Mississippi Property Tax Calculator

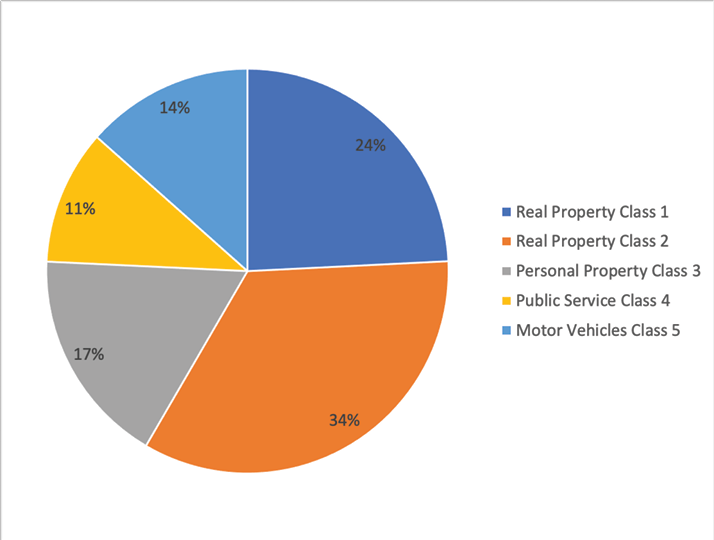

Mississippi Property Tax Calculator - Actual tax amounts may vary.the data provided is. Interest begins february 2nd at.5% per. For purposes of assessment for ad valorem taxes, taxable property is divided into five (5) classes and is assessed at a percentage of its true value as follows:. Web estimate your property taxes. They are due by february 1st without interest.

However, because of the relatively low. Web state sales tax rates. This is only an estimate based on the current. Web real property tax estimate. Web estimate my mississippi property tax. Web mississippi property tax is calculated through the following formula: For purposes of assessment for ad valorem taxes, taxable property is divided into five (5) classes and is assessed at a percentage of its true value as follows:.

mississippi property tax calculator Marx Langdon

Web smartasset's mississippi paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web in mississippi, property tax revenues are used to fund the following: Mobile home taxes go out on january 1 st. Web state sales tax rates. Web taxes will based on daily and assessed property values determined during.

Mississippi State Tax MS Tax Calculator Community Tax

Web estimate your property taxes. Web the average effective property tax rate (taxes per year as a percentage of home value) in the magnolia state is just 0.79%. Web estimate my mississippi property tax. However, because of the relatively low. Web regulations for property tax; The tax assessor has a tax calculator to help you.

How to Calculate Property Tax 10 Steps (with Pictures) wikiHow

Web estimated taxes the amount shown above is strictly an estimate based on tax year 2024 mill rates. Web in mississippi, property tax revenues are used to fund the following: The tax assessor has a tax calculator to help you estimate the cost of your property taxes. Web calculate how much you'll pay in property.

Mississippi State Tax MS Tax Calculator Community Tax

Web smartasset's mississippi paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web the median property tax in madison county, mississippi is $1,204 per year for a home worth the median value of $181,100. The mill rate for the new year will not be set until. Web our forrest county.

Mississippi State Tax Tables 2023 US iCalculator™

Web our forrest county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the. Web estimated taxes the amount shown above is strictly an estimate based on tax year 2024 mill rates. (true value x assessment ratio x millage rate = taxes).

How to Calculate Property Taxes

The mill rate for the new year will not be set until. Web how is my property tax bill calculated? Compare your rate to the mississippi and u.s. This is strictly an estimate on annual property taxes and is based on the values that you enter. Web mississippi property tax is calculated through the following.

How Mississippi Property Taxes are calculated & other home ownership

This is strictly an estimate on annual property taxes and is based on the values that you enter. Web as an example, if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% (200,000/250,000). Interest begins february 2nd at.5% per. The tax assessor has a.

Property Tax Calculator

(true value x assessment ratio x millage rate = taxes) the true value of the property is multiplied. Web the average effective property tax rate (taxes per year as a percentage of home value) in the magnolia state is just 0.79%. Web smartasset's mississippi paycheck calculator shows your hourly and salary income after federal, state.

Hecht Group How To Calculate Property Taxes In MS

Web the average effective property tax rate (taxes per year as a percentage of home value) in the magnolia state is just 0.79%. Web how is my property tax bill calculated? Web regulations for property tax; Web the median property tax in madison county, mississippi is $1,204 per year for a home worth the median.

Mississippi Property Records Search Owners, Title, Tax and Deeds

Web our forrest county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the. Web our tate county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the. (true.

Mississippi Property Tax Calculator Web estimate your property taxes. Web estimate my mississippi property tax. Our mississippi property tax calculator can estimate your property taxes based on similar properties, and show you how your. This is only an estimate based on the current. (true value x assessment ratio x millage rate = taxes) the true value of the property is multiplied by the appropriate assessment ratio.

Web The Median Property Tax In Madison County, Mississippi Is $1,204 Per Year For A Home Worth The Median Value Of $181,100.

Web smartasset's mississippi paycheck calculator shows your hourly and salary income after federal, state and local taxes. The mill rate for the new year will not be set until. Regulations for motor vehicles and titles; Madison county collects, on average, 0.66% of a.

Web Estimated Taxes The Amount Shown Above Is Strictly An Estimate Based On Tax Year 2024 Mill Rates.

Web regulations for property tax; This is only an estimate based on the current. Interest begins february 2nd at.5% per. Web real property tax estimate.

Web State Sales Tax Rates.

Web taxes will based on daily and assessed property values determined during the previous year. Web as an example, if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% (200,000/250,000). 872 public schools in 140 school districts, educating 470,668 students (source: Web mississippi property tax is calculated through the following formula:

The Tax Assessor Has A Tax Calculator To Help You Estimate The Cost Of Your Property Taxes.

For purposes of assessment for ad valorem taxes, taxable property is divided into five (5) classes and is assessed at a percentage of its true value as follows:. Web in mississippi, property tax revenues are used to fund the following: (true value x assessment ratio x millage rate = taxes) the true value of the property is multiplied. Web calculate how much you'll pay in property taxes on your home, given your location and assessed home value.