Guide TRUiC

The wyoming state sales tax rate is 4%, and the average wy sales tax after local surtaxes. The seller acts as a de facto. Web a tax deduction for legal fees would help the plaintiff to avoid owing tax on the legal fees, but starting in 2018, many legal fees paid before 2026 are no.

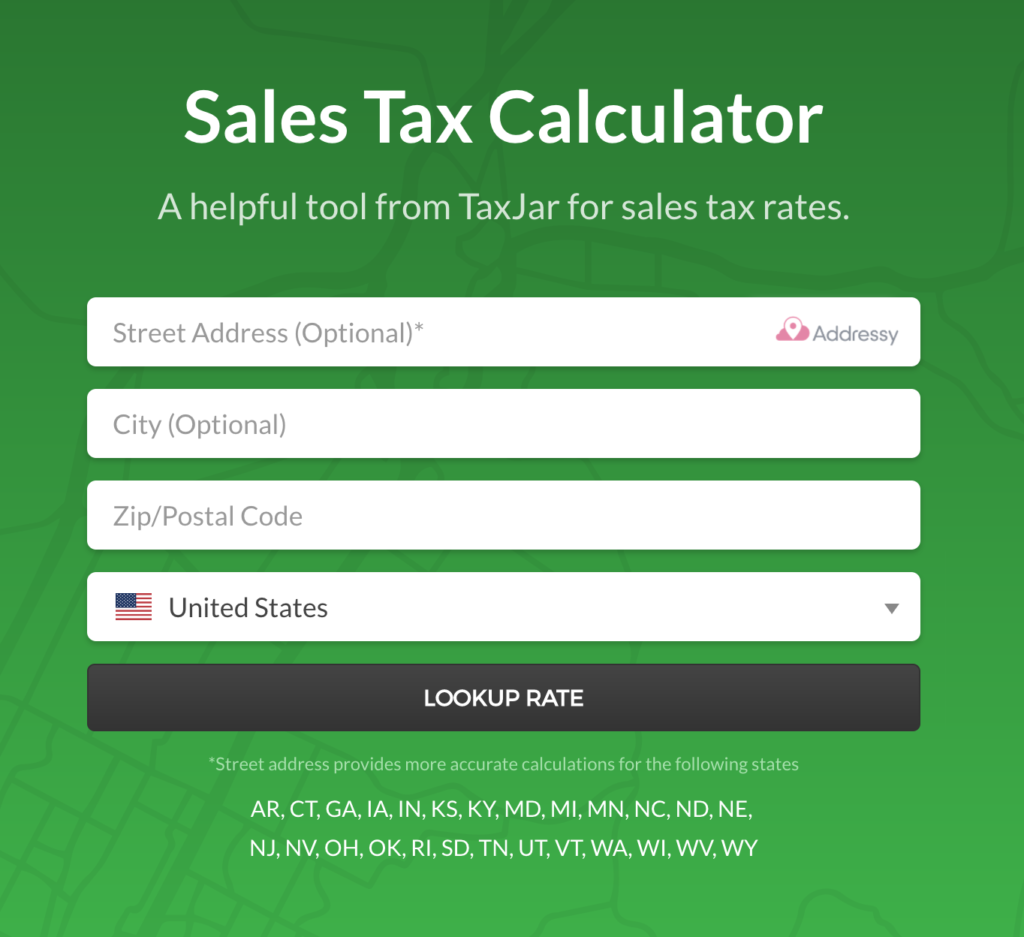

Wyoming Sales Tax Calculator 2023 State, County & Local Rates

Web local tax rates in wyoming range from 0% to 2%, making the sales tax range in wyoming 4% to 6%. If there have not been any rate changes then the most recently dated rate. The seller acts as a de facto. Web a tax deduction for legal fees would help the plaintiff to avoid.

What is Sales Tax Nexus Learn all about Nexus

Web local tax rates in wyoming range from 0% to 2%, making the sales tax range in wyoming 4% to 6%. Web you can calculate the sales tax in wyoming by multiplying the final purchase price by.04%. Rates include state, county and city taxes. Find your wyoming combined state and local tax rate. Web wyoming.

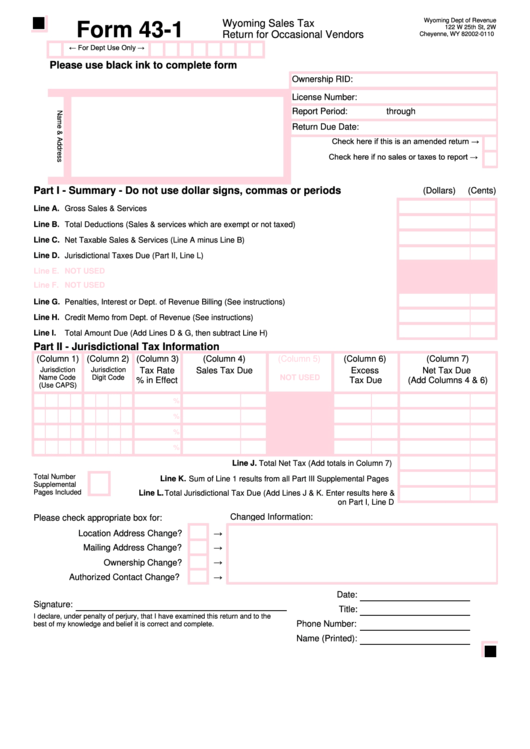

Fillable Form 431 Wyoming Sales Tax Return For Occasional Vendors

Web get a quick rate range. Make any calculation according to the state sales taxes + added taxes. Web the average sales tax rate in wyoming in 2024 is 4%. Find your wyoming combined state and local tax rate. Web you can calculate the sales tax in wyoming by multiplying the final purchase price by.04%..

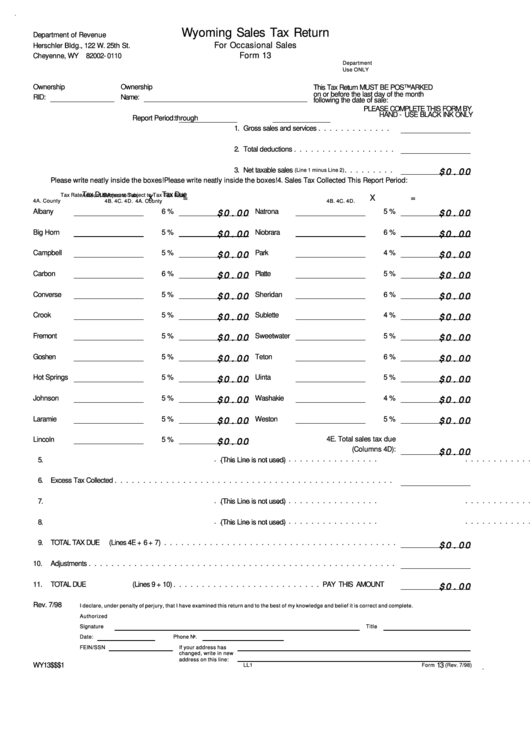

Form 13 Wyoming Sales Tax Return For Occasional Sales Wyoming

Tax rate charts are only updated as changes in rates occur. Web use our sales tax calculator to determine your exact sales tax rate and total purchase amount. Web 5.518% wyoming has state sales tax of 4% , and allows local governments to collect a local option sales tax of up to 2%. Web you.

Ultimate Wyoming Sales Tax Guide Zamp

Web wyoming state rate (s) for 2024. Wyoming sales tax map legend: Web local tax rates in wyoming range from 0% to 2%, making the sales tax range in wyoming 4% to 6%. For example, let’s say that you want to purchase a new car for $30,000,. Web you can calculate the sales tax in.

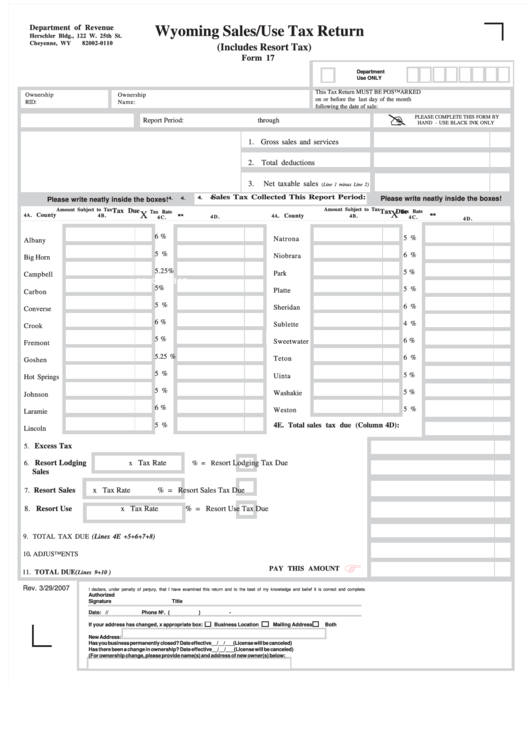

Form 17 Wyoming Sales/use Tax Return printable pdf download

Web a tax deduction for legal fees would help the plaintiff to avoid owing tax on the legal fees, but starting in 2018, many legal fees paid before 2026 are no longer. In addition, local and optional taxes can be assessed if approved by a vote of the citizens. Web state wide sales tax is.

Wyoming Sales Tax Calculator Step By Step Business

2024 wyoming state sales tax. Web a tax deduction for legal fees would help the plaintiff to avoid owing tax on the legal fees, but starting in 2018, many legal fees paid before 2026 are no longer. View a detailed list of local sales tax rates in wyoming with supporting sales tax calculator. Address lookup.

Wyoming Sales Tax Calculator Web sales & use tax rate charts. Address lookup for jurisdictions and sales tax rate. Intuit.com has been visited by 1m+ users in the past month If there have not been any rate changes then the most recently dated rate. Web on this page you can find the wyoming sales tax calculator which for 2024 which allows you to calculate sales tax for each location within wyoming.

Average Sales Tax (Including Local Taxes ):

The calculator will show you. Address lookup for jurisdictions and sales tax rate. Web the average sales tax rate in wyoming in 2024 is 4%. Wyoming state sales tax rate range.

Web The Latest Sales Tax Rates For Cities In Wyoming (Wy) State.

Web tax rates can vary based on the location of your business and the location of your customer, plus the levels of sales tax that apply in those specific locations. This takes into account the rates on the. Web 5.518% wyoming has state sales tax of 4% , and allows local governments to collect a local option sales tax of up to 2%. The wyoming state sales tax rate is 4%, and the average wy sales tax after local surtaxes.

Web 2024 Wyoming Sales Tax Map By County.

Web wyoming sales tax calculator. Web you can calculate the sales tax in wyoming by multiplying the final purchase price by.04%. 4% is the smallest possible tax rate ( laramie, wyoming) 5%, 5.25%, 5.5%, 6% are all the other possible sales tax rates of wyoming cities. Wyoming sales tax calculator sales tax for wyoming % net.

Web On This Page You Can Find The Wyoming Sales Tax Calculator Which For 2024 Which Allows You To Calculate Sales Tax For Each Location Within Wyoming.

Average local + state sales tax. Wyoming sales tax map legend: Tax rate charts are only updated as changes in rates occur. 2020 rates included for use while preparing your income tax.