C Corp Tax Calculator

C Corp Tax Calculator - Web see your 2023 business taxes. $27,700 for married couples filing jointly or qualifying surviving spouse. Add tax credits and subtract from the taxes owed. Choosing the c corp or s. Web corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

Web to calculate the corporate tax rate, start by figuring out what your taxable income is. Set your business up for success with our free 2023 small business tax calculator. Web use our corporation tax calculator and tax forecaster that use the most recent government and forecast tax rates Add tax credits and subtract from the taxes owed. Web $0 learn more » more: Calculating the total tax the c corporation needs to pay is a. $27,700 for married couples filing jointly or qualifying surviving spouse.

Tax Plan Includes Increased C Corp Rate Cost Segregation Services, LLC

Set your business up for success with our free 2023 small business tax calculator. A c corp pays a flat 21% tax on income for. Several factors distinguish the tax advantages of both s corps and c corps. Web this tax calculator shows these values at the top of your results. Web corporations generally have.

Tax CPA Tips S Corp v C Corp Which is Best?

Add tax credits and subtract from the taxes owed. Several factors distinguish the tax advantages of both s corps and c corps. Web the standard deduction for 2023 is: You may have to pay estimated tax. $27,700 for married couples filing jointly or qualifying surviving spouse. What percentage of taxes does a c corp pay?.

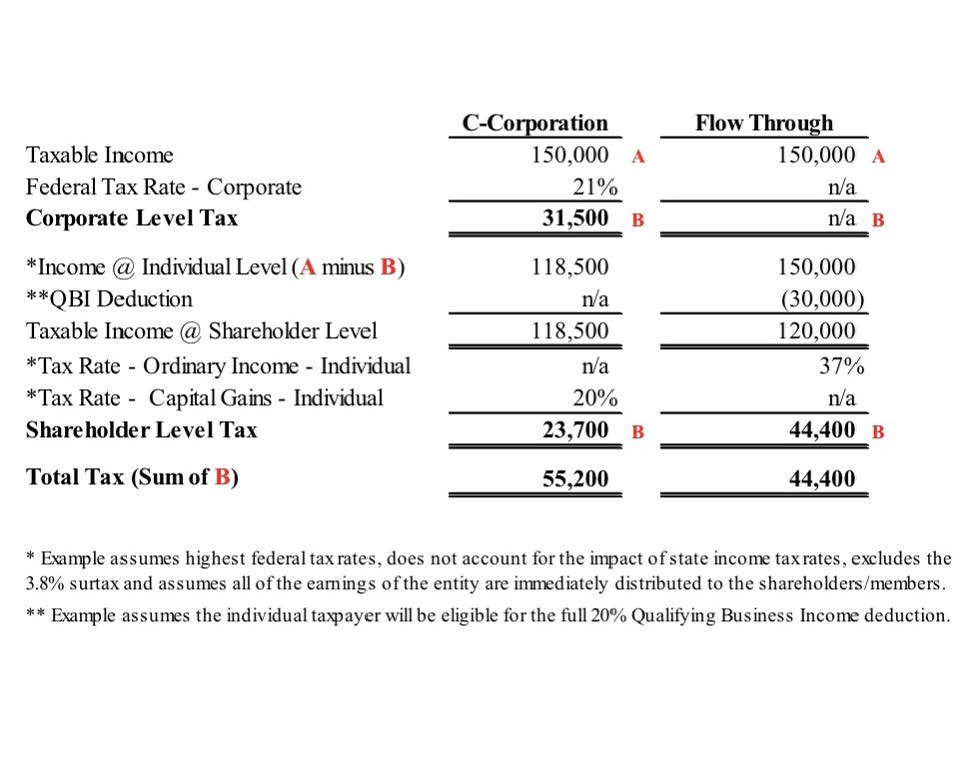

What is Double Taxation for CCorps? The Exciting Secrets of Pass

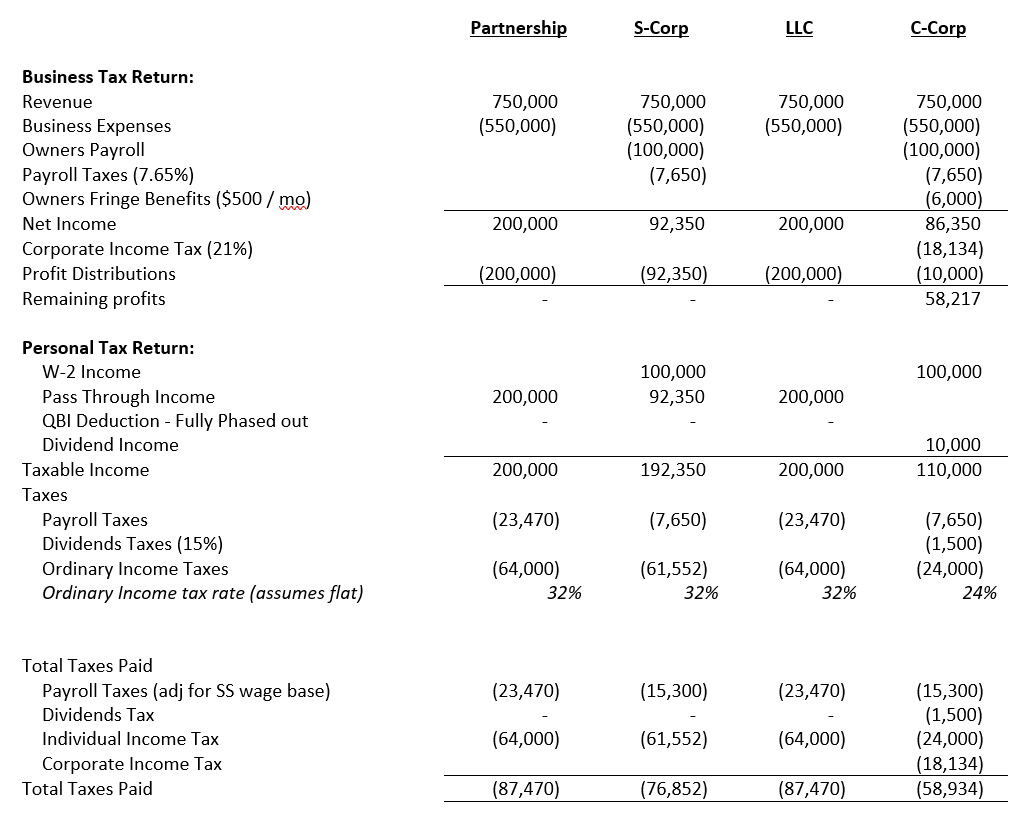

Startups, often with foreign ownership, and growing businesses, to do it right from the start. As of january 1, 2000, newly incorporated or qualified. Web one of the top questions that clients ask is for real life example of how switching to a c corp, s corporation, or llc could benefit them from a tax.

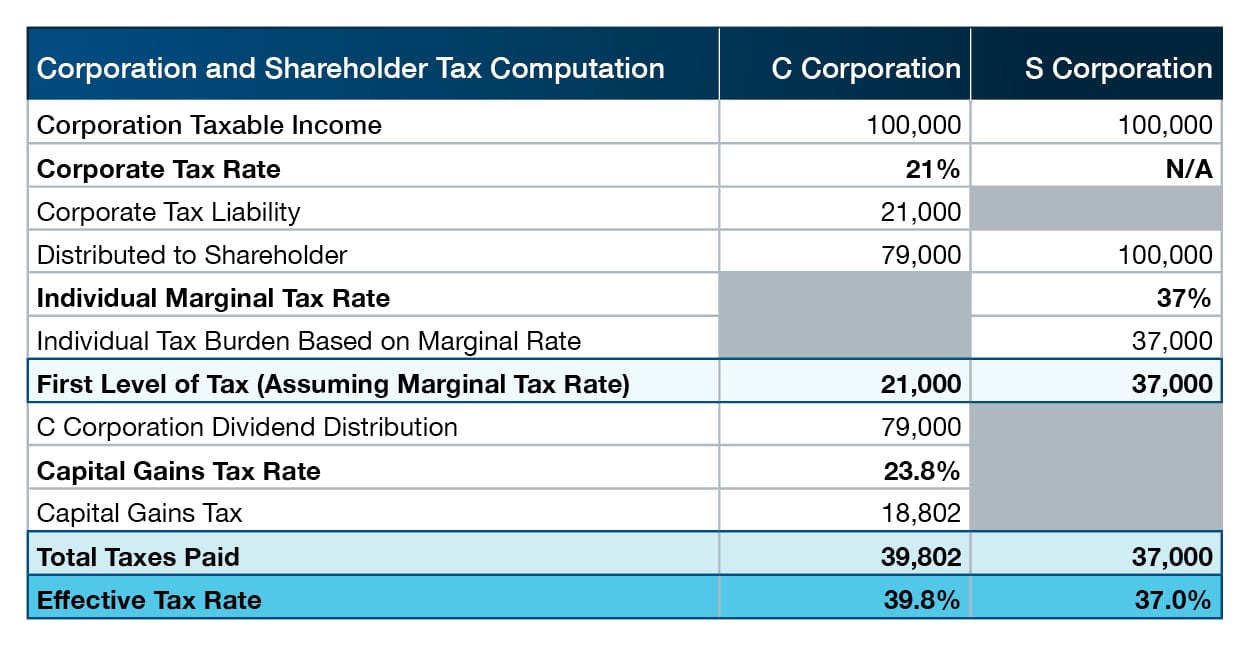

How Changes in Corporate Tax Rate Can Affect Choice of C vs. S Corp.

If you’re new to personal taxes 15.3% sounds like a lot less than the top bracket of 37%. What percentage of taxes does a c corp pay? Choosing the c corp or s. $27,700 for married couples filing jointly or qualifying surviving spouse. Have a tax preparer calculate it or look at your prior year's.

S Corporation or C Corporation Under the Tax Cuts and Jobs Act PYA

Web see your 2023 business taxes. $27,700 for married couples filing jointly or qualifying surviving spouse. So if a company brought in $100,000 in revenue for a fiscal. Have a tax preparer calculate it or look at your prior year's taxable income to. What percentage of taxes does a c corp pay? Web check each.

C Corporation 101 Everything You Need to Know in 2023

Sales, reimbursements, services, gross receipts. The annual tax for c corporations is the greater of 8.84% of the corporation's net income or $800. Simplify c corporation tax filing with taxact business 1120 edition and streamline your tax preparation. What percentage of taxes does a c corp pay? Web see your 2023 business taxes. Web one.

Corporation tax 2023 Everything you need to know Foxy Monkey

$27,700 for married couples filing jointly or qualifying surviving spouse. Web this tax calculator shows these values at the top of your results. You may have to pay estimated tax. Web one of the top questions that clients ask is for real life example of how switching to a c corp, s corporation, or llc.

Corporation Tax Calculator Excel Excel Templates

$13,850 for single or married filing separately. Calculating the total tax the c corporation needs to pay is a. Have a tax preparer calculate it or look at your prior year's taxable income to. Choosing the c corp or s. $27,700 for married couples filing jointly or qualifying surviving spouse. Web this section contains the.

The Tax Calculator Is The Best Of All To Deal With!! Bin File Blog

By default, the earnings of an llc are passed on to your personal income and exposed to. Calculating the total tax the c corporation needs to pay is a. So if a company brought in $100,000 in revenue for a fiscal. Web $0 learn more » more: $27,700 for married couples filing jointly or qualifying.

Corporation tax calculator AbbigaelBain

Web one of the top questions that clients ask is for real life example of how switching to a c corp, s corporation, or llc could benefit them from a tax perspective. Set your business up for success with our free 2023 small business tax calculator. Web $0 learn more » more: Payroll tax +.

C Corp Tax Calculator Make sure to enter an amount or 0 in each field for accurate result. If you’re new to personal taxes 15.3% sounds like a lot less than the top bracket of 37%. As of january 1, 2000, newly incorporated or qualified. Web use our corporation tax calculator and tax forecaster that use the most recent government and forecast tax rates Startups, often with foreign ownership, and growing businesses, to do it right from the start.

Web Financial Advisors S Corp Vs.

Add any additional taxes owed, like base. Add tax credits and subtract from the taxes owed. Startups, often with foreign ownership, and growing businesses, to do it right from the start. Make sure to enter an amount or 0 in each field for accurate result.

As Of January 1, 2000, Newly Incorporated Or Qualified.

Simplify c corporation tax filing with taxact business 1120 edition and streamline your tax preparation. Web the standard deduction for 2023 is: $13,850 for single or married filing separately. Choosing the c corp or s.

Web Use Our Corporation Tax Calculator And Tax Forecaster That Use The Most Recent Government And Forecast Tax Rates

So if a company brought in $100,000 in revenue for a fiscal. Web this section contains the rules for how c corporations are taxed. Sales, reimbursements, services, gross receipts. You may have to pay estimated tax.

A C Corp Pays A Flat 21% Tax On Income For.

Web one of the top questions that clients ask is for real life example of how switching to a c corp, s corporation, or llc could benefit them from a tax perspective. Have a tax preparer calculate it or look at your prior year's taxable income to. Calculating the total tax the c corporation needs to pay is a. By default, the earnings of an llc are passed on to your personal income and exposed to.