Dscr Ratio Calculator

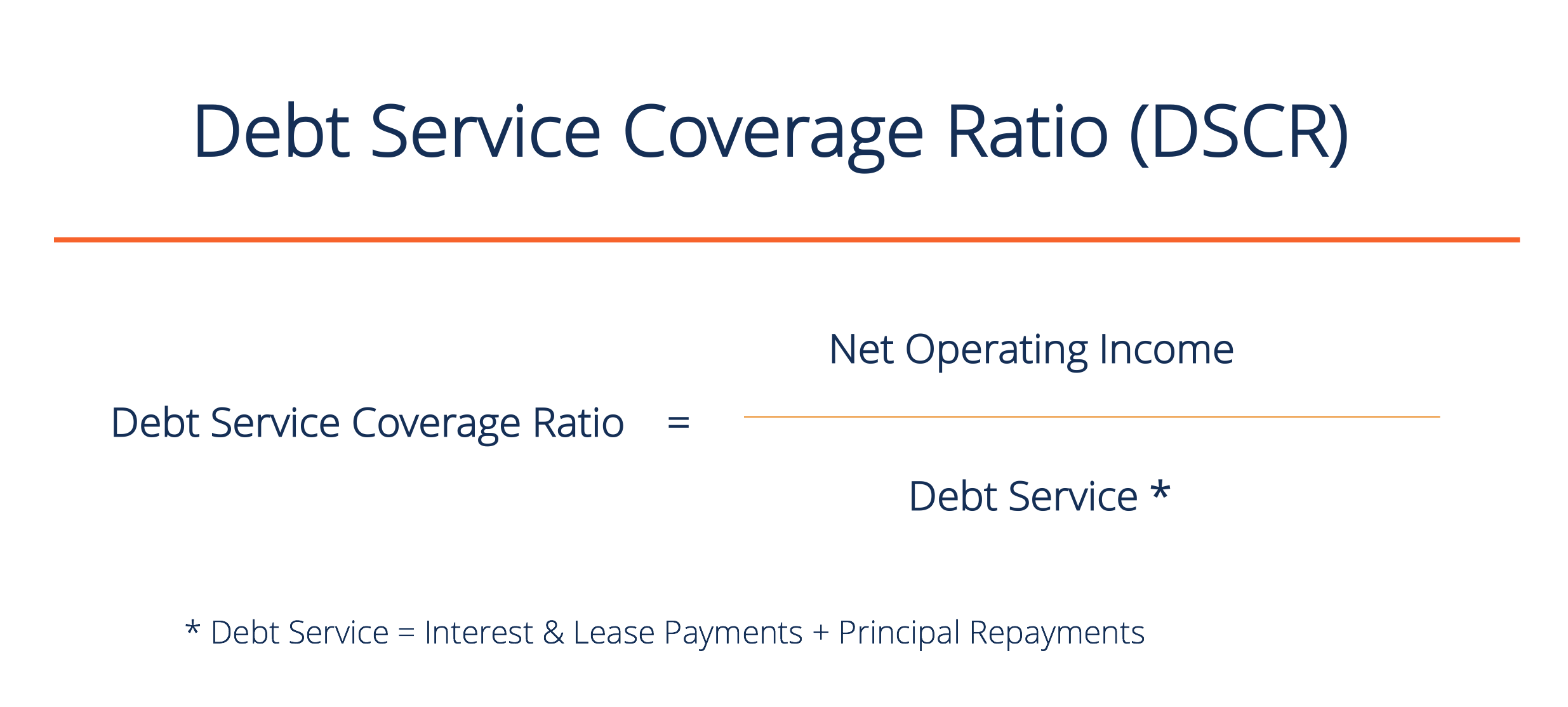

Dscr Ratio Calculator - Dscr = net operating income (noi)/ annual debt service this method is most commonly used for commercial properties. To calculate dscr with this. Web debt service coverage ratio, or dscr, is a measurement of a property’s cash flow versus its debt obligations. What is a debt service coverage. The lender’s formula for dscr is gross rental income ÷ total debt service, so you will enter.

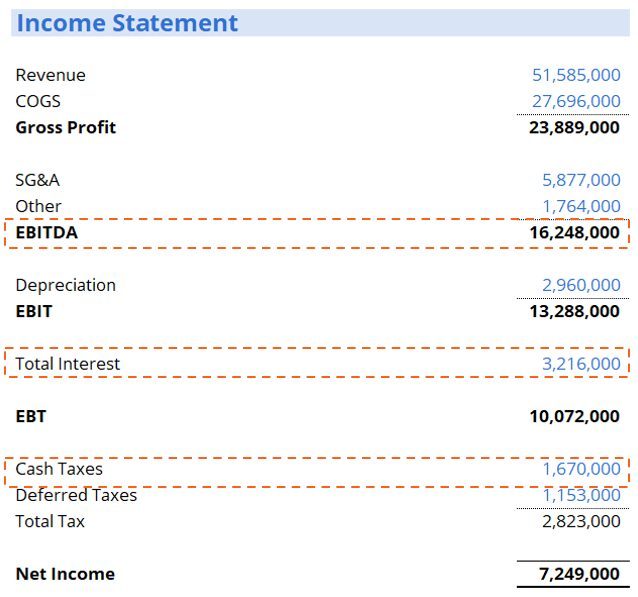

To calculate dscr with this. Dscr = net operating income (noi)/ annual debt service this method is most commonly used for commercial properties. Net operating income (noi) → the noi metric is used in. Web what is debt service coverage ratio (dscr)? Web the debt service coverage ratio shows to what extent a person’s or entity’s net operating income covers their debt obligations for the year. Web learn how to use excel to calculate the debt service coverage ratio (dscr), a measure of a company's cash flow available to pay its debt obligations. Substitute the values and calculate:

Debt Service Coverage Ratio Guide on How to Calculate DSCR

It is equal to the. Common values are between 50 and 80 loan to value (ltv) % interest rate what interest rate do. Web purchase price loan to value (ltv) what loan to value (ltv)? Web the first step in calculating the debt service coverage ratio is to figure out your annual net operating income..

Debt Service Coverage Ratio (Formula, Examples) DSCR Calculation

Net operating income (noi) = gross operating income − vacancy loss − operating expenses. The lender’s formula for dscr is gross rental income ÷ total debt service, so you will enter. Web the first step in calculating the debt service coverage ratio is to figure out your annual net operating income. Web the debt service.

Debt Service Coverage Ratio Formula Calculator (Excel Template)

Use the debt service coverage ratio (dscr) calculator to calculate your companys' debt service coverage ratio (dscr). Net operating income (noi) → the noi metric is used in. Typically, dscr is useful for corporates,. In multifamily real estate, that entity is typically an. Web this dscr calculator can help you determine your debt service coverage.

Debt Service Coverage Ratio (DSCR) Calculator HUD Loans

Net operating income (noi) → the noi metric is used in. Web debt service coverage ratio (dscr) = net operating income (noi) ÷ annual debt service where: Web we use the following formulas to determine the debt service coverage ratio: Typically, dscr is useful for corporates,. Dscr is a financial metric to assess whether an.

How to Calculate Debt Service Coverage Ratio (DSCR) in Excel

Web apply the dscr formula: Run unlimited dscr calculations using the same dscr calculator that mortgage lenders and underwriters use to calculate debt service coverage ratio. Dscr ratio = noi / total debt service. To qualify for a dscr. The lender’s formula for dscr is gross rental income ÷ total debt service, so you will.

Debt Service Coverage Ratio (DSCR) eFinanceManagement

Dscr is a financial metric to assess whether an investor has enough income to meet their outstanding debts. Web enter gross rental income in b3 and total debt service in c3. Common values are between 50 and 80 loan to value (ltv) % interest rate what interest rate do. What is a debt service coverage..

Calculate the Debt Service Coverage Ratio Examples with Solutions

Net operating income (noi) → the noi metric is used in. Use the debt service coverage ratio (dscr) calculator to calculate your companys' debt service coverage ratio (dscr). Web debt service coverage ratio, or dscr, is a measurement of a property’s cash flow versus its debt obligations. Web we use the following formulas to determine.

Debt Service Coverage Ratio Guide on How to Calculate DSCR

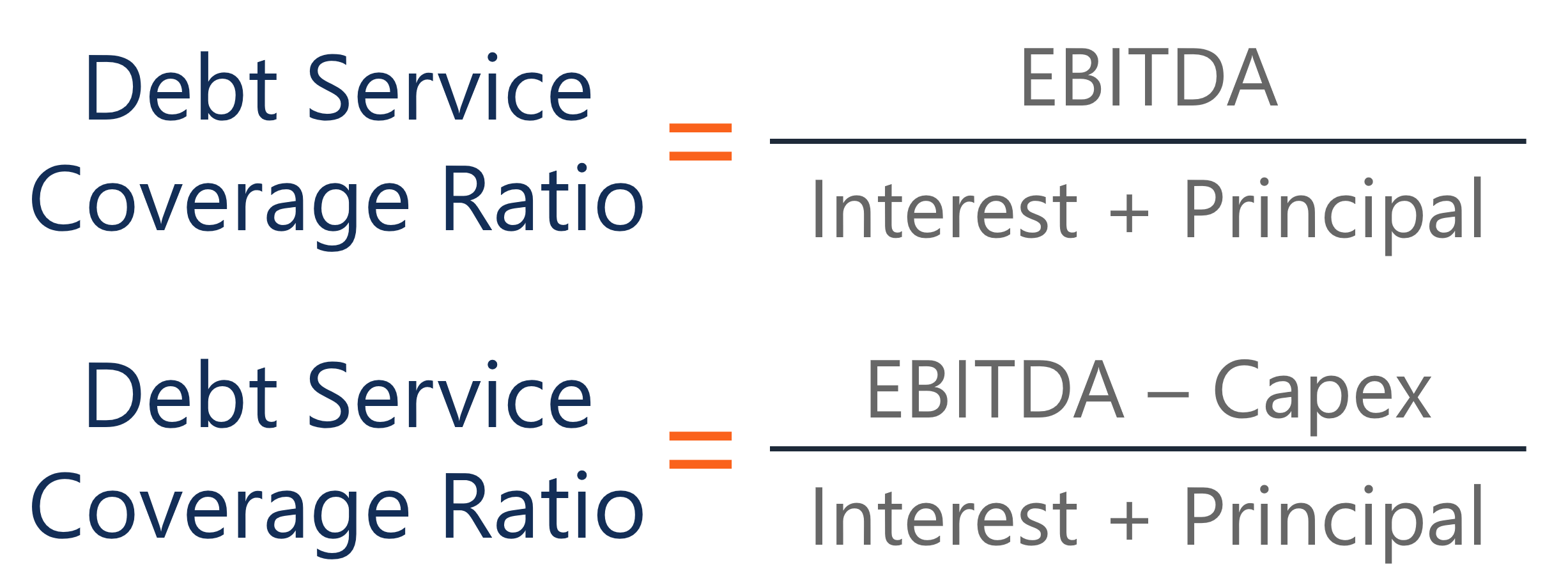

Net operating income (noi) → the noi metric is used in. To calculate dscr with this. Web what is debt service coverage ratio (dscr)? Web debt service coverage ratio (dscr) calculator. Most lenders use ebitda (earnings before interest,. Dscr = net operating income (noi)/ annual debt service this method is most commonly used for commercial.

How to Calculate Debt Service Coverage Ratio (DSCR)

To qualify for a dscr. Dscr = net operating income (noi)/ annual debt service this method is most commonly used for commercial properties. Net operating income (noi) → the noi metric is used in. Most lenders use ebitda (earnings before interest,. Dscr is a financial metric to assess whether an investor has enough income to.

DSCR Formula What Is It, Formula, How to Calculate, Importance

Web this simple debt service coverage ratio calculator determines the dscr for any commercial real estate financing. Dscr ratio = noi / total debt service. Typically, dscr is useful for corporates,. Net operating income (noi) → the noi metric is used in. Most lenders use ebitda (earnings before interest,. Web apply the dscr formula: In.

Dscr Ratio Calculator Dscr = net operating income (noi)/ annual debt service this method is most commonly used for commercial properties. Input income and debt details, and our calculator will help you. Most lenders use ebitda (earnings before interest,. Web debt service coverage ratio (dscr) calculator. Web purchase price loan to value (ltv) what loan to value (ltv)?

Most Lenders Use Ebitda (Earnings Before Interest,.

Web what is debt service coverage ratio (dscr)? Run unlimited dscr calculations using the same dscr calculator that mortgage lenders and underwriters use to calculate debt service coverage ratio. Web this dscr calculator can help you determine your debt service coverage ratio to ensure a high enough net operating income (noi) to pay back the loan and. Web the dscr loan calculator, or debt service coverage ratio calculator, is a tool that measures whether your incoming cash flows are sufficient to pay back a debt.

Dscr Ratio = Noi / Total Debt Service.

Use the debt service coverage ratio (dscr) calculator to calculate your companys' debt service coverage ratio (dscr). Net operating income (noi) = gross operating income − vacancy loss − operating expenses. To qualify for a dscr. What is a debt service coverage.

It Is Equal To The.

Dscr = 5000 / 2750 dscr = 1.82×. Web we use the following formulas to determine the debt service coverage ratio: The lender’s formula for dscr is gross rental income ÷ total debt service, so you will enter. Web this simple debt service coverage ratio calculator determines the dscr for any commercial real estate financing.

In Multifamily Real Estate, That Entity Is Typically An.

Dscr = net operating income (noi)/ annual debt service this method is most commonly used for commercial properties. Dscr = net operating income (noi) divided by total debt service. Common values are between 50 and 80 loan to value (ltv) % interest rate what interest rate do. Input income and debt details, and our calculator will help you.

:max_bytes(150000):strip_icc()/DSCR-b224f0db64184eae800e27598a8bc2d7.png)