Section 179 Depreciation Calculator

Section 179 Depreciation Calculator - Web section 179 depreciation software calculates depreciation expense that can be claimed under irs section 179. Web use our 2023 section 179 calculator to quickly calculate potential depreciation on qualifying business equipment, office furniture, technology, software and other business. Web you can use this section 179 deduction calculator to estimate how much tax you could save under section 179. Thus, if the amount exceeds this amount you are not eligible for the. This calculator will help you estimate your tax savings.

Web use our section 179 deduction calculator to find out. Web what is the irs section 179 deduction? Web section 179 is limited to a maximum deduction of $1,080,000 and a value of property purchased to $2,700,000 for the year 2022. Depreciation is the amount you can deduct annually to recover the cost or other basis of business property. Web deduction calculator how much money can section 179 save you in 2024? Web crest capital’s free section 179 calculator has been updated for 2024 to show how much money you will keep. What are my tax savings with section 179 deduction?

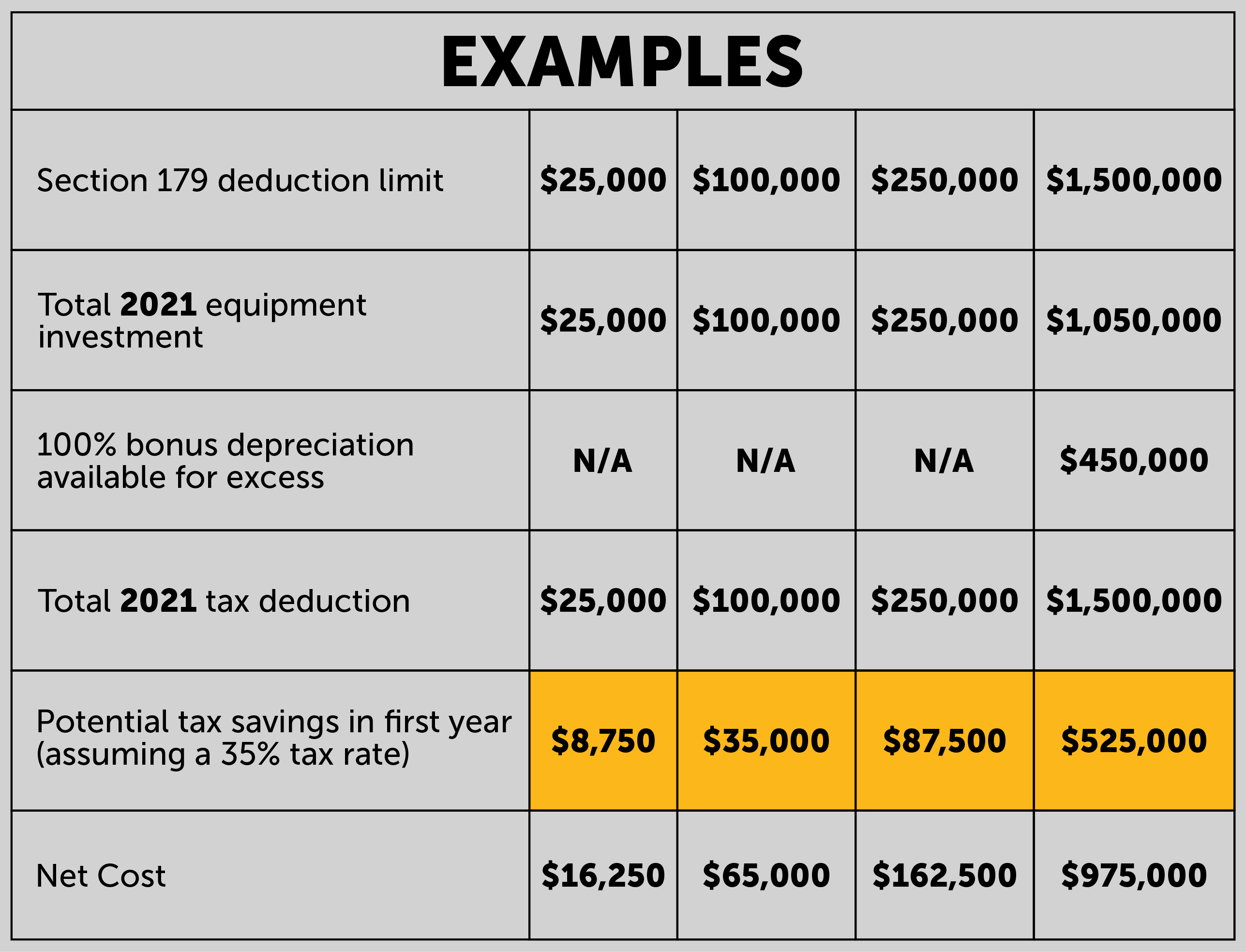

Section 179 for Small Businesses 2021 Shared Economy Tax

Furthermore, the phaseout ends at $3,780,000. Web section 179 deduction dollar limits. Web what is the irs section 179 deduction? Web section 179 allows you to take the cost of certain types of business property and subtract up to $1,050,000 of it from your taxable income for the year you purchase it. Web you can.

Section 179 Deduction and How it Can Help Your Company Save Money and

Updated for 2023 irs guidelines the software also calculates. Web what is the irs section 179 deduction? This calculator will help you estimate your tax savings. 1.* enter total cost of section 179 property (including qualified section 179 real property) placed in service during the. The irs section 179 deduction allows you to take the.

How to WriteOff a New Equipment Purchase Using Section 179 and 100

Web what is the irs section 179 deduction? With the current deduction limit set at a significant $1,220,000 for 2024,. Web section 179 depreciation software calculates depreciation expense that can be claimed under irs section 179. Under the section 179 tax deduction, you are able to deduct a. Web crest capital’s free section 179 calculator.

How Can Section 179 Save You Money? HyBrid Lifts

Heavy the internal revenue service (irs) breaks down the list of vehicles that qualify for section 179. 1.* enter total cost of section 179 property (including qualified section 179 real property) placed in service during the. Web what is the irs section 179 deduction? Thus, if the amount exceeds this amount you are not eligible.

The Ultimate Fleet Tax Guide Section 179 GPS Trackit

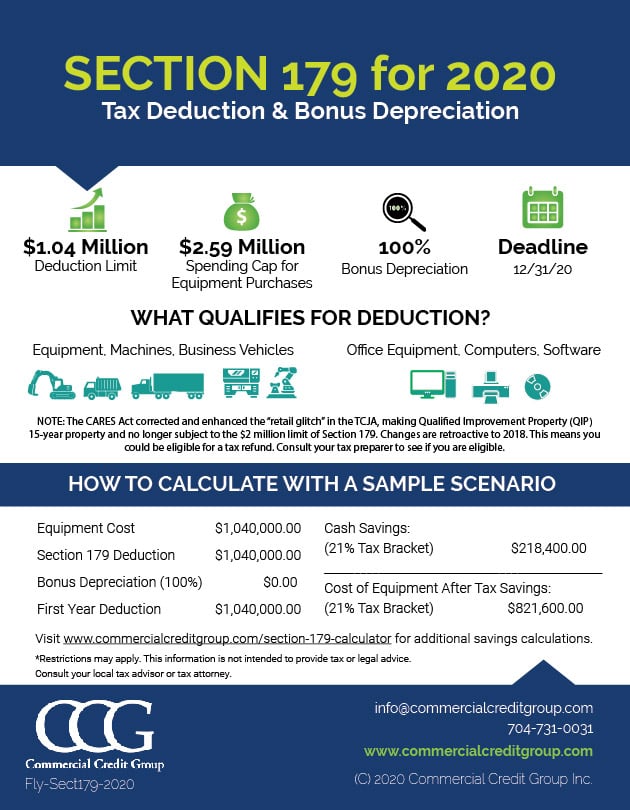

This calculator will help you estimate your tax savings. Heavy the internal revenue service (irs) breaks down the list of vehicles that qualify for section 179. Web section 179 deduction limits for 2020. Web deduction calculator how much money can section 179 save you in 2024? Web section 179 is limited to a maximum deduction.

Line 14 Depreciation and Section 179 Expense Center for

Updated for 2023 irs guidelines the software also calculates. Please use it as much as you like with no obligation. Web deduction calculator how much money can section 179 save you in 2024? This limit is reduced by the amount by which the. Web section 179 depreciation software calculates depreciation expense that can be claimed.

Section 179 Depreciation Guru

Web what is the irs section 179 deduction? Under the section 179 tax deduction, you are able to deduct a. Section 179 of the irs tax code gives businesses the. Please use it as much as you like with no obligation. Updated for 2023 irs guidelines the software also calculates. The irs section 179 deduction.

2021 Section 179 Deduction Calculator & Guide For Equipment Equipment

With the current deduction limit set at a significant $1,220,000 for 2024,. This limit is reduced by the amount by which the. Web section 179 allows you to take the cost of certain types of business property and subtract up to $1,050,000 of it from your taxable income for the year you purchase it. Depreciation.

Section 179 and Bonus Depreciation in 2013 Blackburn, Childers

Heavy the internal revenue service (irs) breaks down the list of vehicles that qualify for section 179. Web use our 2023 section 179 calculator to quickly calculate potential depreciation on qualifying business equipment, office furniture, technology, software and other business. Web section 179 is limited to a maximum deduction of $1,080,000 and a value of.

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions

Please use it as much as you like with no obligation. This calculator will help you estimate your tax savings. With the current deduction limit set at a significant $1,220,000 for 2024,. Web crest capital’s free section 179 calculator has been updated for 2024 to show how much money you will keep. Web maximum section.

Section 179 Depreciation Calculator This calculator will help you estimate your tax savings. What are my tax savings with section 179 deduction? The irs section 179 deduction allows you to take the depreciation deduction for qualifying business assets in their first year, rather than. Web section 179 deduction dollar limits. Web use our 2023 section 179 calculator to quickly calculate potential depreciation on qualifying business equipment, office furniture, technology, software and other business.

Furthermore, The Phaseout Ends At $3,780,000.

Thus, if the amount exceeds this amount you are not eligible for the. Please use it as much as you like with no obligation. Web you can use this section 179 deduction calculator to estimate how much tax you could save under section 179. Web use our section 179 deduction calculator to find out.

1.* Enter Total Cost Of Section 179 Property (Including Qualified Section 179 Real Property) Placed In Service During The.

This calculator will help you estimate your tax savings. Web section 179 allows you to take the cost of certain types of business property and subtract up to $1,050,000 of it from your taxable income for the year you purchase it. Web section 179 is limited to a maximum deduction of $1,080,000 and a value of property purchased to $2,700,000 for the year 2022. What are my tax savings with section 179 deduction?

Web Section 179 Deduction Dollar Limits.

Web crest capital’s free section 179 calculator has been updated for 2024 to show how much money you will keep. This limit is reduced by the amount by which the. Web deduction calculator how much money can section 179 save you in 2024? Under the section 179 tax deduction, you are able to deduct a.

Section 179 Of The Irs Tax Code Gives Businesses The.

With the current deduction limit set at a significant $1,220,000 for 2024,. Updated for 2023 irs guidelines the software also calculates. Web use our 2023 section 179 calculator to quickly calculate potential depreciation on qualifying business equipment, office furniture, technology, software and other business. Web section 179 deduction limits for 2020.