Payroll Guru Calculator

Payroll Guru Calculator - Employers can use it to calculate net. Web our free payroll tax calculators make it simple to figure out withholdings and deductions in any state — for any type of payment. Web free paycheck and payroll calculators to help you succeed. Web use free or paid paycheck calculator app and precise payroll guru app to calculate employee's payroll check in the residence state. This number is the gross pay per pay period.

Employers can use it to calculate net. We’ll do the math for you—all you need to do is. Web free paycheck and payroll calculators to help you succeed. Payroll guru calculates paycheck's net amount and applicable payroll taxes from gross wages for all 50 states and us territories. Web our employer tax calculator quickly gives you a clearer picture of all the payroll taxes you’ll owe when bringing on a new employee. Web 2023 payroll tax and paycheck calculator for all 50 states and us territories. Web federal paycheck calculator photo credit:

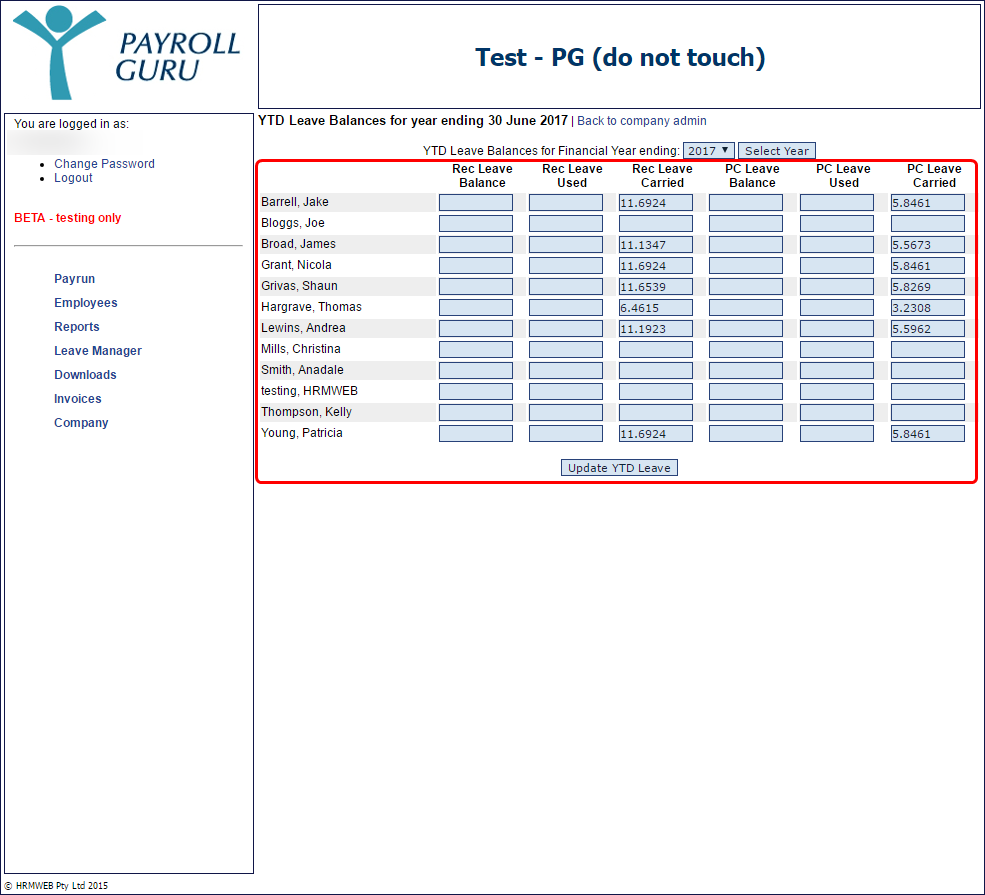

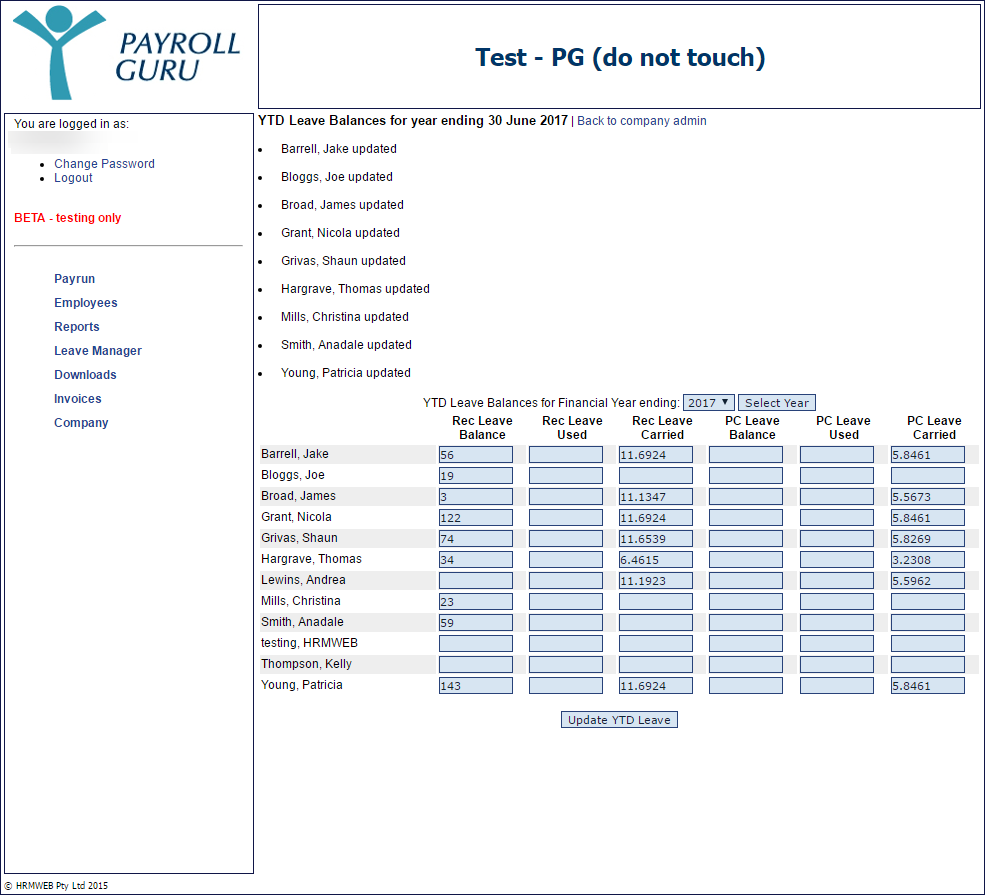

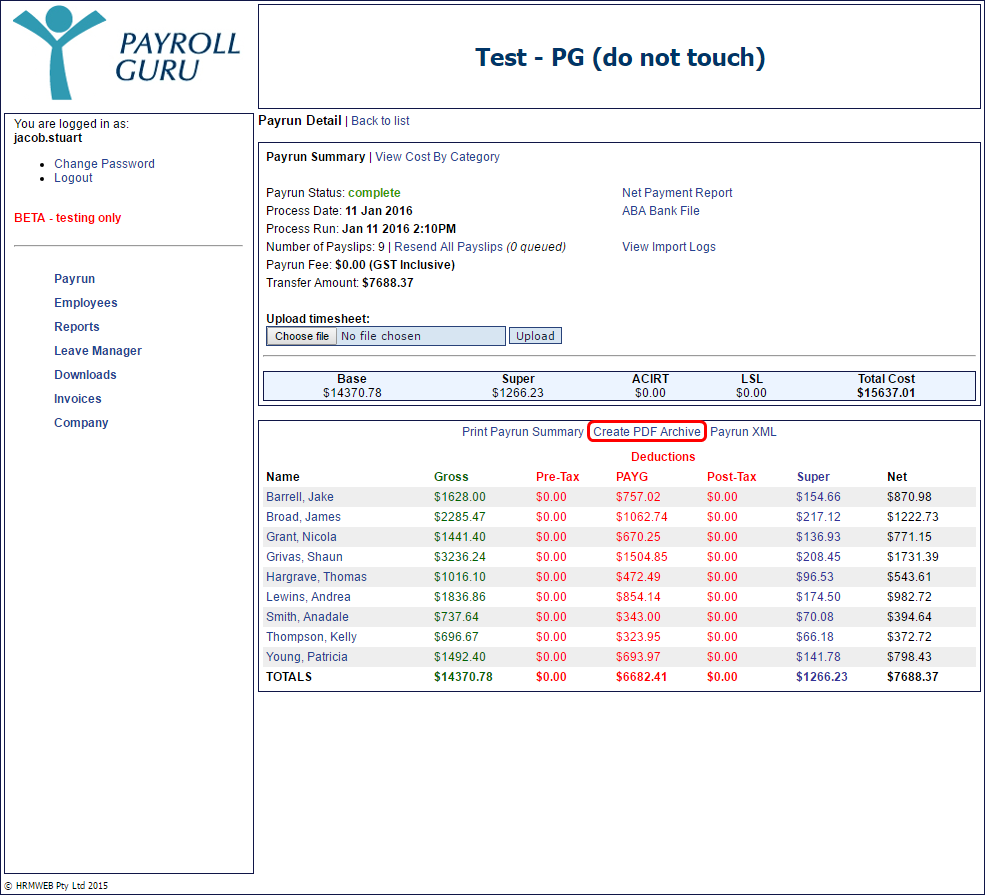

Payroll Guru configuring YTD values easyemployer support

If you feel like you’re swimming in numbers soup, our calculators can help you back to dry land. Get an accurate picture of the employee’s gross. For example, if an employee earns $1,500 per week, the. Web hourly paycheck and payroll calculator. Web 2023 payroll tax and paycheck calculator for all 50 states and us.

Payroll Guru configuring YTD values easyemployer support

Web hourly paycheck and payroll calculator. Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Web paycheck manager's free payroll calculator offers.

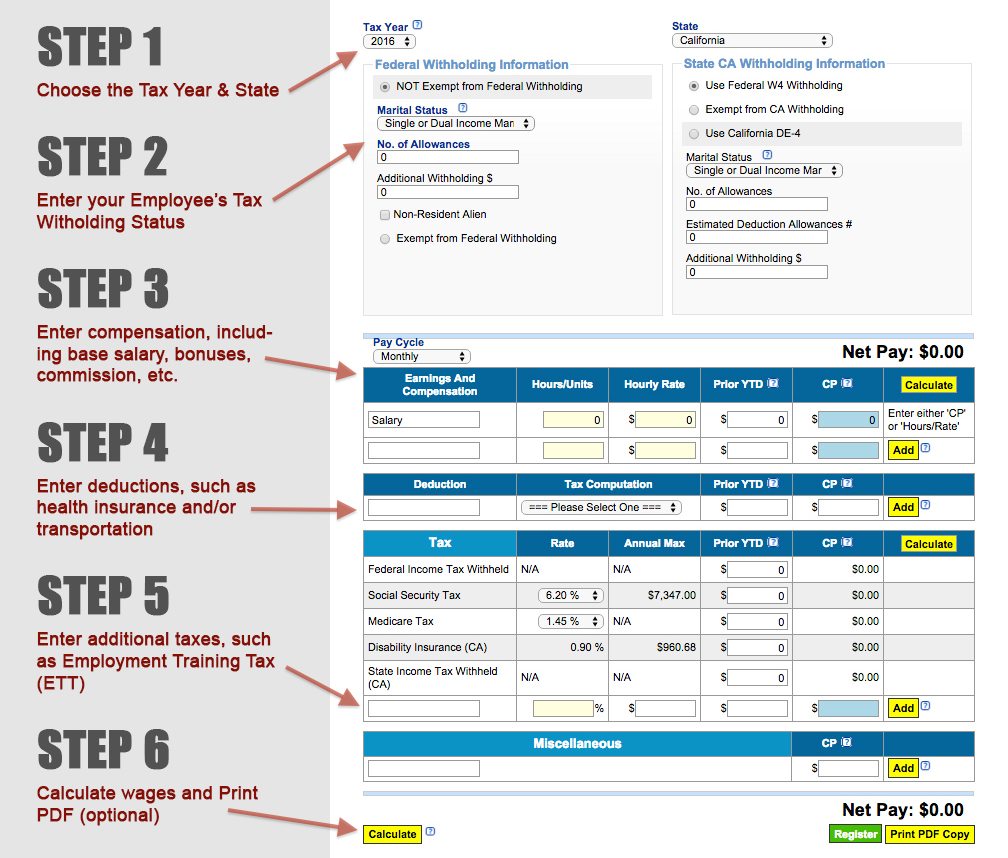

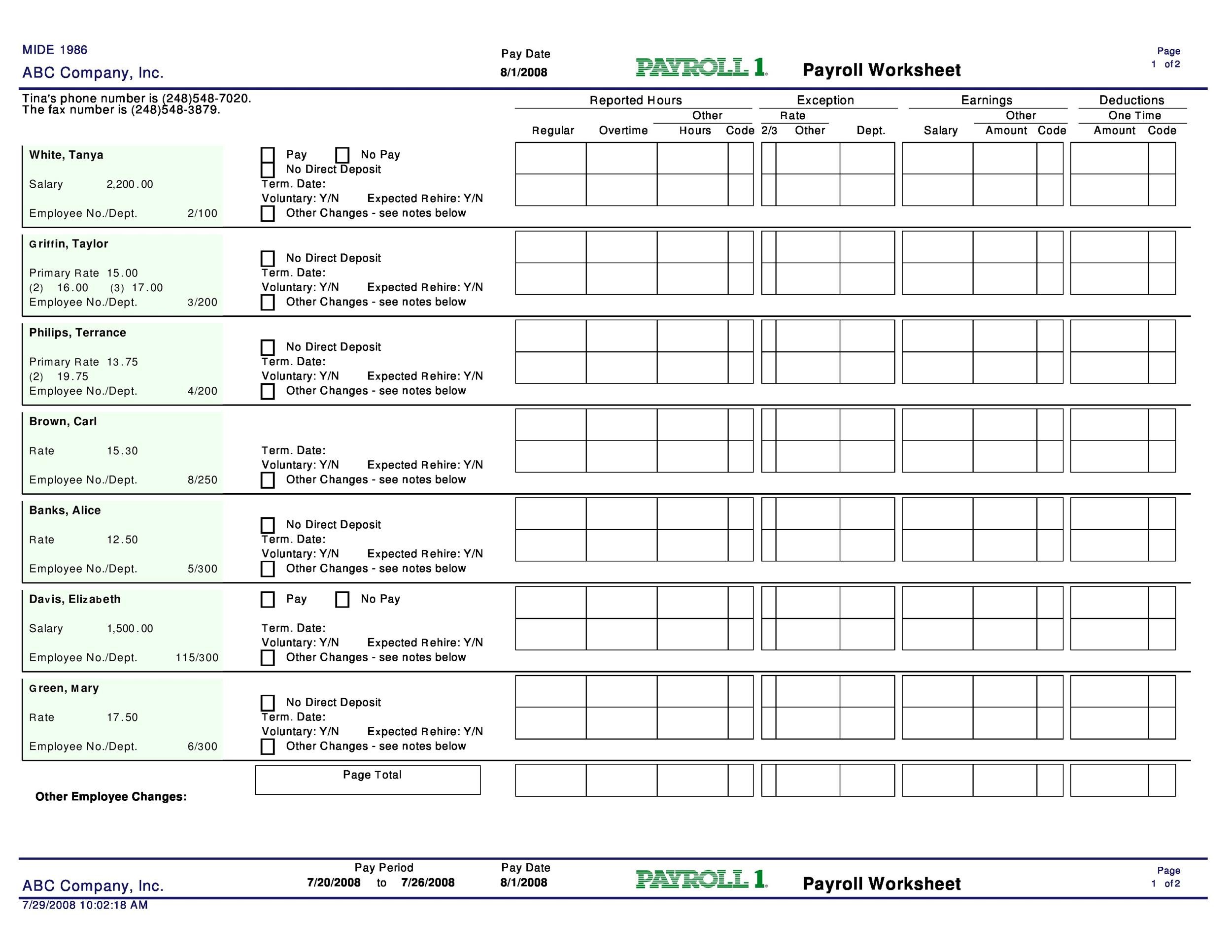

How to Use a Free Payroll Calculator

Web free paycheck and payroll calculators to help you succeed. If you feel like you’re swimming in numbers soup, our calculators can help you back to dry land. Web 2023 payroll tax and paycheck calculator for all 50 states and us territories. Web to calculate a paycheck start with the annual salary amount and divide.

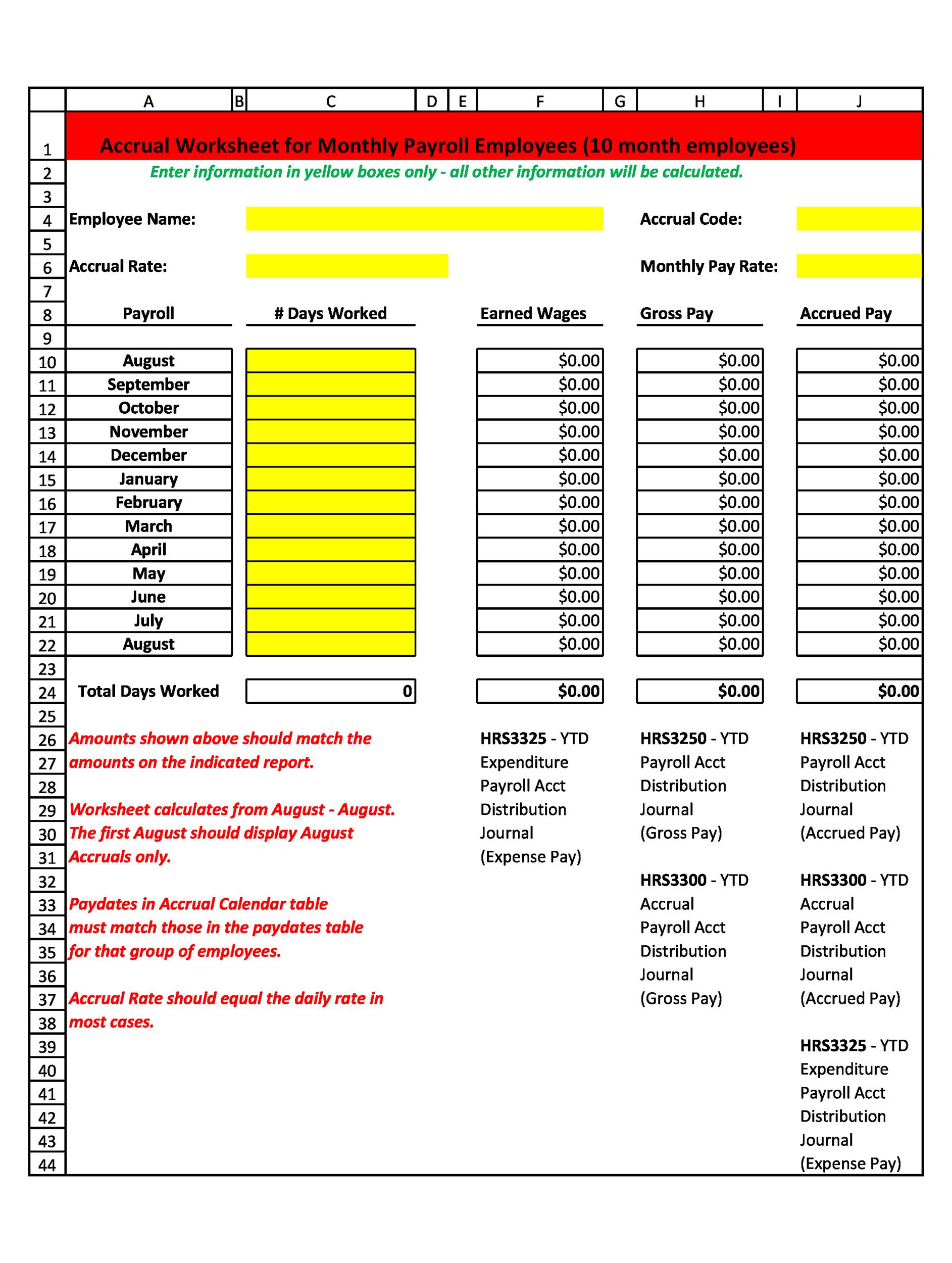

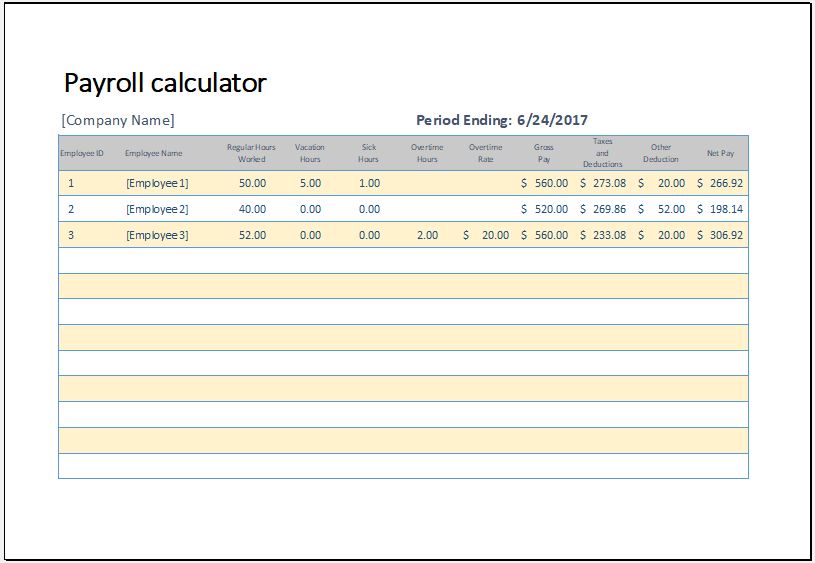

Payroll Calculator Templates 15+ Free Docs, Xlsx & PDF Formats

Calculate net payroll amount (after payroll taxes), federal withholding, including social security. Web free paycheck and payroll calculators to help you succeed. Paycheck lite computes your payroll check from a gross payroll amount or calculates hourly wages, that may include overtime and double time. Web our payroll calculator takes into account factors like the gross.

Payroll guru pay slips downloading easyemployer support

Web to calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. Web use free or paid paycheck calculator app and precise payroll guru app to calculate employee's payroll check in the residence state. For example, if an employee earns $1,500 per week, the. If you.

Payroll Calculator Template for MS Excel Word & Excel Templates

We’ll do the math for you—all you need to do is. Web our payroll calculator takes into account factors like the gross pay of employee wages, tax rates, and tax deductions, to provide you with an accurate calculation of payroll taxes. Web hourly paycheck and payroll calculator. ©istock.com/ryanjlane federal paycheck quick facts federal income tax.

Payroll for Android

Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Payroll guru calculates paycheck's net amount and applicable payroll taxes from gross wages.

Payroll Calculator Templates 15+ Free Docs, Xlsx & PDF Formats

Vensure.com has been visited by 10k+ users in the past month Web use free or paid paycheck calculator app and precise payroll guru app to calculate employee's payroll check in the residence state. Web our employer tax calculator quickly gives you a clearer picture of all the payroll taxes you’ll owe when bringing on a.

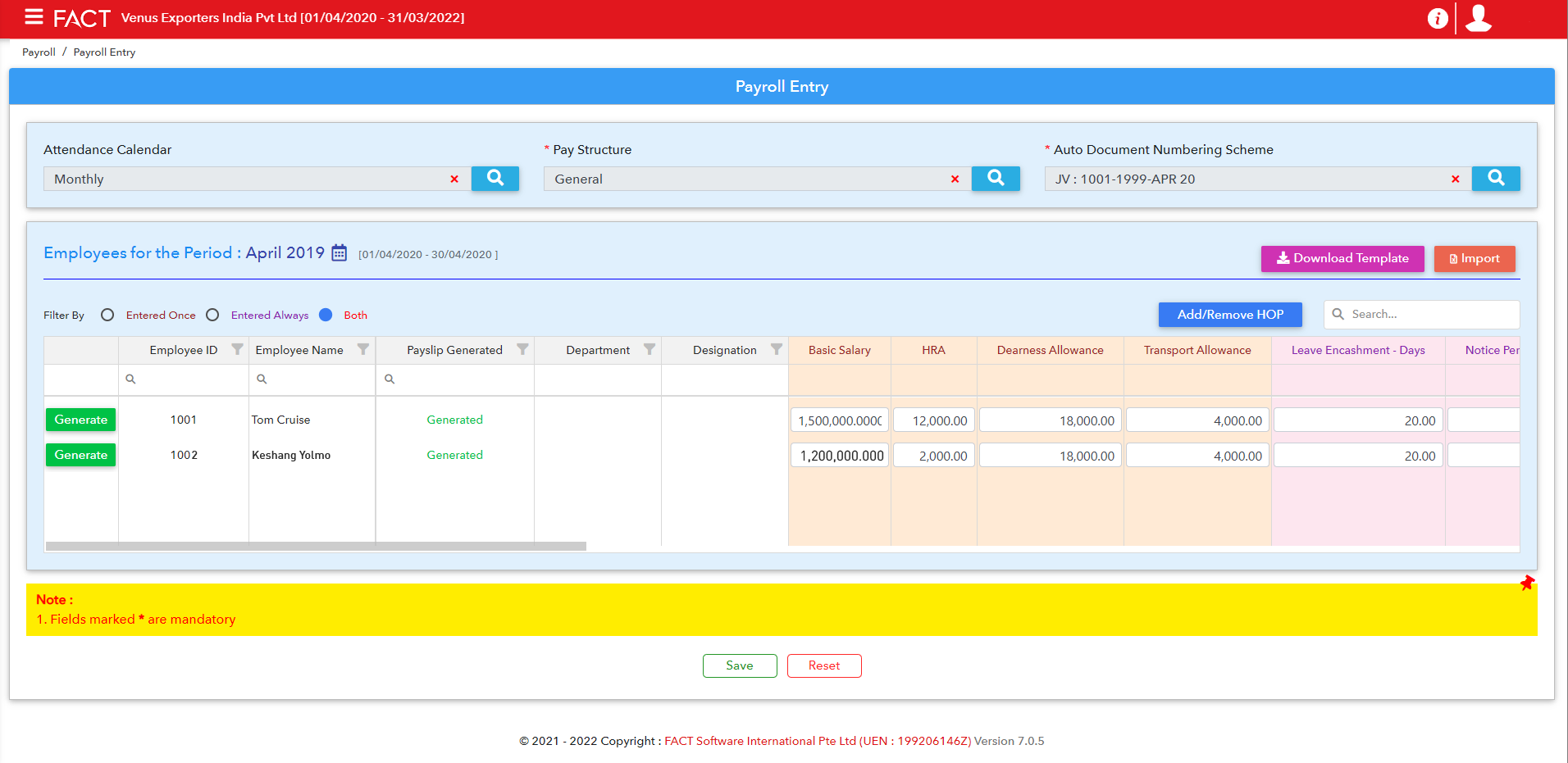

Ichiban Payroll Guru Software Reviews, Demo & Pricing 2023

Vensure.com has been visited by 10k+ users in the past month Ever wondered about the journey your gross. Paycheck lite computes your payroll check from a gross payroll amount or calculates hourly wages, that may include overtime and double time. Web this free hourly and salary paycheck calculator can estimate an employee’s net pay, based.

Payroll guru calculator IfforArveen

Web free paycheck and payroll calculators to help you succeed. Web federal paycheck calculator photo credit: Web this free hourly and salary paycheck calculator can estimate an employee’s net pay, based on their taxes and withholdings. Select a state annual wage: Web 2023 payroll tax and paycheck calculator for all 50 states and us territories..

Payroll Guru Calculator Paycheck lite computes your payroll check from a gross payroll amount or calculates hourly wages, that may include overtime and double time. Web free paycheck and payroll calculators to help you succeed. Web to calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. Web our payroll calculator takes into account factors like the gross pay of employee wages, tax rates, and tax deductions, to provide you with an accurate calculation of payroll taxes. Web 2023 payroll tax and paycheck calculator for all 50 states and us territories.

We’ll Do The Math For You—All You Need To Do Is.

Web free paycheck and payroll calculators to help you succeed. Payroll guru calculates paycheck's net amount and applicable payroll taxes from gross wages for all 50 states and us territories. For example, if an employee earns $1,500 per week, the. Web our payroll calculator takes into account factors like the gross pay of employee wages, tax rates, and tax deductions, to provide you with an accurate calculation of payroll taxes.

Web Use Free Or Paid Paycheck Calculator App And Precise Payroll Guru App To Calculate Employee's Payroll Check In The Residence State.

Vensure.com has been visited by 10k+ users in the past month Ever wondered about the journey your gross. Web federal paycheck calculator photo credit: Employers can use it to calculate net.

Get An Accurate Picture Of The Employee’s Gross.

Web this free hourly and salary paycheck calculator can estimate an employee’s net pay, based on their taxes and withholdings. Web 2023 payroll tax and paycheck calculator for all 50 states and us territories. Web paycheck manager's free payroll calculator offers online payroll tax deduction calculation, federal income tax withheld, pay stubs, and more. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%.

Select A State Annual Wage:

This number is the gross pay per pay period. Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. If you feel like you’re swimming in numbers soup, our calculators can help you back to dry land. Web hourly paycheck and payroll calculator.