1031 Exchange Calculation

1031 Exchange Calculation - The basics suppose you are a real estate investor. The exchange must be reported in the tax year when the investor relinquishing. Web an example calculating the basis in 1031 exchange. Closing date what day will escrow. Federal tax on depreciation recapture:

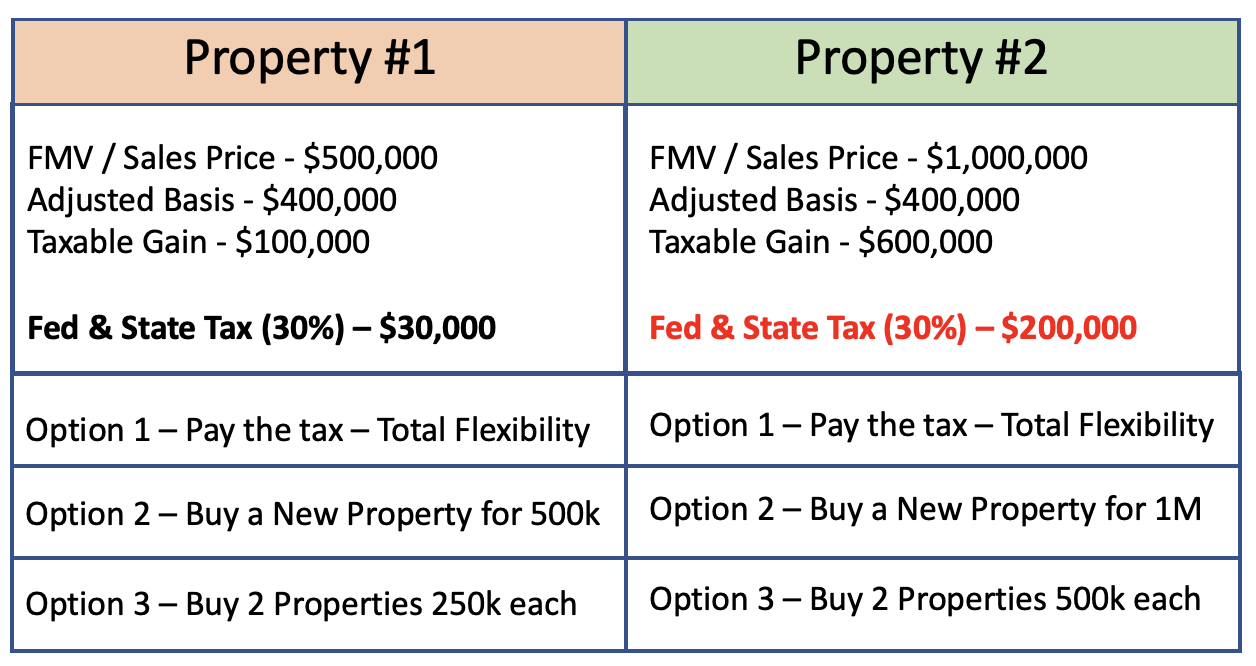

The simplest type of section 1031 exchange is a simultaneous swap of one property for. Property you are selling selling price of property selling. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. State tax on total gain: Web 1031 exchange deadline calculator. This simplified estimator is for example. To pay no tax when executing a 1031 exchange, you must purchase at least as much as you sell (net sale) and you must use all of the cash received (net.

What is a 1031 Exchange?

Web an example calculating the basis in 1031 exchange. Property you are selling selling price of property selling. Federal tax on depreciation recapture: To pay no tax when executing a 1031 exchange, you must purchase at least. The basics suppose you are a real estate investor. Web this 1031 exchange calculator will estimate the taxable.

1031 Exchange When Selling a Business

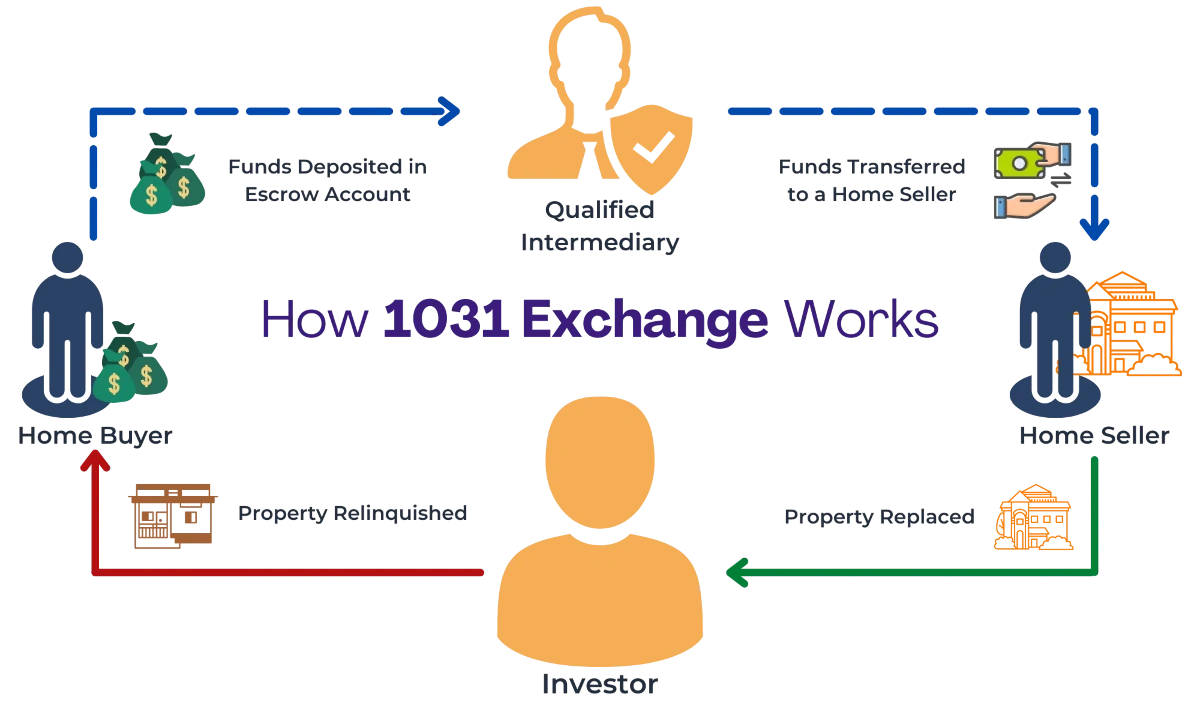

Reverse and improvement exchange parking structures; Meet our teamover 20,000 transactionssubmit a messageover 30 years experience The simplest type of section 1031 exchange is a simultaneous swap of one property for. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your.

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

1031crowdfunding.com has been visited by 10k+ users in the past month Web follow these steps to do a 1031 exchange: Web tax calculations federal tax on capital gains: The exchange must be reported in the tax year when the investor relinquishing. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale.

When and How to use the 1031 Exchange Mark J. Kohler

Web an example calculating the basis in 1031 exchange. Web the build to suit exchange. Reverse and improvement exchange parking structures; Web 1031 exchange deadline calculator. This simplified estimator is for example. Federal tax on depreciation recapture: Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. 1031crowdfunding.com has.

The Complete Guide to 1031 Exchange Rules

Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into. Closing date what day will escrow. This must be an investment property—not a primary residence—and it should. Web this 1031 exchange calculator will estimate the taxable impact of your.

1031 Exchange Full Guide Casaplorer

To pay no tax when executing a 1031 exchange, you must purchase at least. Web use the 1031 exchange calculator to estimate net sales available for reinvestment with and without a 1031 exchange. Web tax calculations federal tax on capital gains: The simplest type of section 1031 exchange is a simultaneous swap of one property.

1031 Exchange Calculation Worksheet

1031crowdfunding.com has been visited by 10k+ users in the past month Web even though taxes are being deferred, 1031 exchanges must be reported to the irs. The exchange must be reported in the tax year when the investor relinquishing. For example, let’s say you perform a 1031 exchange by selling a property for $300,000. Web.

What Is A 1031 Exchange? Properties & Paradise BlogProperties

Web the build to suit exchange. 1031crowdfunding.com has been visited by 10k+ users in the past month Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web this capital gains tax calculator estimator is provided to illustrate potential taxes to be paid in a taxable sale (versus a.

How To Do A 1031 Exchange Like A Pro Free Guide

Web an example calculating the basis in 1031 exchange. The basis for the new asset. Web the build to suit exchange. Federal tax on depreciation recapture: What is a 1031 exchange?. Reverse and improvement exchange parking structures; Web to accomplish a section 1031 exchange, there must be an exchange of properties. To pay no tax.

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

Total tax savings resulting from deferral of. Web to accomplish a section 1031 exchange, there must be an exchange of properties. The simplest type of section 1031 exchange is a simultaneous swap of one property for. Web this capital gains tax calculator estimator is provided to illustrate potential taxes to be paid in a taxable.

1031 Exchange Calculation Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into. This must be an investment property—not a primary residence—and it should. Property you are selling selling price of property selling. The exchange must be reported in the tax year when the investor relinquishing. This simplified estimator is for example.

This Simplified Estimator Is For Example.

Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into. Closing date what day will escrow. Web use the 1031 exchange calculator to estimate net sales available for reinvestment with and without a 1031 exchange. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase.

Web Tax Calculations Federal Tax On Capital Gains:

To pay no tax when executing a 1031 exchange, you must purchase at least. For example, let’s say you perform a 1031 exchange by selling a property for $300,000. This must be an investment property—not a primary residence—and it should. Web an example calculating the basis in 1031 exchange.

You Choose To Sell Your Current Property With A $150,000 Mortgage On It.

Identify the property you want to sell. Federal tax on depreciation recapture: Web 1031 exchange deadline calculator. Web updated december 20, 2023 reviewed by david kindness fact checked by marcus reeves a 1031 exchange is a swap of one real estate investment property for another that.

Web Follow These Steps To Do A 1031 Exchange:

The basis for the new asset. Web a 1031 exchange is a real estate investing tool that allows investors to exchange an investment property for another property of equal or higher value and defer. Web use our exchange date calculator tool to determine your identification and closing deadlines to help you plan your 1031 exchange. 1031crowdfunding.com has been visited by 10k+ users in the past month