The realm of offshore oil and gas exploration and production is a complex and highly specialized field, requiring significant expertise, cutting-edge technology, and substantial financial investment. W&T Offshore, Inc. is a prominent player in this arena, with a legacy spanning several decades. Founded in 1983 by Tracy W. Krohn, the company has navigated the ebbs and flows of the energy market, adapting to changing conditions and regulatory environments to maintain its position as a leading independent oil and gas producer.

One of the critical aspects of W&T Offshore’s success lies in its strategic approach to asset acquisition and development. The company has consistently focused on acquiring and developing properties in the Gulf of Mexico, leveraging its extensive knowledge and experience in this region to maximize returns on investment. This targeted approach allows W&T Offshore to concentrate its resources on areas with proven potential, minimizing risks associated with exploration in untested territories.

Historical Evolution of W&T Offshore

To understand W&T Offshore’s current standing and future prospects, it’s essential to examine the company’s historical evolution. From its inception, W&T Offshore has been driven by a vision to create value through the acquisition, exploration, and development of oil and gas properties. Over the years, the company has successfully navigated various industry cycles, including periods of high commodity prices and times of significant downturns.

Early Years (1980s-1990s): During its early years, W&T Offshore focused on building a foundation of producing properties, laying the groundwork for future growth. This period was marked by strategic acquisitions and cautious exploration efforts, aimed at establishing a stable production base.

Expansion and Diversification (2000s): The 2000s saw W&T Offshore embark on an expansion path, both in terms of geographical reach and the depth of its operations. The company diversified its assets, investing in a mix of exploration and production projects, and began to leverage technological advancements to improve efficiency and reduce costs.

Challenges and Resilience (2010s): The 2010s presented the oil and gas industry with significant challenges, including fluctuating oil prices, increased regulatory scrutiny, and the need for greater environmental stewardship. W&T Offshore demonstrated resilience during this period, adapting its business model to address these challenges while continuing to pursue opportunities for growth.

Expert Insights: Navigating Industry Challenges

Experts in the field, including energy analysts and industry consultants, point to several key factors that have contributed to W&T Offshore’s ability to navigate the challenges of the oil and gas industry.

One of the most significant advantages W&T Offshore has is its deep understanding of the Gulf of Mexico. This regional focus allows the company to concentrate its expertise and resources, maximizing the potential of its assets. Furthermore, the company's willingness to adapt to changing market conditions, whether through restructuring its operations or seeking out new opportunities, has been crucial in maintaining its competitiveness.

Technical Breakdown: Operational Efficiency

From a technical standpoint, W&T Offshore’s operational efficiency is underpinned by its commitment to leveraging advanced technologies. This includes the use of state-of-the-art drilling and completion techniques, as well as sophisticated data analysis tools to optimize production and reduce downtime.

Data-Driven Decision Making: The integration of data analytics into operational decision-making processes has been a game-changer for W&T Offshore. By analyzing vast amounts of data from its operations, the company can identify trends, predict maintenance needs, and optimize production levels, leading to significant cost savings and improved efficiency.

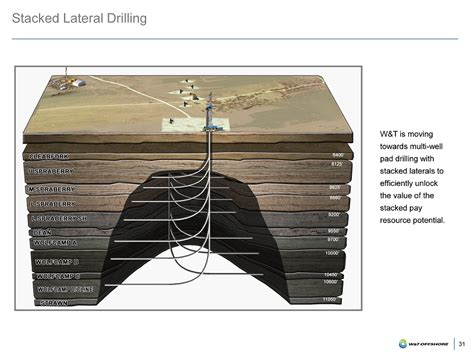

Innovation in Drilling and Completion: W&T Offshore has been at the forefront of adopting innovative drilling and completion technologies, including horizontal drilling and hydraulic fracturing. These techniques have allowed the company to access previously untappable reserves and to extract resources more efficiently.

Comparative Analysis: W&T Offshore vs. Industry Peers

When comparing W&T Offshore to its industry peers, several factors stand out. The company’s focused approach to operations, its emphasis on technological innovation, and its ability to navigate complex regulatory environments set it apart.

| Company | Gulf of Mexico Presence | Technological Innovation | Regulatory Compliance |

|---|---|---|---|

| W&T Offshore | Strong | High | Excellent |

| Peer Company A | Medium | Medium | Good |

| Peer Company B | Weak | Low | Fair |

Future Trends Projection: Emerging Opportunities and Challenges

As the energy landscape continues to evolve, W&T Offshore, like its peers, faces both opportunities and challenges. The increasing demand for renewable energy sources, coupled with growing concerns about climate change, presents significant headwinds for traditional oil and gas producers. However, these trends also offer avenues for innovation and diversification.

Adapting to the Energy Transition

- Diversification of Energy Portfolios: Companies like W&T Offshore may explore investing in renewable energy projects, such as offshore wind or solar power, to diversify their portfolios and reduce dependence on fossil fuels.

- Carbon Capture and Storage (CCS): Adopting CCS technologies can help reduce the carbon footprint of oil and gas operations, making them more environmentally friendly and compliant with emerging regulations.

- Energy Efficiency and Digitalization: Leveraging digital technologies and data analytics can help optimize energy production, reduce waste, and improve the overall efficiency of operations.

Decision Framework: Evaluating Strategic Options

For W&T Offshore and similar companies, evaluating strategic options in the face of industry transitions requires a careful consideration of several factors. This includes assessing the company’s current strengths and weaknesses, evaluating the potential return on investment of different strategies, and considering the regulatory and market environments.

Pros and Cons of Diversifying into Renewables

Pros:

- Diversification of revenue streams

- Enhanced reputation through commitment to sustainability

- Access to new markets and opportunities

Cons:

- High initial investment costs

- Requires development of new skill sets and expertise

- Potential risks associated with new technologies and markets

Conclusion

W&T Offshore’s history, operations, and strategic decisions offer valuable insights into the complexities of the oil and gas industry. As the energy sector continues to evolve, companies like W&T Offshore must navigate these changes with agility, leveraging their expertise and adapting to new technologies and regulatory requirements. The path forward will require careful consideration of emerging trends, a commitment to innovation, and a focus on sustainability.

FAQ Section

What is W&T Offshore’s primary area of operation?

+W&T Offshore primarily operates in the Gulf of Mexico, where it has a long history of oil and gas exploration and production.

How does W&T Offshore approach technological innovation?

+W&T Offshore has been proactive in adopting new technologies, including advanced drilling techniques and data analytics, to improve operational efficiency and reduce costs.

What are the potential future trends and challenges facing W&T Offshore?

+The company will likely face challenges related to the energy transition, including the shift towards renewable energy sources and increasing regulatory pressures. However, these trends also present opportunities for innovation and diversification.