Charitable Remainder Trust Tax Deduction Calculator

Charitable Remainder Trust Tax Deduction Calculator - The potential tax savings are calculated depending on the. Here's how it usually works. Web this charitable tax deduction calculator can calculate the potential tax savings from a charitable donation or gift. Web the calculator estimates the potential income tax charitable deduction based on the gift’s value, the expected payments to the individual beneficiary (ies) and. Rita could claim an income tax deduction for her charitable donation over five years.

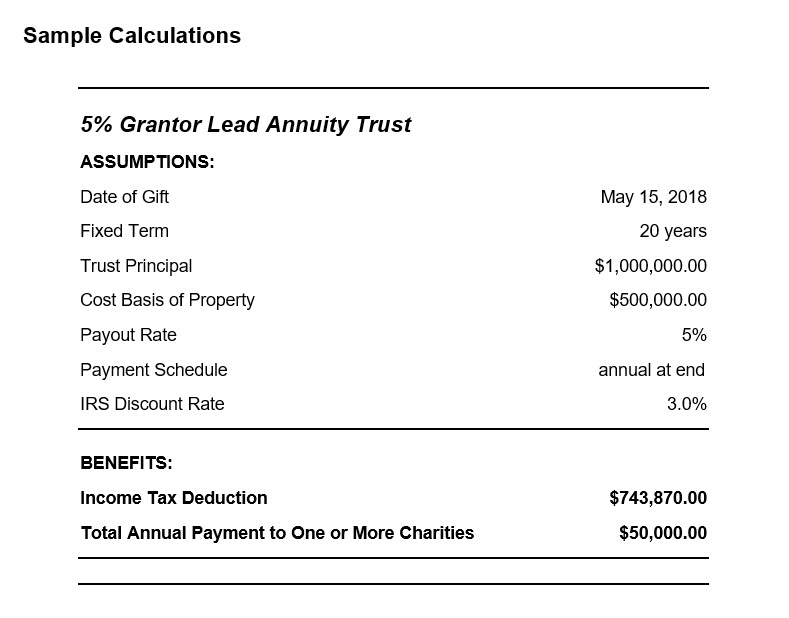

Web the calculator below determines the charitable deduction for any of the following gift types: You transfer cash or assets. $50,000 x 13.8342 = $691,710. Web this charitable tax deduction calculator can calculate the potential tax savings from a charitable donation or gift. To qualify you for your crut tax deduction, we calculate the amount you expect to donate at the end of your trust which is based on three things: Finally, subtract the value of the. Web charitable remainder trust the most common type of charitable trust is called a charitable remainder trust.

Charitable Remainder Trusts 3 Calculating Deductions YouTube

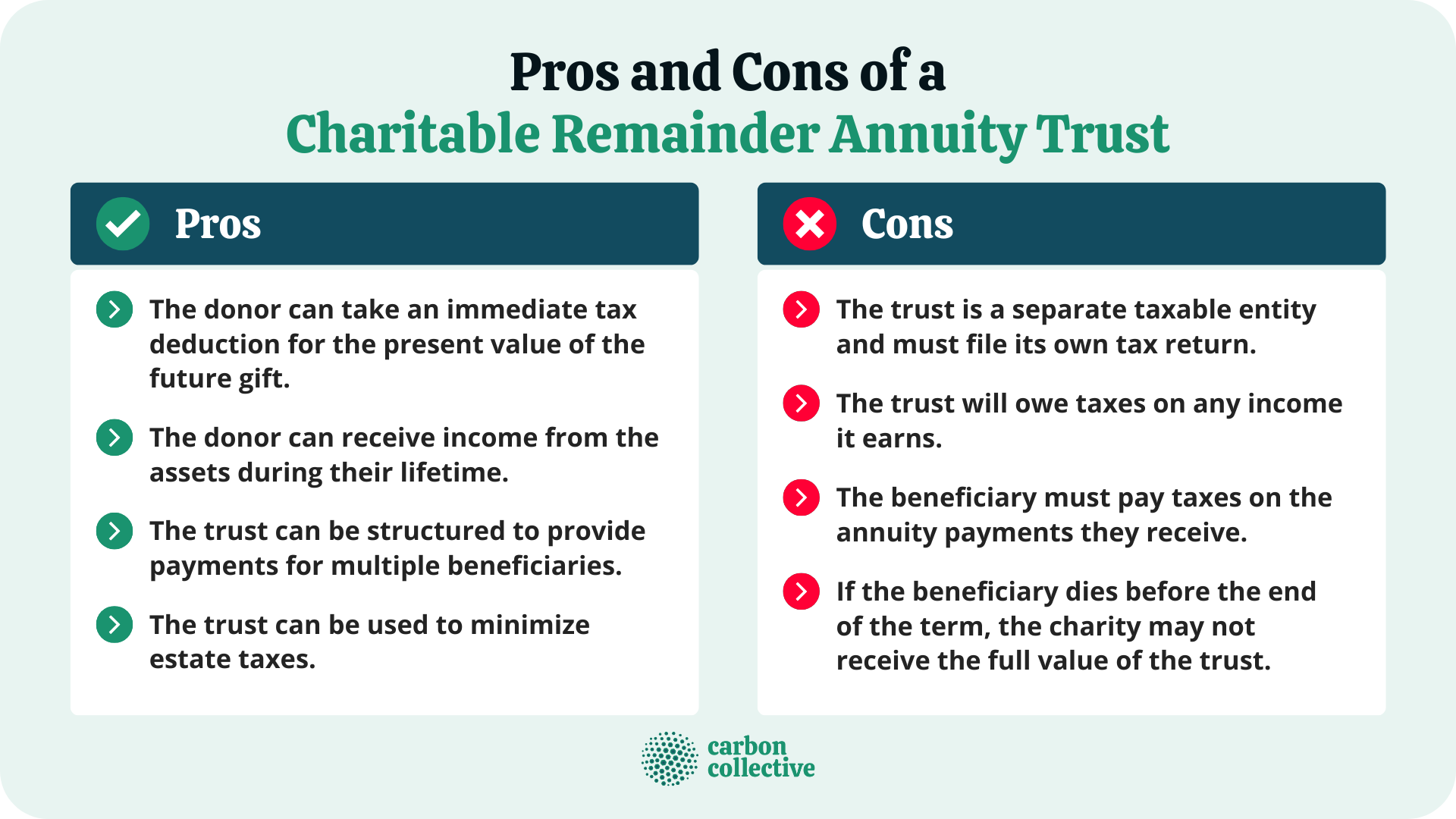

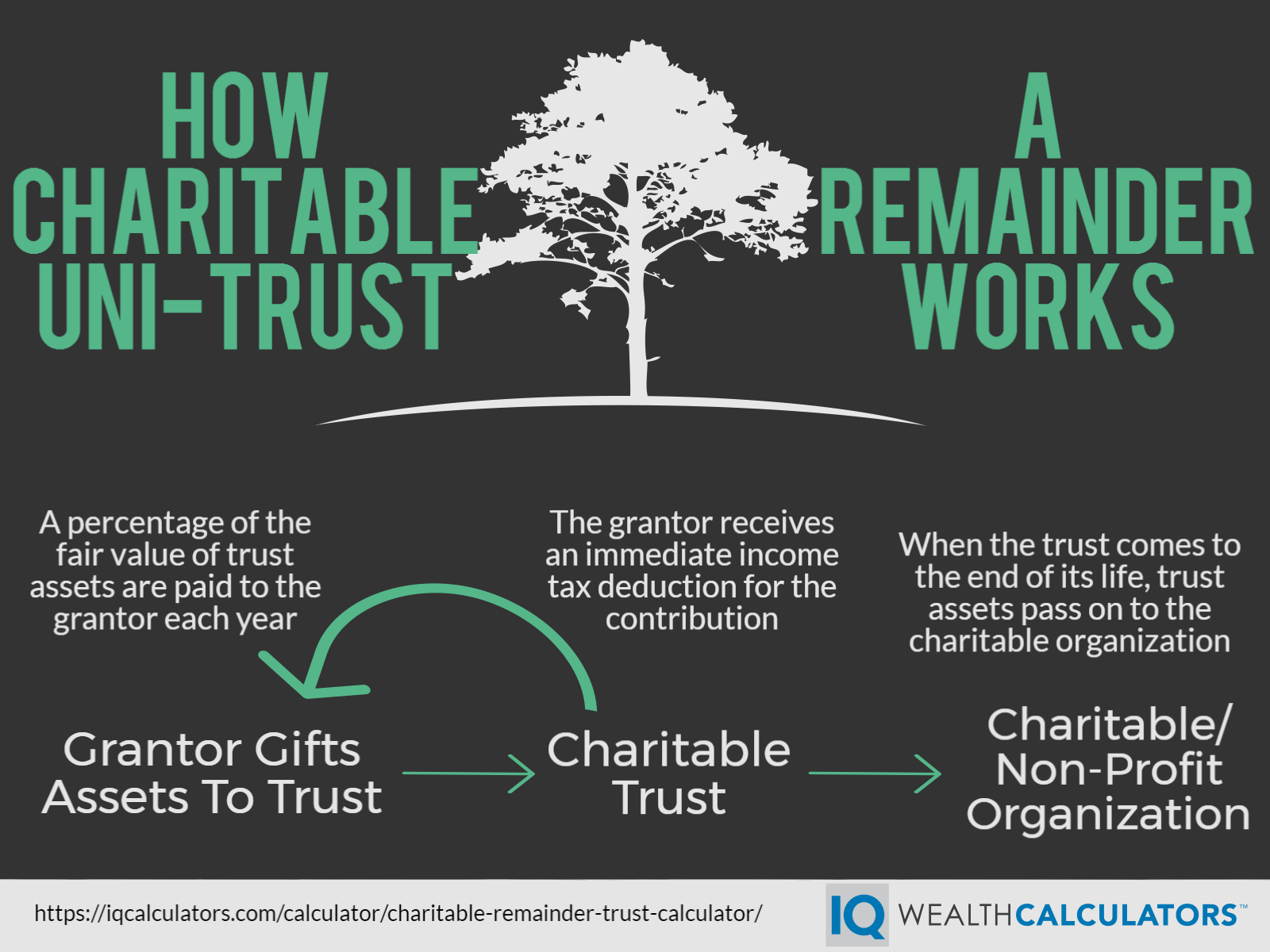

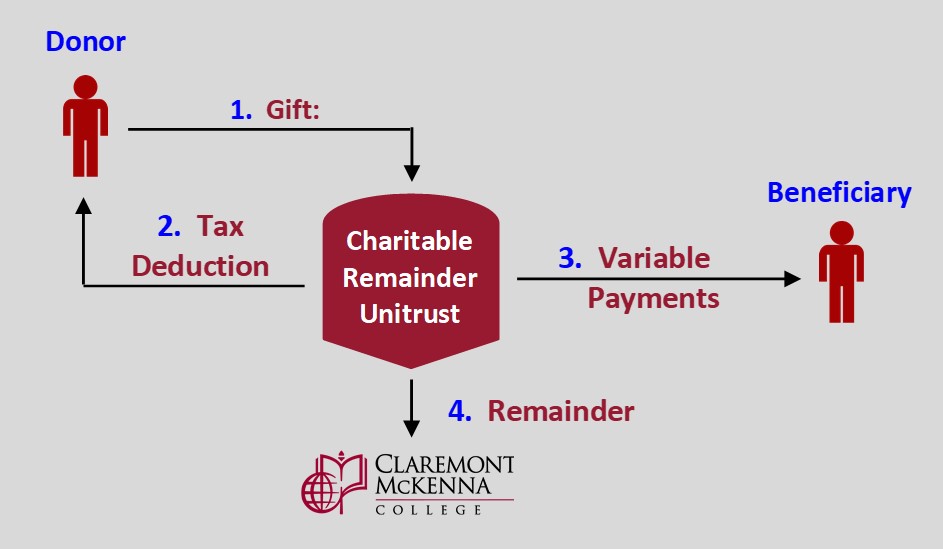

Web charitable remainder trust the most common type of charitable trust is called a charitable remainder trust. Web a charitable remainder trust is a “split interest” giving vehicle that allows you to make contributions to the trust and be eligible for a partial tax deduction, based on the crt’s. Because it is irrevocable, assets contributed.

The Basics of Tax Deductions for Charitable Donations

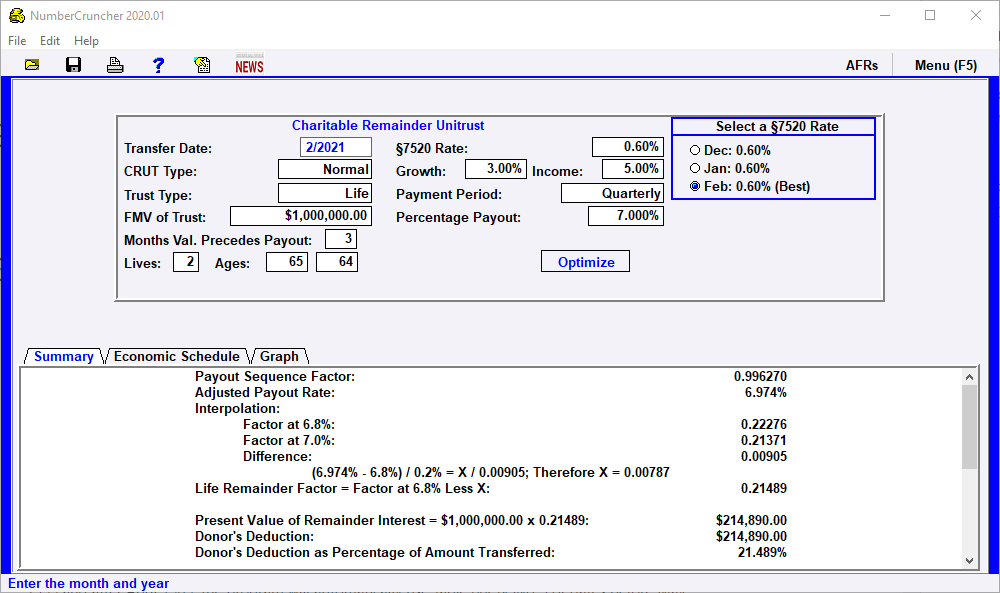

Web charitable remainder unitrust calculator. Intuit.com has been visited by 1m+ users in the past month To qualify you for your crut tax deduction, we calculate the amount you expect to donate at the end of your trust which is based on three things: Web the charity would be in charge of investing and managing.

Charitable Lead Trust Calculator calculatorw

Web the charity would be in charge of investing and managing the $3.8 million. Web second, multiply the annuity amount by the present value factor to determine the value of the annuity: Because it is irrevocable, assets contributed to a crt may be removed from your estate for estate tax purposes potential. Rita could claim.

CRUT Charitable Remainder Unitrust Leimberg, LeClair, & Lackner, Inc.

Web the calculator estimates the potential income tax charitable deduction based on the gift’s value, the expected payments to the individual beneficiary (ies) and. You transfer cash or assets. Web a charitable remainder trust (crt) is a gift of cash or other property to an irrevocable trust. Web charitable remainder unitrust calculator. Ensure accurate and.

How to Maximize Your Charity Tax Deductible Donation WealthFit

Web here’s an example of how the limit works: Web contributions to a charitable remainder trust qualify for a partial charitable deduction. If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). $50,000 x 13.8342 = $691,710. The donor receives an income stream from the trust.

Estimate Tax Deductions, Annual Payments, and More Using a Charitable

Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. Web charitable remainder trusts are an estate planning tool that can be used to claim tax breaks and set yourself up to receive income—all while giving money to. Web the gift calculator below will allow you to test out.

Charitable remainder trust calculator NikiZsombor

Web reduce or eliminate estate taxes. Web contributions to a charitable remainder trust qualify for a partial charitable deduction. Charitable remainder trust calculator long term gains tax avoided $112,500 income tax deduction $267,553 deduction tax savings $66,888 total after tax income $886,307 charitable trust ending value $817,907 charitable strategy compound after tax income $1,539,412 value.

Charitable Remainder Annuity Trust (CRAT) What It Is & How It Works

Web the calculator estimates the potential income tax charitable deduction based on the gift’s value, the expected payments to the individual beneficiary (ies) and. Web a charitable remainder trust is a “split interest” giving vehicle that allows you to make contributions to the trust and be eligible for a partial tax deduction, based on the.

Charitable Remainder Trust Calculator CRUT Calculator

Web contributions to a charitable remainder trust qualify for a partial charitable deduction. Web charitable remainder unitrust calculator. Web the charitable giving tax savings calculator demonstrates the tax savings power of your charitable giving. Web charitable remainder unitrust calculator. Rita could claim an income tax deduction for her charitable donation over five years. Web the.

Charitable remainder trust calculator NikiZsombor

Web the calculator below determines the charitable deduction for any of the following gift types: Each year they’ll receive a total. Web the charity would be in charge of investing and managing the $3.8 million. You can deduct up to 60% of your. Web the gift calculator below will allow you to test out different.

Charitable Remainder Trust Tax Deduction Calculator Web the gift calculator below will allow you to test out different charitable remainder trust scenarios. Web charitable remainder unitrust calculator. Web charitable remainder trusts are an estate planning tool that can be used to claim tax breaks and set yourself up to receive income—all while giving money to. The deduction is limited to the present value of the charitable. Web monthly lifetime payments are to begin immediately.

You Can Deduct Up To 60% Of Your.

If your agi is $60,000, the maximum amount you can deduct for charitable contributions is $36,000 ($60,000 * 0.60). The donor receives an income stream from the trust for a term of years and/or for. Web charitable remainder unitrust calculator. Use our interactive tool to see how giving can help you save on.

Web A Charitable Remainder Trust Is A “Split Interest” Giving Vehicle That Allows You To Make Contributions To The Trust And Be Eligible For A Partial Tax Deduction, Based On The Crt’s.

You transfer cash or assets. Web the calculator below determines the charitable deduction for any of the following gift types: The potential tax savings are calculated depending on the. Web the gift calculator below will allow you to test out different charitable remainder trust scenarios.

Web Charitable Remainder Unitrust Calculator.

Charitable remainder trust calculator long term gains tax avoided $112,500 income tax deduction $267,553 deduction tax savings $66,888 total after tax income $886,307 charitable trust ending value $817,907 charitable strategy compound after tax income $1,539,412 value left to. Here's how it usually works. Finally, subtract the value of the. Web second, multiply the annuity amount by the present value factor to determine the value of the annuity:

Each Year They’ll Receive A Total.

Web charitable remainder trust the most common type of charitable trust is called a charitable remainder trust. Web reduce or eliminate estate taxes. Rita could claim an income tax deduction for her charitable donation over five years. Web the calculator estimates the potential income tax charitable deduction based on the gift’s value, the expected payments to the individual beneficiary (ies) and.

:max_bytes(150000):strip_icc()/NoTaxesonDividendsandCapitalGainsforMillionsofAmericanHouseholds-56a5dcdd5f9b58b7d0dec9d5.jpg)