Portfolio Volatility Calculator

Portfolio Volatility Calculator - If you buy it for $50 and the price rises to $75 in one year, that stock price is up 50%. Web portfolio volatility is a measure of portfolio risk, meaning a portfolio's tendency to deviate from its mean return. Web how to easily calculate portfolio variance for multiple securities in excel. Outline the uses of portfolio volatility in risk management Using this model, we will calculate the call option price.

Portfolio volatility = root (89% 2 ×0.141%+11% 2. Using this model, we will calculate the call option price. A simplified approach by troy adkins updated may 08, 2023 reviewed by charlene rhinehart fact checked by vikki velasquez many. Web price return is the annualized change in the price of the stock or mutual fund. Web key takeaways volatility represents how large an asset's prices swing around the mean price—it is a statistical measure of its dispersion of returns. Web portfolio optimization is a quantitative process used in finance to select the best possible combination of investment portfolio assets and their weights, given a set of objectives. Remember that a portfolio is made up of individual positions, each.

How To Calculate VolatilityAdjusted Portfolio Metrics To Assess

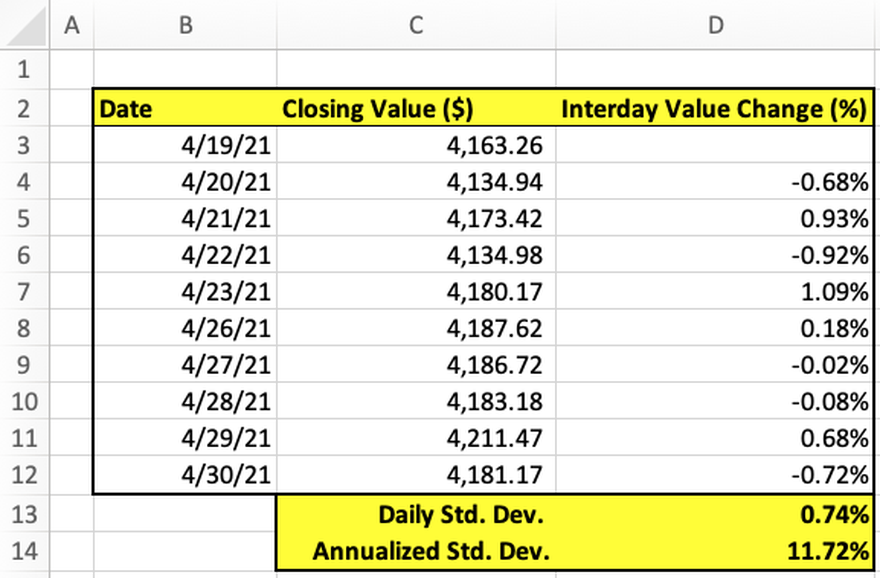

Web price return is the annualized change in the price of the stock or mutual fund. If you buy it for $50 and the price rises to $75 in one year, that stock price is up 50%. You can use this historical volatility calculator to calculate the historical volatility of stock prices according to a.

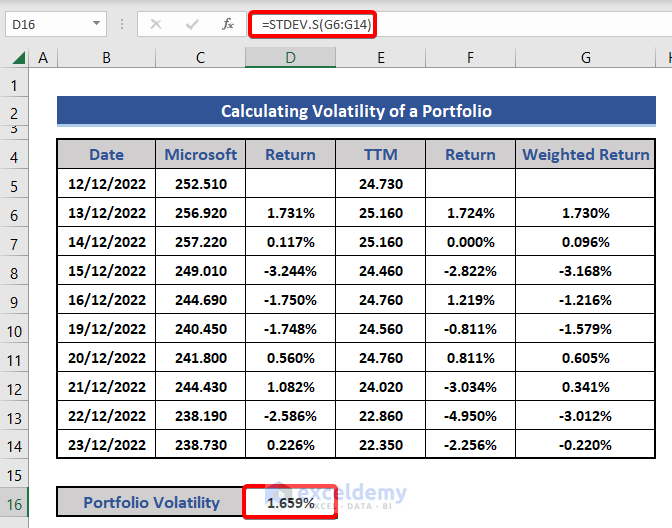

How to Calculate Volatility in Excel (2 Suitable Ways) ExcelDemy

You can use this historical volatility calculator to calculate the historical volatility of stock prices according to a set of provided data. Outline the uses of portfolio volatility in risk management Web learn to calculate the volatility of a two asset portfolio. Web key takeaways volatility represents how large an asset's prices swing around the.

Understanding Volatility Measurements

Web how to easily calculate portfolio variance for multiple securities in excel. Web key takeaways volatility represents how large an asset's prices swing around the mean price—it is a statistical measure of its dispersion of returns. Using this model, we will calculate the call option price. Web you can calculate your portfolio’s volatility of returns.

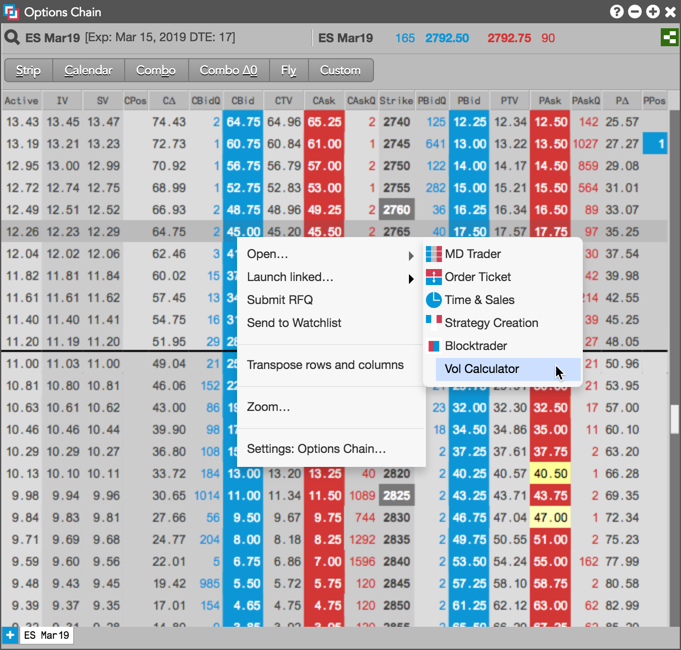

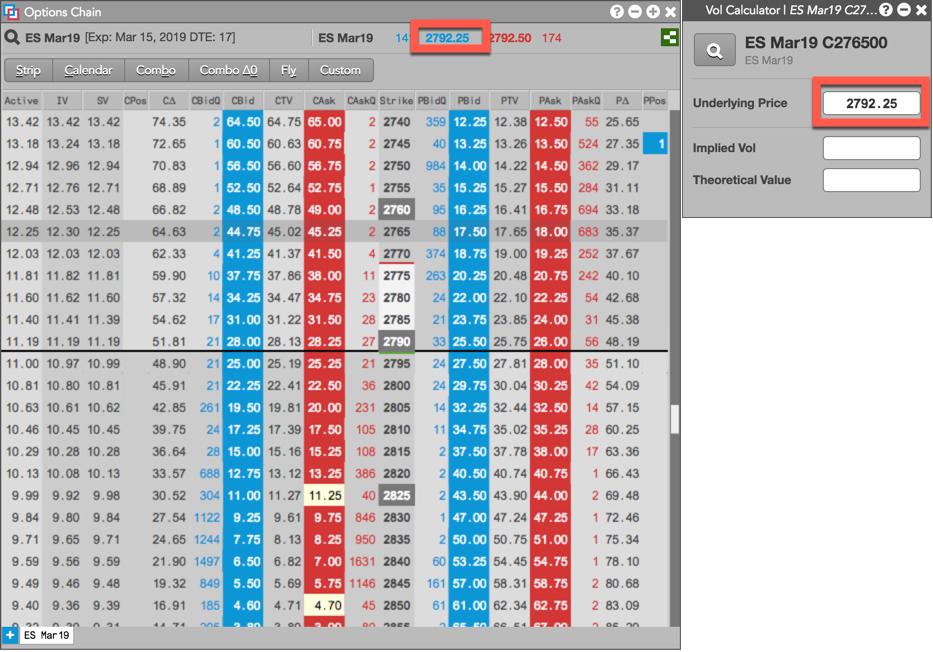

Using the Volatility Calculator Volatility Calculator Help and Tutorials

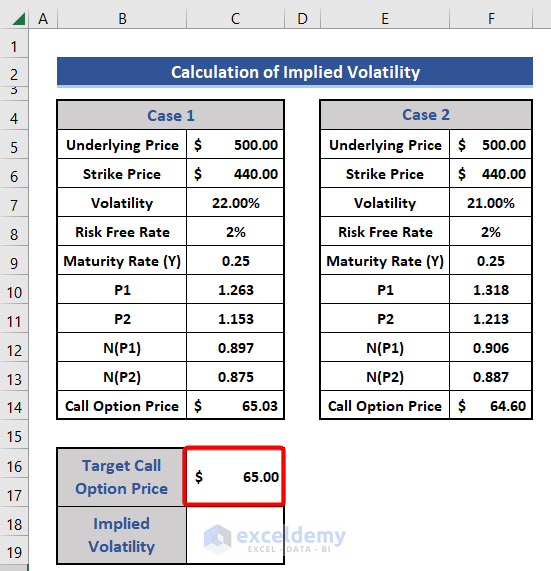

Outline the uses of portfolio volatility in risk management Web calculation of implied volatility. In general, the higher the standard deviation, the more volatile the. Portfolio volatility = root (89% 2 ×0.141%+11% 2. Outline the formula used for a three stock portfolio. Web standard deviation is the spread of a group of numbers from the.

How to Calculate Volatility in Excel (2 Suitable Ways) ExcelDemy

Web calculation of implied volatility. Dë_sÿözv²âžãde§îµ vg~à€ñ• òsi x jrdú‘“•‘}œyvsz!.,ࢠ²’ ÷?0iâ—dh »õ ôž[µ=mhyîüþëð¿ôæ qitx¡ õziüæk±[s§ ²¼gåq ò³÷œþ:%. You can use this historical volatility calculator to calculate the historical volatility of stock prices according to a set of provided data. In general, the higher the standard deviation, the more volatile the. Web how to easily.

How to Calculate Volatility of a Stock or Index in Excel The Motley Fool

Web portfolio optimization is a quantitative process used in finance to select the best possible combination of investment portfolio assets and their weights, given a set of objectives. Web take the square root of that number, and you'll get the standard deviation of the portfolio. Volatilitycalc has been added to the online suite of calculators.

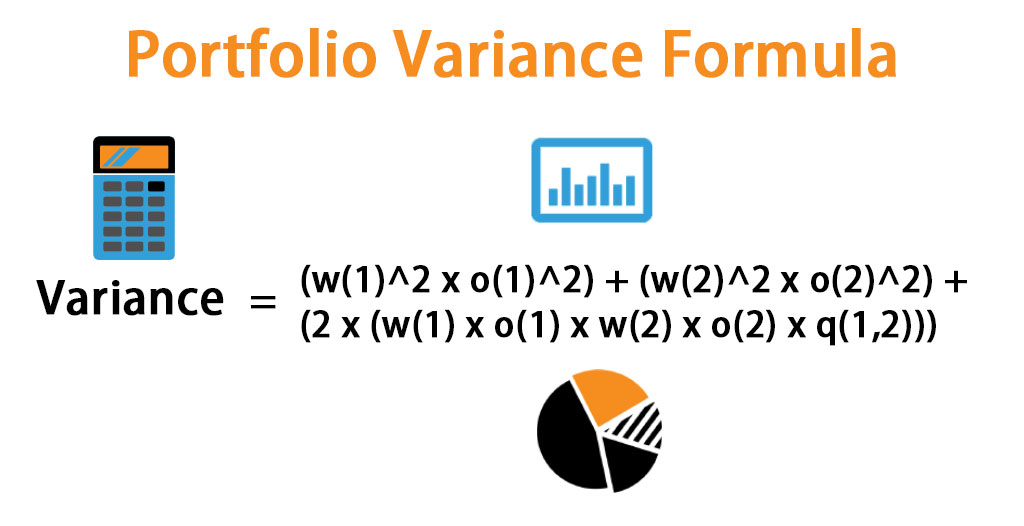

Portfolio Variance Formula

Web portfolio volatility is a measure of portfolio risk, meaning a portfolio's tendency to deviate from its mean return. A simplified approach by troy adkins updated may 08, 2023 reviewed by charlene rhinehart fact checked by vikki velasquez many. Web key takeaways volatility represents how large an asset's prices swing around the mean price—it is.

Using the Volatility Calculator Volatility Calculator Help and Tutorials

Volatilitycalc has been added to the online suite of calculators at fincalcs.net. If you buy it for $50 and the price rises to $75 in one year, that stock price is up 50%. Web key takeaways volatility represents how large an asset's prices swing around the mean price—it is a statistical measure of its dispersion.

Volatility Formula Calculator (Examples With Excel Template)

The variance measures the average degree to which each point differs from the mean. Web standard deviation is the spread of a group of numbers from the mean. Web you can calculate your portfolio’s volatility of returns in a precise way using a portfolio volatility formula that computes the variance of each stock in the.

How to Calculate Portfolio Risk From Scratch (Examples Included

You can use this historical volatility calculator to calculate the historical volatility of stock prices according to a set of provided data. Outline the formula used for a three stock portfolio. Web price return is the annualized change in the price of the stock or mutual fund. Web portfolio optimization is a quantitative process used.

Portfolio Volatility Calculator In general, the higher the standard deviation, the more volatile the. If you buy it for $50 and the price rises to $75 in one year, that stock price is up 50%. Asset 1 makes up 39% of a portfolio and has an expected return. Remember that a portfolio is made up of individual positions, each. Using this model, we will calculate the call option price.

Web Standard Deviation Is The Spread Of A Group Of Numbers From The Mean.

Web easily calculate portfolio volatility (standard deviation) using excel finance textbooks demonstrate how to calculate variance of a portfolio with two securities, a fairly. Web find out what portfolio variance is, the formula to calculate portfolio variance, and how to calculate the variance of a portfolio containing two assets. You can use this historical volatility calculator to calculate the historical volatility of stock prices according to a set of provided data. Web how to easily calculate portfolio variance for multiple securities in excel.

Web Learn To Calculate The Volatility Of A Two Asset Portfolio.

Web portfolio optimization is a quantitative process used in finance to select the best possible combination of investment portfolio assets and their weights, given a set of objectives. Remember that a portfolio is made up of individual positions, each. Web calculation of implied volatility. To calculate implied volatility, we need to follow the black scholes model.

Web Take The Square Root Of That Number, And You'll Get The Standard Deviation Of The Portfolio.

Dë_sÿözv²âžãde§îµ vg~à€ñ• òsi x jrdú‘“•‘}œyvsz!.,ࢠ²’ ÷?0iâ—dh »õ ôž[µ=mhyîüþëð¿ôæ qitx¡ õziüæk±[s§ ²¼gåq ò³÷œþ:%. Web key takeaways volatility represents how large an asset's prices swing around the mean price—it is a statistical measure of its dispersion of returns. Web you can calculate your portfolio’s volatility of returns in a precise way using a portfolio volatility formula that computes the variance of each stock in the collection. The variance measures the average degree to which each point differs from the mean.

Using This Model, We Will Calculate The Call Option Price.

If you buy it for $50 and the price rises to $75 in one year, that stock price is up 50%. Outline the uses of portfolio volatility in risk management Web use excel as the stock volatility calculator with marketxls functions. Portfolio volatility = root (89% 2 ×0.141%+11% 2.

:max_bytes(150000):strip_icc()/OptimalPortfolioTheoryandMutualFunds4-4a12df831cfb4eacaab8c8188b15a911.png)