Risk-Free Rate Calculator

Risk-Free Rate Calculator - Web capital asset pricing model calculator (capm) expect return on stock (%) risk free rate (%) expected return on market (%) beta for stock A nominal interest raterefers to the interest rate before taking inflation into account. Web real risk free rate = (1 + nominal risk free rate) / (1 + inflation rate) examples of risk free rate formula (with excel template) let’s take an example to. Web 10 risk free rates that this product currently supports sofr, corra, sonia, estr, saron, thor, sora, honia, tonar, and aonia. Web e (r i) = r f + [ e (r m) − r f ] × β i.

By investing in the cd, you’d be falling 6.26% short of keeping pace with current inflation. Web market participants need tools that help validate payment calculations for complex deals and reduce the risk of costly errors. Web e (r i) = r f + [ e (r m) − r f ] × β i. Web this is what asc 842 states when determining the discount rate: R i is the applicable rate for day i. Web 10 risk free rates that this product currently supports sofr, corra, sonia, estr, saron, thor, sora, honia, tonar, and aonia. A nominal interest raterefers to the interest rate before taking inflation into account.

How To Calculate Beta Risk Free Rate Haiper

Web risk free rates detailed compounding and simple interest calculations for sofr, sonia, estr, tonar, sora, and saron. Web 10 risk free rates that this product currently supports sofr, corra, sonia, estr, saron, thor, sora, honia, tonar, and aonia. In this guide, we’ll delve into the nuances of. Easy onboarding of more risk. By investing.

RiskFree Rate (rf) Formula and Calculator (StepbyStep)

Web e (r i) = r f + [ e (r m) − r f ] × β i. Web 10 risk free rates that this product currently supports sofr, corra, sonia, estr, saron, thor, sora, honia, tonar, and aonia. R i is the applicable rate for day i. Web market participants need tools that.

RiskFree Rate (rf) Formula and Calculator (StepbyStep)

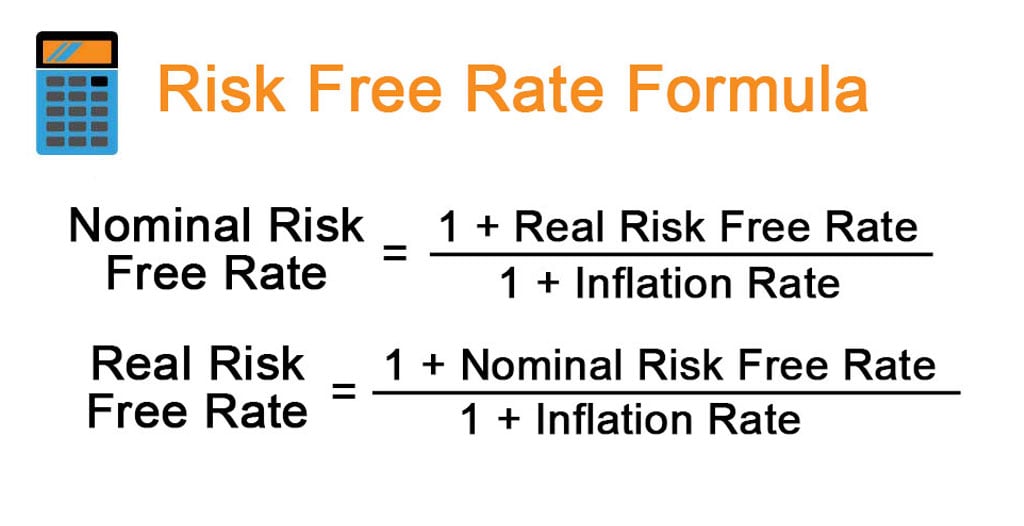

Web real risk free rate = (1 + nominal risk free rate) / (1 + inflation rate) examples of risk free rate formula (with excel template) let’s take an example to. Web capital asset pricing model calculator (capm) expect return on stock (%) risk free rate (%) expected return on market (%) beta for stock.

How to calculate the riskfree rate? VCRC

This time a month ago, the. By investing in the cd, you’d be falling 6.26% short of keeping pace with current inflation. Web capital asset pricing model calculator (capm) expect return on stock (%) risk free rate (%) expected return on market (%) beta for stock Initial commitment * start date * end date *.

Risk Free Rate Formula How to Calculate Risk Free Rate with Examples

A nominal interest raterefers to the interest rate before taking inflation into account. Nominal risk free rate = (1 + real risk free rate) × (1 + inflation rate) − 1 a real interest rateis the interest rate that takes inflation into account. Web this is what asc 842 states when determining the discount rate:.

RiskFree Rate What Is It, Formula, Example

Web capital asset pricing model calculator (capm) expect return on stock (%) risk free rate (%) expected return on market (%) beta for stock R p = ∑ i = 1 n r i n r p = ∑ i = 1 n r i n. Initial commitment * start date * end date *.

What Is What Is RiskFree Rate? Valuation Master Class

This means it adjusts for inflation and gives the real rate of a bond or loan. Easy onboarding of more risk. Web realisedrate.com provides compounded realised rates for key rfr benchmarks including sonia, sofr, €str and tonar using data published by the bank of england, new. Web real risk free rate = (1 + nominal.

What is a riskfree rate? Definition and meaning Market Business News

Web capital asset pricing model calculator (capm) expect return on stock (%) risk free rate (%) expected return on market (%) beta for stock A nominal interest raterefers to the interest rate before taking inflation into account. Web market participants need tools that help validate payment calculations for complex deals and reduce the risk of.

RiskFree Rate (rf) Formula and Calculator (StepbyStep)

Web e (r i) = r f + [ e (r m) − r f ] × β i. Web this is what asc 842 states when determining the discount rate: Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and.

How to Calculate RiskFree Rate A Beginner’s Guide The Cognition

This time a month ago, the. This means it adjusts for inflation and gives the real rate of a bond or loan. Web real risk free rate = (1 + nominal risk free rate) / (1 + inflation rate) examples of risk free rate formula (with excel template) let’s take an example to. Web this.

Risk-Free Rate Calculator Web e (r i) = r f + [ e (r m) − r f ] × β i. R i is the applicable rate for day i. Web realisedrate.com provides compounded realised rates for key rfr benchmarks including sonia, sofr, €str and tonar using data published by the bank of england, new. This time a month ago, the. Web capital asset pricing model calculator (capm) expect return on stock (%) risk free rate (%) expected return on market (%) beta for stock

Web Realisedrate.com Provides Compounded Realised Rates For Key Rfr Benchmarks Including Sonia, Sofr, €Str And Tonar Using Data Published By The Bank Of England, New.

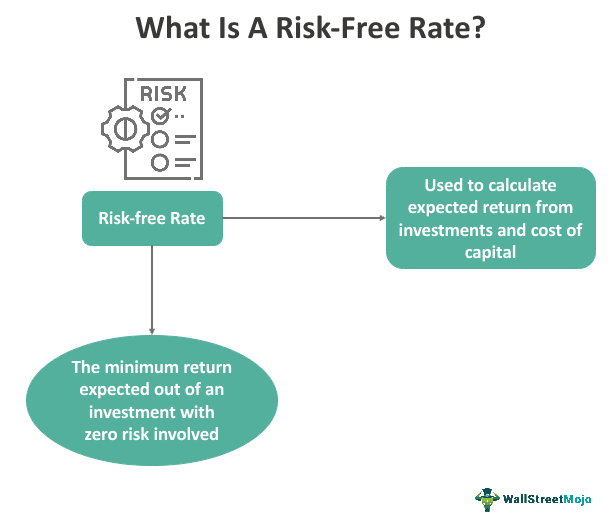

Web it refers to the rate of return you could earn over a period of time on an that carries zero risk. Web e (r i) = r f + [ e (r m) − r f ] × β i. Web capital asset pricing model calculator (capm) expect return on stock (%) risk free rate (%) expected return on market (%) beta for stock The average overnight rate r p for each interest period p is calculated as follows:

Web Market Participants Need Tools That Help Validate Payment Calculations For Complex Deals And Reduce The Risk Of Costly Errors.

Web if you start with zero and put away $135 a month (about $33.75 a week) in a savings account that compounds monthly and earns a 4% annual interest rate, you. Web real risk free rate = (1 + nominal risk free rate) / (1 + inflation rate) examples of risk free rate formula (with excel template) let’s take an example to. Initial commitment * start date * end date * add. In this guide, we’ll delve into the nuances of.

Web Risk Free Rates Detailed Compounding And Simple Interest Calculations For Sofr, Sonia, Estr, Tonar, Sora, And Saron.

Nominal risk free rate = (1 + real risk free rate) × (1 + inflation rate) − 1 a real interest rateis the interest rate that takes inflation into account. Easy onboarding of more risk. R p = ∑ i = 1 n r i n r p = ∑ i = 1 n r i n. Web this is what asc 842 states when determining the discount rate:

A Nominal Interest Raterefers To The Interest Rate Before Taking Inflation Into Account.

This time a month ago, the. By investing in the cd, you’d be falling 6.26% short of keeping pace with current inflation. Our rfr calculator provides financial institutions. This means it adjusts for inflation and gives the real rate of a bond or loan.

13.47.03.png)