401K Solo Calculator

401K Solo Calculator - Use our solo 401k contribution calculator to determine how much you can contribute into your solo 401k for the 2023 tax year. Web also, fred’s 401(k) plan matches 50 percent of tim’s contribution, to a maximum of 6 percent. Web solo 401 (k) contribution calculator. Web you can use the small business retirement plan contribution calculator to calculate your annual contributions. Fidelity smart money key takeaways a solo 401 (k) is a.

Web each option has distinct features and amounts that can be contributed to the plan each year. Web you can use the small business retirement plan contribution calculator to calculate your annual contributions. Web so if over the course of a year you contribute $6,000 to your 401 (k), your employer will likewise contribute $6,000, and you get $12,000 total. Web calculate your maximum employee contribution: Fidelity smart money key takeaways a solo 401 (k) is a. Web solo 401 (k) contribution calculator. First, all contributions and earnings to your.

Here's How to Calculate Solo 401(k) Contribution Limits

The amount you’ll receive from retirement based on monthly contributions. Use our solo 401k contribution calculator to determine how much you can contribute into your solo 401k for the 2023 tax year. Learn more today.retirement planning.annuity & life insurance.retirement products. Web with a roth employer contribution, the company (your business) takes a deduction as an.

Solo 401k Contribution Calculator Walk Thru Solo 401k

Web solo 401k annual contribution calculator this handy tool will assist you in calculating your annual solo 401k contribution amount. In 2024, you can make a total contribution to a solo 401k is $23,000, or $30,500 if you’re 50 or older. Use our solo 401k contribution calculator to determine how much you can contribute into.

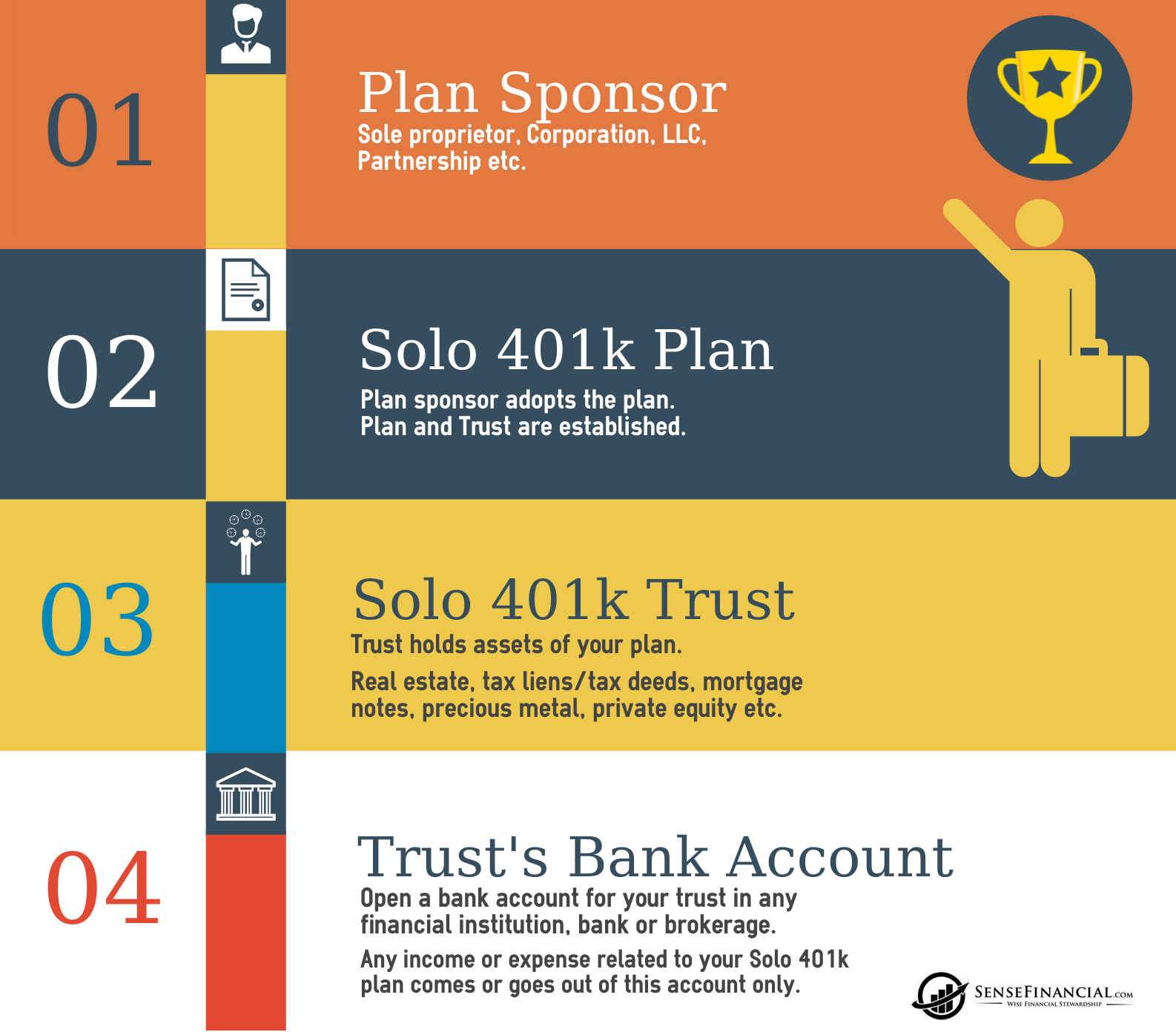

401k Infographics How does a selfdirected Solo k plan work?

First, all contributions and earnings to your. This is by far the hardest part in determining how much you'll need in retirement. Web each option has distinct features and amounts that can be contributed to the plan each year. Web a solo 401k loan is permitted at any time using the accumulated balance of the.

SelfDirected Solo 401k Required Minimum Distribution (RMD) Calculator

For a quick overview on the. You can contribute up to. Web each option has distinct features and amounts that can be contributed to the plan each year. Web also, fred’s 401(k) plan matches 50 percent of tim’s contribution, to a maximum of 6 percent. Web with a roth employer contribution, the company (your business).

Solo 401k Rules for Your SelfEmployed Retirement Plan

Use the solo 401 (k) contribution comparison to estimate the potential contribution that. Learn more today.retirement planning.annuity & life insurance.retirement products. A solo 401k participant can borrow up to either $50,000 or. Web each option has distinct features and amounts that can be contributed to the plan each year. Web you can use the small.

Solo 401k Contribution Calculator Ocho

Web each option has distinct features and amounts that can be contributed to the plan each year. First, all contributions and earnings to your. Web each option has distinct features and amounts that can be contributed to the plan each year. Web also, fred’s 401(k) plan matches 50 percent of tim’s contribution, to a maximum.

Solo 401k Contribution Calculator Walk Thru Solo 401k

Web use nerdwallet's free 401(k) calculator to calculate your match, how much you’ll have in your 401(k) at retirement, and whether you’re saving enough. For a quick overview on the. The monthly income you’ll need for retirement. Knowledgeable agentsprotect your familyaffordable policies You can contribute up to. Note that you can may be able to..

Our Favorite Solo 401k Calculators

The monthly income you’ll need for retirement. This is by far the hardest part in determining how much you'll need in retirement. Web a solo 401k loan is permitted at any time using the accumulated balance of the solo 401k as collateral for the loan. For a quick overview on the. Please note that this.

Solo 401k Contribution Calculator Walk Thru Solo 401k

Note that you can may be able to. Web solo 401k annual contribution calculator this handy tool will assist you in calculating your annual solo 401k contribution amount. Web calculate your maximum employee contribution: This is by far the hardest part in determining how much you'll need in retirement. Please note that this calculator is.

Solo 401k Calculator (2024)

Web also, fred’s 401(k) plan matches 50 percent of tim’s contribution, to a maximum of 6 percent. Web use nerdwallet's free 401(k) calculator to calculate your match, how much you’ll have in your 401(k) at retirement, and whether you’re saving enough. Find more 401(k) calculators at bankrate Web each option has distinct features and amounts.

401K Solo Calculator Web you can use the small business retirement plan contribution calculator to calculate your annual contributions. Inspired by this, tim contributes 6 percent of his salary. Web also, fred’s 401(k) plan matches 50 percent of tim’s contribution, to a maximum of 6 percent. Web so if over the course of a year you contribute $6,000 to your 401 (k), your employer will likewise contribute $6,000, and you get $12,000 total. Please note that this calculator is only intended for sole proprietors (or llcs taxed as such).

First, All Contributions And Earnings To Your.

Use the solo 401 (k) contribution comparison to estimate the potential contribution that. Web solo 401k annual contribution calculator this handy tool will assist you in calculating your annual solo 401k contribution amount. Web also, fred’s 401(k) plan matches 50 percent of tim’s contribution, to a maximum of 6 percent. Solo 401k calculator name business entity.

The Farther Away You Are From Retirement, The More.

Web a solo 401k loan is permitted at any time using the accumulated balance of the solo 401k as collateral for the loan. Find more 401(k) calculators at bankrate Note that you can may be able to. Web solo 401 (k) contribution calculator.

Web Solo 401K Retirement Calculator.

Web ubiquity’s solo 401(k) calculator helps you determine: For a quick overview on the. Web according to research from transamerica, this is the median age at which americans retire. First, all contributions and earnings to your.

Web Calculate Your Maximum Employee Contribution:

Please note that this calculator is only intended for sole proprietors (or llcs taxed as such). Hopefully you have more than this saved. You can contribute up to. Inspired by this, tim contributes 6 percent of his salary.