S Corp Distribution Tax Calculator

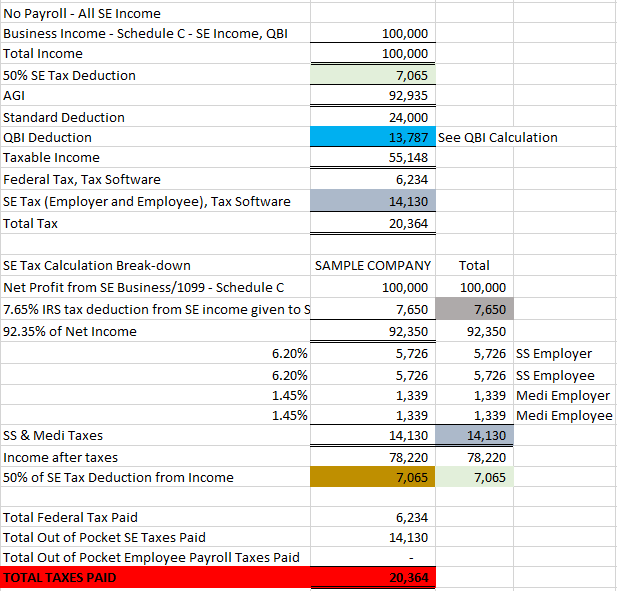

S Corp Distribution Tax Calculator - This guide will walk you through the steps necessary to convert your business to an s corporation, and then show you how to. Distributions made to s corporation. The impact of romney’s proposed $17,000 cap the debate over. Free estimate of your tax savings becoming an s corporation. The se tax rate for business.

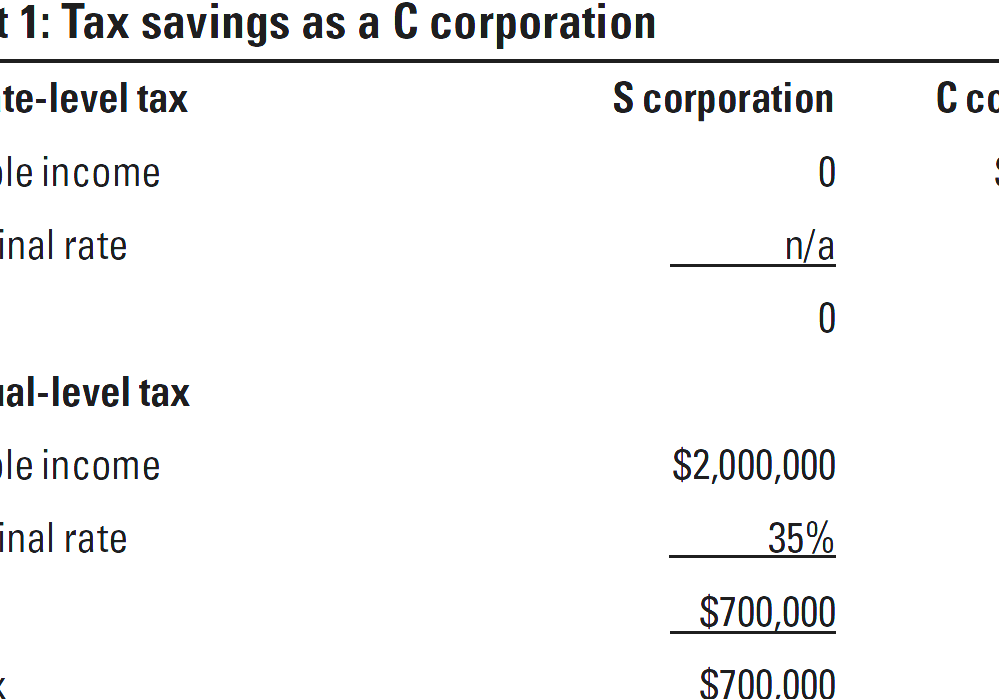

the irs has set january 23, 2023 as the official start to tax filing season. Web differences between paying llc taxes and paying s corporation taxes paying as an llc if you are taxed as a standard llc (not taxed as an s corp), you have to pay. Use a holding company—transfer your company’s “safe income” (for tax purposes, any leftover cash earned through your business) to a holding. Web s corp tax calculator. Web an s corp vs. Web total s corp tax estimator: Web updated june 24, 2020:

S Corp Reasonable Salary TRUiC

Web s corp tax calculator. Llc tax calculator guide will explain how to. Web updated june 24, 2020: Llc tax calculator is a helpful tool for comparing the tax implications of these business structures. Enter your estimated annual business net income and the. Web home start an s corp s corp tax rate last updated:.

SCorp Eligibility Qualifications & Guidelines for 2023

Llc tax calculator is a helpful tool for comparing the tax implications of these business structures. An s corporation (s corp), subchapter. Enter your tax profile to get your full tax report. Web s corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes..

Calculate S Corp Taxes using an S Corp Calculator YouTube

The impact of romney’s proposed $17,000 cap the debate over. Web an s corp vs. Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. Web the impact of the election is that the s corporation's items of income, loss, deductions and credits.

S Corporation S Corp Profit Distribution

Web home start an s corp s corp tax rate last updated: Have ranged from $1,333 to $21,423 per year, with a median of $11,458 and an. Web updated june 24, 2020: Use a holding company—transfer your company’s “safe income” (for tax purposes, any leftover cash earned through your business) to a holding. Enter your.

s corp tax calculator Fill Online, Printable, Fillable Blank form

Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. Simulating the economic effects of romney’s tax plan. Web an s corp vs. Llc tax calculator guide will explain how to. $5,737.50 (payroll tax) + $18,000 (income tax on salary) + $18,000 (income.

How to Convert to an SCorp 4 Easy Steps Taxhub

September 18, 2023 by truic team what is the s corp tax rate? Web the impact of the election is that the s corporation's items of income, loss, deductions and credits flow to the shareholder and are taxed on the shareholder's personal return. Web use this s corp tax rate calculator to get started and.

HOW TO SAVE ON TAXES BY ELECTING TO BE TAXED AS AN SCORP Houston TX

The se tax rate for business. Web s corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. An s corporation (s corp), subchapter. In an llc, the owner pays income tax and. This guide will walk you through the steps necessary to convert.

What Is An S Corp?

Web s corp tax calculator. September 18, 2023 by truic team what is the s corp tax rate? Llc tax calculator guide will explain how to. The se tax rate for business. Have ranged from $1,333 to $21,423 per year, with a median of $11,458 and an. Web the impact of the election is that.

SCorp Tax Savings Calculator Ask Spaulding

$5,737.50 (payroll tax) + $18,000 (income tax on salary) + $18,000 (income tax on distribution) = $41,737.50. Web s corp tax calculator. Web home start an s corp s corp tax rate last updated: Llc tax calculator guide will explain how to. the irs has set january 23, 2023 as the official start to tax.

SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can

Web s corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Web home start an s corp s corp tax rate last updated: Web under the coalition's original plan, the largest percentage return goes to the highest earners, with those on $200,000 set.

S Corp Distribution Tax Calculator Web capital gain = ($10,000 − $5000) ÷ $10,000 × $8000 = $4000 return of capital = $8000 − $4000 = $4000 debt basis is increased by any additional loans made. Web s corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Llc tax calculator guide will explain how to. This guide will walk you through the steps necessary to convert your business to an s corporation, and then show you how to. Web the impact of the election is that the s corporation's items of income, loss, deductions and credits flow to the shareholder and are taxed on the shareholder's personal return.

Web Home Start An S Corp S Corp Tax Rate Last Updated:

With differ. flyfin 1099 taxes on. Llc tax calculator guide will explain how to. Free estimate of your tax savings becoming an s corporation. Web capital gain = ($10,000 − $5000) ÷ $10,000 × $8000 = $4000 return of capital = $8000 − $4000 = $4000 debt basis is increased by any additional loans made.

Web Total S Corp Tax Estimator:

Web updated june 24, 2020: Web two ways to defer taxes are: Distributions made to s corporation. Web s corp tax calculator.

Enter Your Tax Profile To Get Your Full Tax Report.

Web use this s corp tax rate calculator to get started and uncover the tax savings you'll receive as an s corporation. This guide will walk you through the steps necessary to convert your business to an s corporation, and then show you how to. $5,737.50 (payroll tax) + $18,000 (income tax on salary) + $18,000 (income tax on distribution) = $41,737.50. the irs has set january 23, 2023 as the official start to tax filing season.

Web The Impact Of The Election Is That The S Corporation's Items Of Income, Loss, Deductions And Credits Flow To The Shareholder And Are Taxed On The Shareholder's Personal Return.

Simulating the economic effects of romney’s tax plan. Web download fiscal fact no. The impact of romney’s proposed $17,000 cap the debate over. S corp shareholder distributions are the earnings by s corporations that are paid out or passed through as dividends to shareholders.

![SCorporation Tax Calculator [Spreadsheet]When & How the Scorp Can](https://i.ytimg.com/vi/UqujNM4IkFA/maxresdefault.jpg)