Charitable Deductions Calculator

Charitable Deductions Calculator - $13,850 for single or married filing separately. In the united states, both. You may be surprised to learn that you can afford to be even more generous than you thought. Web a charitable donation is essentially a contribution, either in cash or property, given to a nonprofit organization to support its mission. Web here’s an example of how the limit works:

$27,700 for married couples filing jointly or qualifying surviving spouse. You may be surprised to learn that you can afford to be even more generous than you thought. Web this charitable tax deduction calculator can calculate the potential tax savings from a charitable donation or gift. Itsdeductible service will continue—2023 donation tracking is now. Web charitable contribution calculators & tools. It's true that if all you gave was $20 last year, claiming it won't give you a big tax refund. Web taxpayers can deduct charitable contributions for the 2023 and 2024 tax years if they itemize their tax deductions using schedule a of form 1040.

Charitable Giving Tax Savings Calculator Fidelity Charitable

Generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040),. Web the temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns has expired and is no longer available. You can look up clothing, household goods furniture and appliances. If your agi is $60,000,.

iCLAT Calculator Determine IMMEDIATE Charitable Deduction & Resulting

You may be surprised to learn that you can afford to be even more generous than you thought. Web the standard deduction for 2023 is: Web if you plan to claim itemized deductions for charitable contributions on your tax return, the deduction limit has reverted back to a maximum of 60% of your agi. Get.

Appenzeller & Associate, CPA's, P.C., Tempe, Arizona Calculator

Web here’s an example of how the limit works: Web a charitable donation is essentially a contribution, either in cash or property, given to a nonprofit organization to support its mission. Web taxpayers can deduct charitable contributions for the 2023 and 2024 tax years if they itemize their tax deductions using schedule a of form.

How to Claim Tax Deductions on Charity Contributions?

Web charitable contribution calculators & tools. Web for example, if you're a single individual and you don't pay quite enough in, say, annual mortgage interest, property taxes and state income taxes to get over the. Web charitable contributions to qualified organizations may be deductible if you itemize deductions on schedule a (form 1040), itemized deductions.

The Complete Charitable Deductions Tax Guide (2023 & 2024)

Web for the 2022 tax year, the standard deduction is $12,950 for single filers and $25,900 for married couples filing jointly, and in 2023 that will increase to $13,850. You may be surprised to learn that you can afford to be even more generous than you thought. Web if you plan to claim itemized deductions.

Donation Value Guide 2022 Spreadsheet Fill Online, Printable

If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). The profits will receive a charitable contribution deduction of $33,248 this year. These tools will help you better understand how to use charitable giving as part of your investment portfolio. Web use our interactive tool to.

Charitable Tax Deductions by State Tax Foundation

You can look up clothing, household goods furniture and appliances. Web taxpayers can deduct charitable contributions for the 2023 and 2024 tax years if they itemize their tax deductions using schedule a of form 1040. Itsdeductible service will continue—2023 donation tracking is now. Only large donations are significant enough to deduct. Web charitable contributions to.

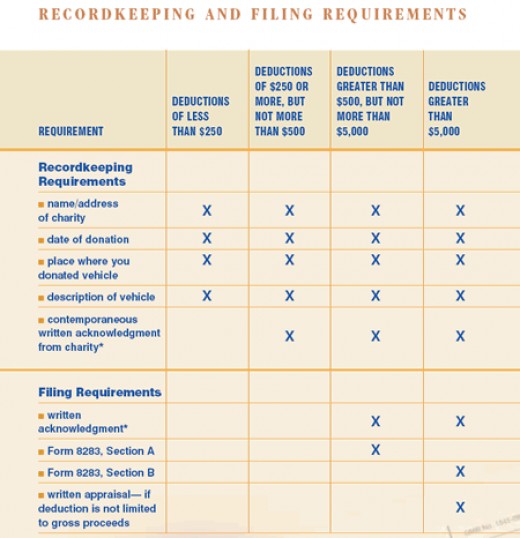

Contributions Tax

Web the standard deduction for 2023 is: Generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040),. The potential tax savings are calculated depending on the. Only large donations are significant enough to deduct. Web taxpayers can deduct charitable contributions for the 2023 and 2024 tax years if they.

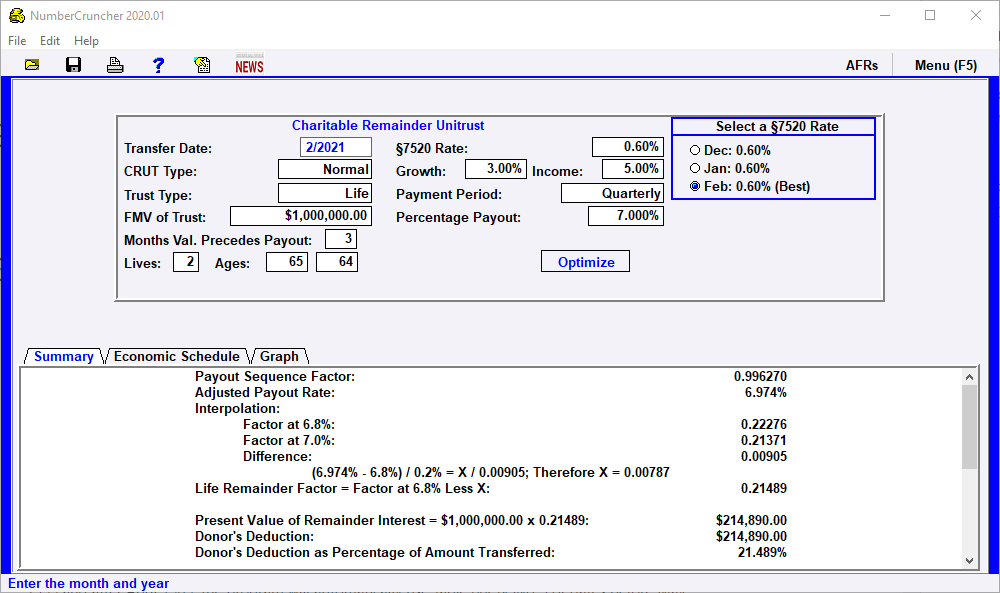

CRUT Charitable Remainder Unitrust Leimberg, LeClair, & Lackner, Inc.

Web this charitable tax deduction calculator can calculate the potential tax savings from a charitable donation or gift. • to qualify as a tax deduction, your charitable contribution needs to be given to a 503 (c) organization. Intuit.com has been visited by 1m+ users in the past month $13,850 for single or married filing separately..

Charitable Remainder Trusts 3 Calculating Deductions YouTube

Web monthly lifetime payments are to begin immediately. Web a charitable donation is essentially a contribution, either in cash or property, given to a nonprofit organization to support its mission. In the united states, both. Web charitable contribution calculators & tools. • to qualify as a tax deduction, your charitable contribution needs to be given.

Charitable Deductions Calculator Web charitable giving tax credit calculator discover the impact a charitable donation can have on your taxes. • to qualify as a tax deduction, your charitable contribution needs to be given to a 503 (c) organization. Web the calculator will display the net cost of the donation and the tax savings. You can only deduct your charitable gifts if you choose to itemize instead of claiming the standard. Web for example, if you're a single individual and you don't pay quite enough in, say, annual mortgage interest, property taxes and state income taxes to get over the.

Web Tax Calculator Tax Savings Calculator Let Us Help You Assess How A Charitable Contribution May Impact Your Tax Liability.

Get started to see how you can save estimated. Web if you plan to claim itemized deductions for charitable contributions on your tax return, the deduction limit has reverted back to a maximum of 60% of your agi. Itsdeductible service will continue—2023 donation tracking is now. You may be surprised to learn that you can afford to be even more generous than you thought.

Web Charitable Giving Tax Credit Calculator Discover The Impact A Charitable Donation Can Have On Your Taxes.

Web the calculator will display the net cost of the donation and the tax savings. Web charitable contributions to qualified organizations may be deductible if you itemize deductions on schedule a (form 1040), itemized deductions pdf. Web here’s an example of how the limit works: These are listed online at the irs exempt organizations.

Web For The 2022 Tax Year, The Standard Deduction Is $12,950 For Single Filers And $25,900 For Married Couples Filing Jointly, And In 2023 That Will Increase To $13,850.

Web use our interactive tool to see how charitable giving can help you save on taxes—and how accelerating your giving with the “bunching” strategy can help save even more. Only large donations are significant enough to deduct. Web taxpayers can deduct charitable contributions for the 2023 and 2024 tax years if they itemize their tax deductions using schedule a of form 1040. $13,850 for single or married filing separately.

In The United States, Both.

The potential tax savings are calculated depending on the. These tools will help you better understand how to use charitable giving as part of your investment portfolio. You can deduct up to 60% of your adjusted gross income. You can only deduct your charitable gifts if you choose to itemize instead of claiming the standard.