Introduction to California 568 Form

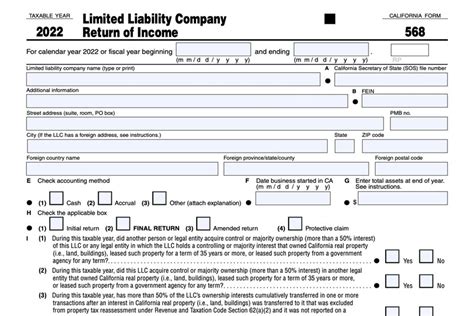

For businesses operating in California, navigating the state’s complex tax landscape can be daunting. One crucial aspect of this is understanding and complying with the requirements for filing the California 568 form. This form, also known as the Limited Liability Company (LLC) Return of Income, is a critical component of the state’s tax regime for certain business entities. In this comprehensive guide, we will delve into the intricacies of the California 568 form, exploring its purpose, who needs to file it, and the steps to ensure compliant and efficient filing.

Purpose of the California 568 Form

The primary purpose of the California 568 form is to report the income, deductions, and credits of limited liability companies (LLCs) and limited liability partnerships (LLPs) that are classified as partnerships for tax purposes. This form is essential for the Franchise Tax Board (FTB) to assess the tax liabilities of these entities. By filing the California 568 form, businesses provide the FTB with a detailed breakdown of their financial activities, enabling the state to calculate the taxes owed.

Who Needs to File the California 568 Form?

Not all businesses in California are required to file the 568 form. The requirement primarily applies to LLCs and LLPs that meet specific criteria:

LLCs and LLPs Classified as Partnerships: For tax purposes, if an LLC or LLP is treated as a partnership, it must file the California 568 form. This classification typically applies to multi-member LLCs and LLPs.

Single-member LLCs: Generally, single-member LLCs are disregarded entities for federal tax purposes, meaning they are not required to file a separate federal income tax return. However, in California, single-member LLCs may still need to file the California 568 form if they have income derived from California sources.

Foreign LLCs: If a foreign LLC has income derived from California sources, it may be required to file the California 568 form.

Steps to File the California 568 Form

Filing the California 568 form involves several steps:

Obtain the Necessary Forms: The first step is to obtain the California 568 form and any required schedules from the California Franchise Tax Board (FTB) website or by contacting the FTB directly.

Gather Financial Documentation: Businesses need to gather all relevant financial documents, including income statements, balance sheets, and any other documentation that supports the information reported on the form.

Complete the Form Accurately: Fill out the California 568 form and any required schedules with accurate and complete information. Ensure that all financial figures are correctly reported and that the form is signed by an authorized representative of the business.

Submit the Form: Once the form is completed, submit it to the FTB by the specified deadline. The deadline for filing the California 568 form typically coincides with the federal income tax filing deadline for partnerships.

Pay Any Tax Due: If the business has a tax liability, ensure that any tax due is paid by the deadline to avoid penalties and interest.

Practical Application Guides and Decision Frameworks

To simplify the filing process and ensure compliance, businesses can follow practical guides and decision frameworks. For instance, creating a checklist of required documents and deadlines can help streamline the preparation process. Additionally, consulting with a tax professional can provide valuable insights and ensure that all aspects of the filing are addressed correctly.

Conclusion and Key Takeaways

The California 568 form is a critical tax filing requirement for certain businesses operating in the state. Understanding who needs to file this form, the steps involved in the filing process, and the importance of accurate and timely submission is essential for compliance and avoiding potential penalties. By leveraging practical guides, decision frameworks, and expert advice, businesses can navigate the complexities of California’s tax landscape with confidence and efficiency.

Frequently Asked Questions (FAQs)

What is the deadline for filing the California 568 form?

The deadline for filing the California 568 form typically coincides with the federal income tax filing deadline for partnerships, which is usually March 15th or the next business day if March 15th falls on a weekend or federal holiday.

Who is required to file the California 568 form?

The California 568 form is primarily required for LLCs and LLPs classified as partnerships for tax purposes, including multi-member LLCs and LLPs, certain single-member LLCs with California-sourced income, and foreign LLCs with California-sourced income.

What happens if a business fails to file the California 568 form?

Failure to file the California 568 form or pay any tax due can result in penalties, interest, and potential loss of business privileges in California. It is crucial for businesses to adhere to the filing requirements and deadlines to avoid these consequences.

Can a business file an extension for the California 568 form?

Yes, businesses can request an extension of time to file the California 568 form by submitting Form 3539, Payment for Automatic Extension for Corporations and Limited Liability Companies, to the FTB by the original filing deadline. This automatic six-month extension provides additional time for filing but does not extend the time for paying any tax due.

Are there any resources available to help with filing the California 568 form?

Yes, the California Franchise Tax Board (FTB) provides extensive resources, including forms, instructions, and FAQs, on its website to assist businesses with filing the California 568 form. Additionally, tax professionals and accounting firms can offer expert guidance and support throughout the filing process.