401K Traditional Vs Roth Calculator

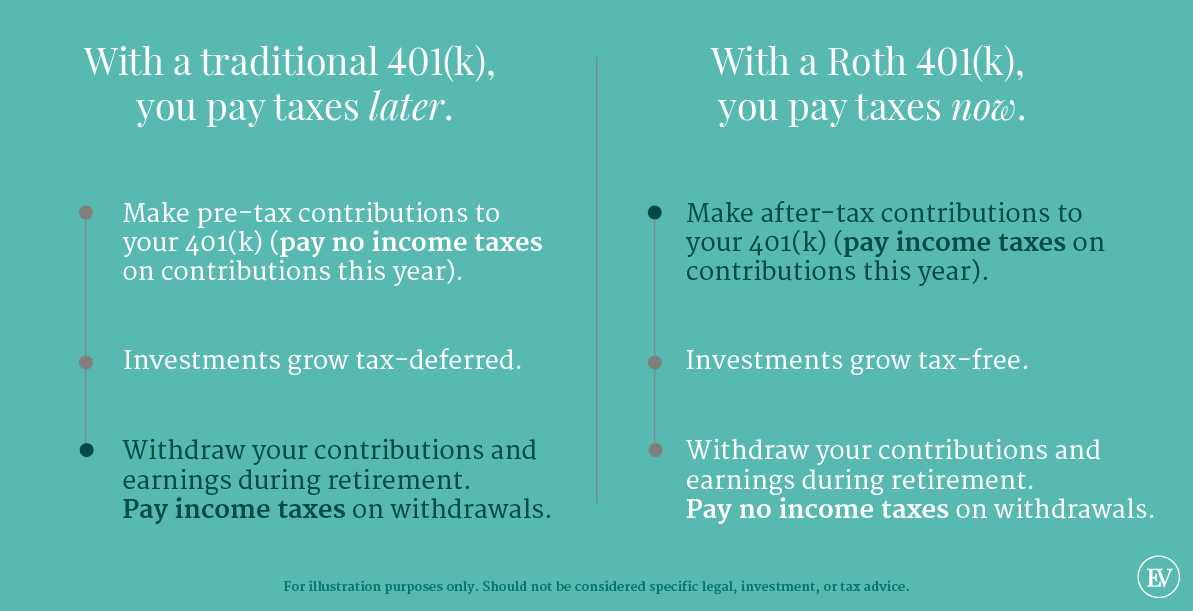

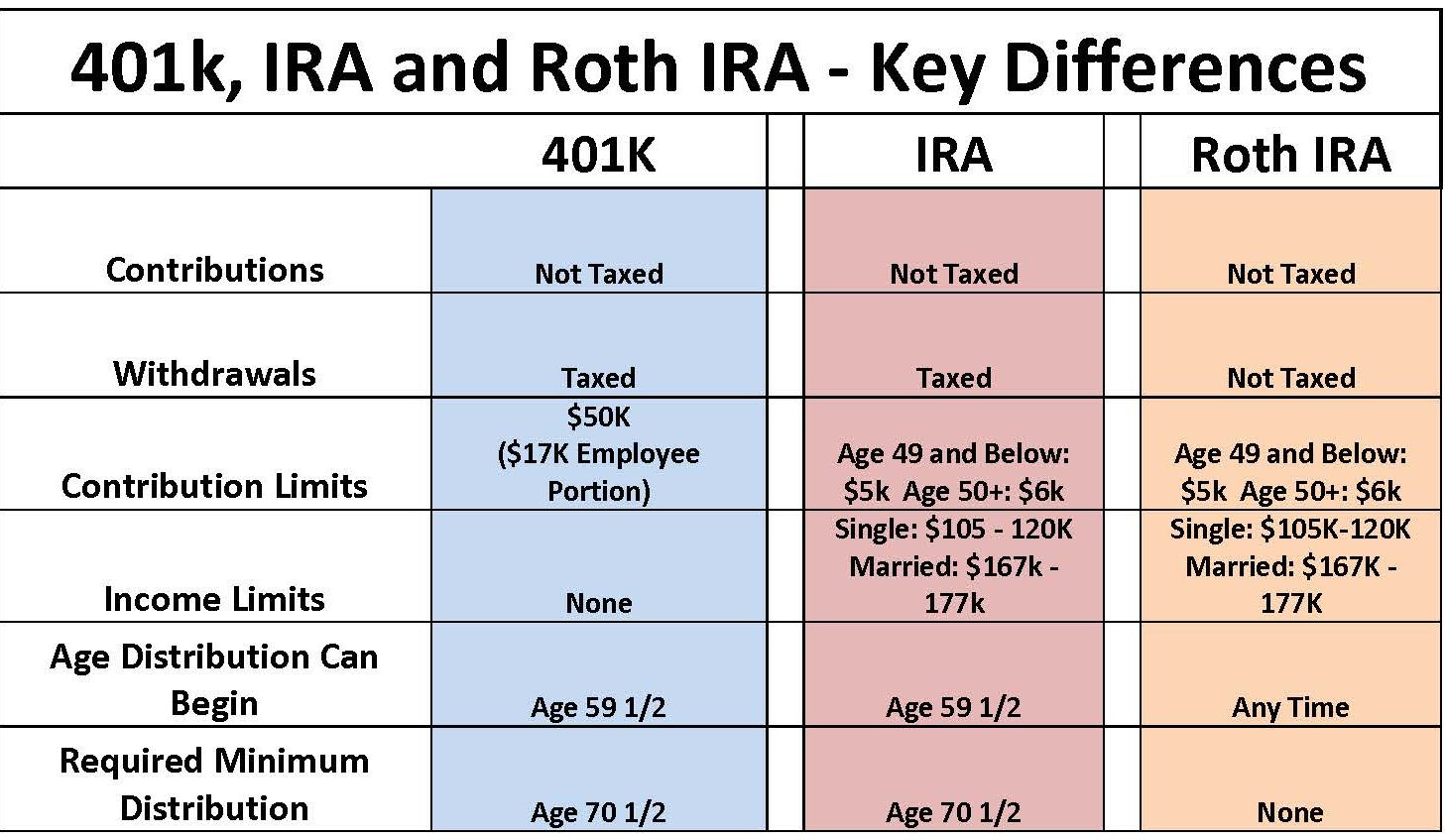

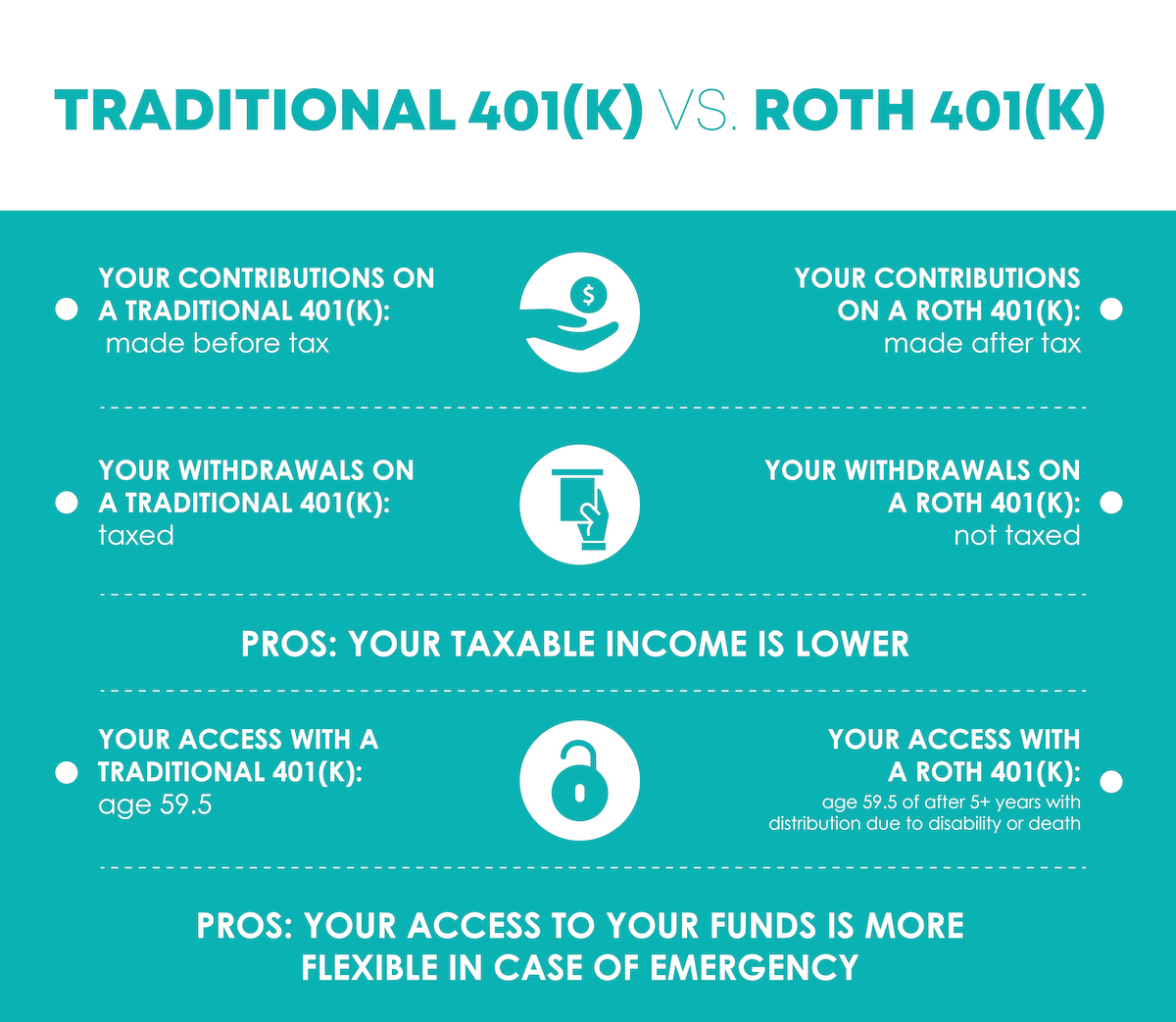

401K Traditional Vs Roth Calculator - Web the main distinction between a roth 401 (k) and a traditional 401 (k) is when you pay taxes. Roth 401(k) contributions are a relatively new type of 401(k) that allows you to invest money after taxes, and pay no taxes when funds are. Web average income = $59,000/year expected annual retirement withdrawal = $225,000 these figures align perfectly to my newfound understanding of the roth. According to fidelity, the vast majority of ira contributions end up going to a roth ira, rather than a traditional. Traditional 401 (k) roth 401 (k).

This tool compares the hypothetical. A traditional 401 (k) may be worth $43,027 more than a roth. Roth 401(k) contributions are a relatively new type of 401(k) that allows you to invest money after taxes, and pay no taxes when funds are. Newyorklife.com has been visited by 100k+ users in the past month Traditional ira depends on your income level and financial goals. Web the main distinction between a roth 401 (k) and a traditional 401 (k) is when you pay taxes. Each offers a different type of tax advantage, and choosing the right.

401(k) vs Roth 401(k) How Do You Decide? Ellevest

According to fidelity, the vast majority of ira contributions end up going to a roth ira, rather than a traditional. A traditional 401 (k) may be worth $43,027 more than a roth. Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax.

Roth 401k calculator with match ChienSelasi

This tool compares the hypothetical. According to fidelity, the vast majority of ira contributions end up going to a roth ira, rather than a traditional. Web a traditional 401 (k) could provide an additional $500 of take home pay per year until retirement. Traditional ira calculator and other 401 (k) calculators to help consumers determine.

Roth 401(k) vs. Traditional 401(k)

It can help lower your lifetime taxes significantly. Roth 401(k) contributions are a relatively new type of 401(k) that allows you to invest money after taxes, and pay no taxes when funds are. Web the roth ira annual contribution limit is the maximum amount of contributions you can make to an ira in a year..

401k to roth ira tax calculator NataliaAsel

Current age (1 to 120) your annual. Web most ira contributions go into this kind of account. Web roth 401 (k) $ 177,592. Change the numbers in each input field by entering a new number or adjusting the sliders. Web roth vs traditional 401(k) calculator. The roth 401 (k) allows. Choosing between a roth vs..

Traditional vs Roth 401(k) Key Differences and Choosing One

Annuity & life insurancegrowth & protection.learn more today.annuity & life insurance. Web roth 401 (k) vs. Web the roth ira annual contribution limit is the maximum amount of contributions you can make to an ira in a year. Traditional 401 (k) roth 401 (k). Traditional ira calculator and other 401 (k) calculators to help consumers.

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

Web calculate your earnings and more a 401 (k) can be an effective retirement tool. Web with a sep ira, you can contribute up to $69,000 or 25% of your income (whichever is less) for 2024. Newyorklife.com has been visited by 100k+ users in the past month Web use this calculator 1 to help determine.

roth ira vs 401k Choosing Your Gold IRA

Web the main distinction between a roth 401 (k) and a traditional 401 (k) is when you pay taxes. Web the contribution limits on a roth 401(k) are the same as those for a traditional 401(k): According to fidelity, the vast majority of ira contributions end up going to a roth ira, rather than a.

Traditional 401k to roth 401k conversion tax calculator SunniaHavin

Web both roth and traditional 401 (k) contribution limits are currently set at $22,500 for 2023 ($30,000 if you’re over the age of 50), and $23,000 (30,500 if you’re. If your biggest interest is saving as. The roth 401 (k) allows you to contribute to your 401 (k) account on an. According to fidelity, the.

Roth 401k Might Make You Richer Millennial Money

Web the roth ira annual contribution limit is the maximum amount of contributions you can make to an ira in a year. Web the contribution limits on a roth 401(k) are the same as those for a traditional 401(k): Web calculate your earnings and more a 401 (k) can be an effective retirement tool. Each.

401k Roth Vs Traditional Photos

Change the numbers in each input field by entering a new number or adjusting the sliders. Web with a sep ira, you can contribute up to $69,000 or 25% of your income (whichever is less) for 2024. Web both roth and traditional 401 (k) contribution limits are currently set at $22,500 for 2023 ($30,000 if.

401K Traditional Vs Roth Calculator The roth 401 (k) allows. Web roth 401 (k) vs. Current age (1 to 120) your annual. Each offers a different type of tax advantage, and choosing the right. Web use this calculator 1 to help determine the option that could work for you and how it might affect your paycheck.

Web Calculate Your Earnings And More A 401 (K) Can Be An Effective Retirement Tool.

Web both roth and traditional 401 (k) contribution limits are currently set at $22,500 for 2023 ($30,000 if you’re over the age of 50), and $23,000 (30,500 if you’re. Web the basic difference between a traditional and a roth 401(k) is when you pay the taxes. Web the roth ira annual contribution limit is the maximum amount of contributions you can make to an ira in a year. The roth 401 (k) allows you to contribute to your 401 (k) account on an.

Change The Numbers In Each Input Field By Entering A New Number Or Adjusting The Sliders.

Roth 401(k) contributions are a relatively new type of 401(k) that allows you to invest money after taxes, and pay no taxes when funds are. A roth or a traditional 401(k)? If your biggest interest is saving as. It can help lower your lifetime taxes significantly.

Web The Contribution Limits On A Roth 401(K) Are The Same As Those For A Traditional 401(K):

Web use this calculator to compare a traditional 401(k) vs. Choosing between a roth vs. Traditional ira depends on your income level and financial goals. Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that you make the conversion.

Web Understanding The Tax Implications Of Roth 401(K) And Traditional 401(K) Plans Is Crucial For Effective Retirement Planning.

The ira contribution limit was $6,500 in 2023 ($7,500 if age. Access to advisorsadvice & guidance Web a traditional 401 (k) could provide an additional $500 of take home pay per year until retirement. Web with a sep ira, you can contribute up to $69,000 or 25% of your income (whichever is less) for 2024.