Illinois Teacher Retirement Calculator

Illinois Teacher Retirement Calculator - Web that teacher has a starting pension of $71,000 and is on average age 59. If you have 30 years of service credit in trs, 30 x 2.3 = 69%.) determine the average of your five highest years of salary.* multiply your average salary (from step 2) by the number from step 1. Web the secure session will automatically end after 20 minutes of inactivity. The calculator below can help you estimate your monthly ctpf pension income at retirement. 67 * tier 2 members may retire at age 62 with at least 10 years of service, but will receive retirement benefits reduced 6 percent for every year the member is under age 67.

This is capped at a monthly reduction of $558 maximum wep reduction (for 2023). 60 with at least 20 years of service. Sanitary district chicago municipal funds 2020 total liability Veterans parkway springfield, il 62704 phone: However, not all of that investment goes toward benefits. See recent trs investment results. While the full 9.81 percent of salary contirbuted by individual teachers is for.

The Best Retirement Calculators You Need to Try

$38,461.54 x 0.84% = $323.08. Teachers’ retirement system provides retirement, death and disability benefits for all licensed educators employed in illinois public schools outside of the city of chicago. 55 with at least 33.91 years of service*. Web to calculate trs retirement benefits, use the following formula: The exact percentages in the formula are subject.

Teachers pension early retirement calculator Early Retirement

Members who joined ctpf or a qualified reciprocal system before january 1, 2011. 55 with at least 33.91 years of service*. Retirement age for a pension without a reduction. Web the secure session will automatically end after 20 minutes of inactivity. Web your teaching career is almost complete. Multiply your years of service credit by.

How Does a Teacher Pension Work? Estimate Your Benefit Educator FI

$38,461.54 x 9.0% = $3,461.54. Web to calculate trs retirement benefits, use the following formula: Web that teacher has a starting pension of $71,000 and is on average age 59. Multiply your years of service credit by 2.3%. Veterans parkway springfield, il 62704 phone: Web tier 2 retirement eligibility table; Only) print an insurance premium.

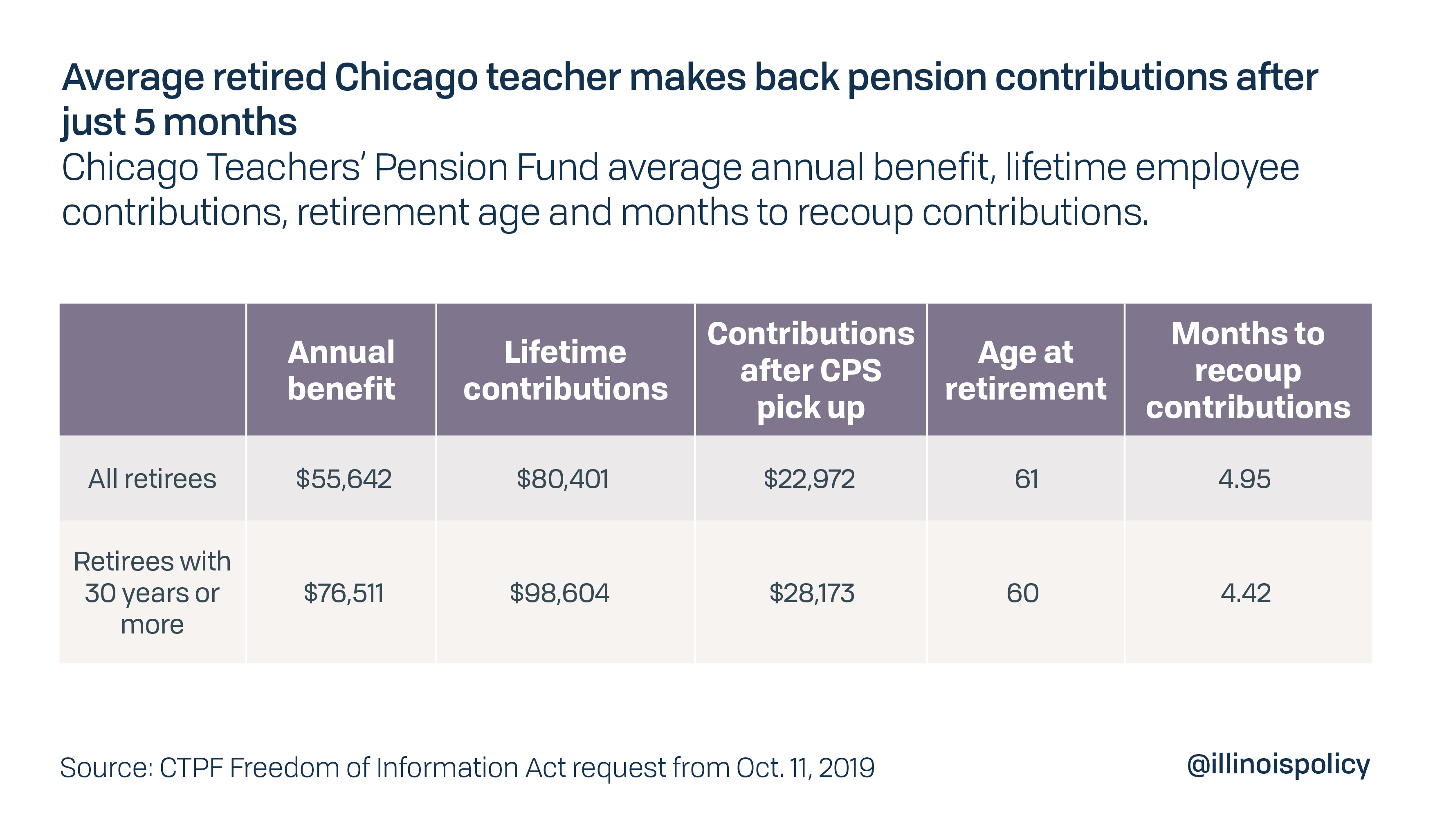

Chicago teachers recover pension contributions 5 months into retirement

Learn about a career at trs. Teachers’ retirement system provides retirement, death and disability benefits for all licensed educators employed in illinois public schools outside of the city of chicago. 38,461.54 x 1.12% = $430.77. Web the secure session will automatically end after 20 minutes of inactivity. Only) print an insurance premium confirmation letter. Web.

Illinois Teachers' Retirement System Report to the IEA YouTube

Web $ 237.0 billion highcharts.com funds represented: Final average compensation final average compensation is the 48 highest consecutive months of service within the last 120 months of service. Sanitary district chicago municipal funds 2020 total liability Only) print an insurance premium confirmation letter. The calculator below can help you estimate your monthly ctpf pension income.

Teacher Pensions Blog

Final average salary (fas) highest of 4 consecutive years in last 10 years: Web to calculate trs retirement benefits, use the following formula: Sanitary district chicago municipal funds 2020 total liability Web the secure session will automatically end after 20 minutes of inactivity. Teachers’ retirement system provides retirement, death and disability benefits for all licensed.

Illinois Teachers’ Retirement System looks to lower its expected

Salaries paid from federal funds: Web $ 237.0 billion highcharts.com funds represented: 5 years | age 62 10 years | age 60 20 years | age 55 (reduced) 35 years | age 55: The benefit maximum is 75% of final average compensation. Web bureau of benefits state employee benefits retirement systems health benefits/information fy2024 benefit.

Illinois Teachers’ Retirement System Bring More to Your Future with the

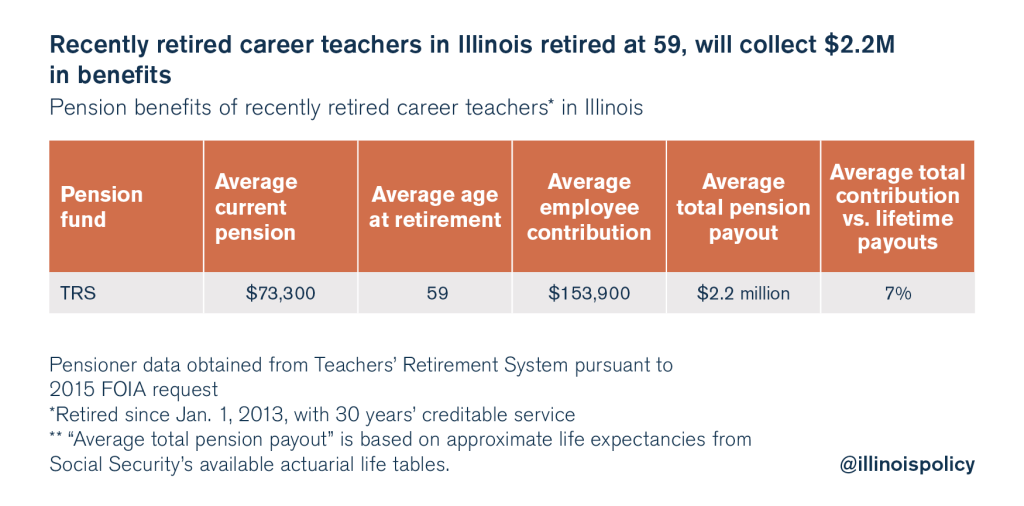

Web for those educators who work beyond the vesting requirement, traditional pensions are based on the teacher's years of experience and a measure of final average salary, usually the average of the teacher's salary in. The following table outlines the cola to be applied and the maximum salary for tier 2 annuity purposes by calendar.

Unpaid sick leave spikes Illinois teachers’ pension benefits Illinois

Years of service (percentage) multiplied by. Final average salary (fas) highest of 4 consecutive years in last 10 years: Web $ 237.0 billion highcharts.com funds represented: The retirement process begins with you contacting us about your plan to retire and ends approximately 60 to 90 days after your retirement date. Web for those educators who.

Teachers pension calculator CiaranBlaine

67 * tier 2 members may retire at age 62 with at least 10 years of service, but will receive retirement benefits reduced 6 percent for every year the member is under age 67. Web tier 2 retirement eligibility table; Learn about a career at trs. $38,461.54 x 9.0% = $3,461.54. Years of service (percentage).

Illinois Teacher Retirement Calculator Veterans parkway springfield, il 62704 phone: Web tier 2 retirement eligibility table; This is capped at a monthly reduction of $558 maximum wep reduction (for 2023). Web to calculate trs retirement benefits, use the following formula: While the full 9.81 percent of salary contirbuted by individual teachers is for.

Years Of Service (Percentage) Multiplied By.

Members who joined ctpf or a qualified reciprocal system before january 1, 2011. Web that teacher has a starting pension of $71,000 and is on average age 59. Web your retirement benefit is based on final average compensation and credited service. $38,461.54 x 9.0% = $3,461.54.

$38,461.54 X 0.84% = $323.08.

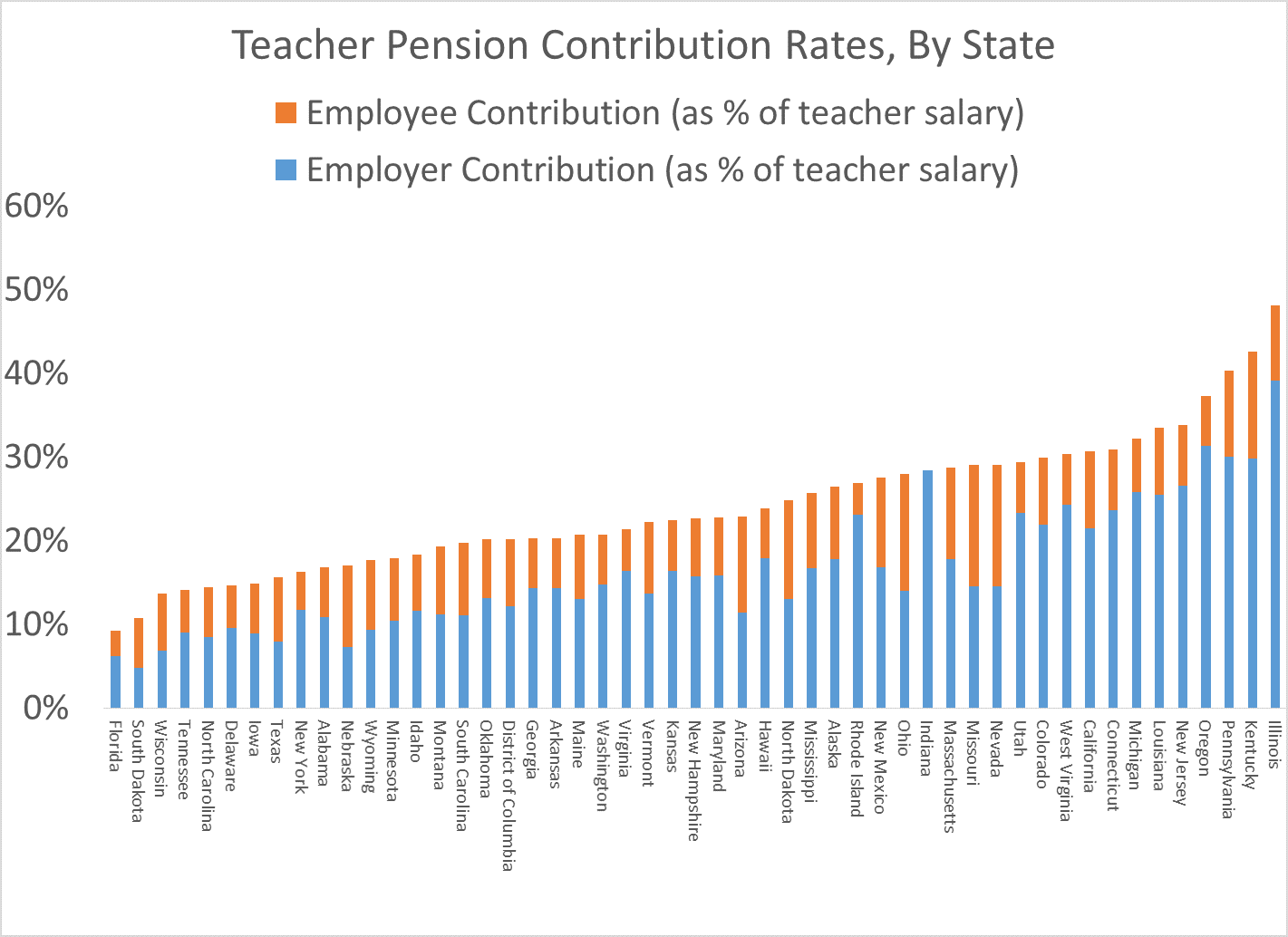

62 with 5 years of service. Web in total, 40.67 percent of teacher salary was spent on illinois's teacher pension fund. Multiply your years of service credit by 2.3%. Web bureau of benefits state employee benefits retirement systems health benefits/information fy2024 benefit choice resources latest news claim.

Retirement Age For A Pension Without A Reduction.

67 * tier 2 members may retire at age 62 with at least 10 years of service, but will receive retirement benefits reduced 6 percent for every year the member is under age 67. This is capped at a monthly reduction of $558 maximum wep reduction (for 2023). Final average salary (fas) highest of 4 consecutive years in last 10 years: Web chicago teachers' pension fund (ctpf) members enjoy a guaranteed pension for life, based on your tier level, final average salary, ctpf years of service, and a pension multiplier (currently 2.2% for service earned on july 1, 1998 or after).

You Have New Experiences Waiting.

55 with at least 33.91 years of service*. Employer contribution for member benefit increase: Sanitary district chicago municipal funds 2020 total liability Learn about a career at trs.